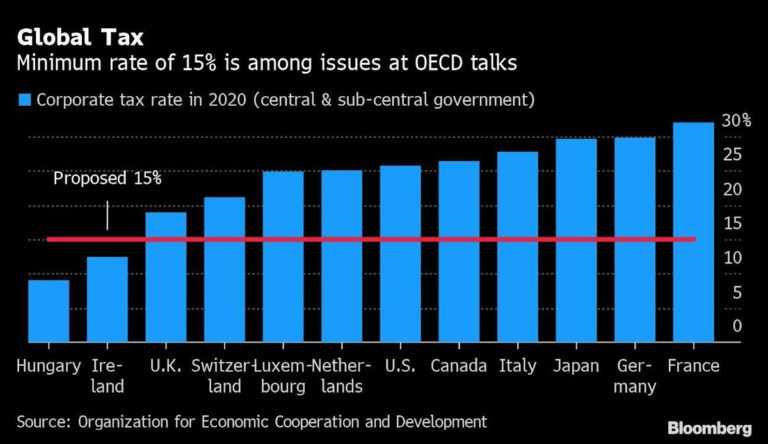

More than 130 countries and jurisdictions last year agreed to a global minimum tax framework, ensuring that companies pay at least 15% in taxes on excess profits in all jurisdictions they operate in.

It could be a tough requirement for global multinational corporations. But a safe harbor could ensure that taxpayers face minimal compliance requirements in most countries that have tax rates significantly above the 15% threshold, or who pass special domestic taxes matching the new international standard. According to several companies, tax practitioners and business groups who submitted comments to the OECD on April 13, a safe harbor could be crucial to ensure that the complex and unprecedented project is implemented smoothly.

What is A Safe Harbor?

Used by tax administrations all around the globe to promote certainty and reduce compliance costs, a safe harbor allows a taxpayer to reduce or eliminate audit risks so long as they follow set guidelines, which go beyond those required by law.

The OECD received a total of 69 comments from stakeholders and held a virtual public consultation on April 25. A replay is available HERE.

The global minimum tax is part of a larger OECD project to address concerns that the international tax system was failing to capture all transactions and profits in the digital economy. The tax, known as Pillar Two of a two-pillar package, aims to tax income earned through valuable intangible assets such as intellectual property, which are often used in complex tax structures because they are mobile and difficult to value.

By ensuring that companies cannot place intangibles–and their profits–in low-tax jurisdictions without paying a higher tax where they are headquartered, Pillar Two will remove the incentive for corporations to shift income purely for tax reasons. At least, that’s the OECD’s theory.

What the Critics Have To Say

The project has come under fire from critics who claim it could hit companies for using incentives Congress has enacted into law, such as the research and development credit or credits for low-income housing and green energy. They also claim the measure’s complexity could prove daunting for both tax administrations and taxpayers.

Part of the administrative challenge is the new definition of taxable income created for Pillar Two, based on financial accounting information, such as the statements submitted by publicly traded companies to shareholders. The OECD said this method was the simplest way to reach a common tax base among all of the participating nations, preventing mismatches and double taxation. The framework also includes a “substance-based carveout,” an exemption for 5% of the value of tangible assets and payroll, to ensure that the tax only hits intangible or excess income.

Many commenters said the OECD should create a “whitelist” or “angel’s list” of countries whose tax rates are high enough that companies should not be required to calculate their Pillar Two tax liabilities, or to follow Pillar Two documentation requirements.

“Requiring businesses to produce full detailed Pillar Two calculations in respect of operations where there is little risk of low taxed profits arising will result in an unnecessary additional burden, and no additional taxation,” wrote Deloitte LLP.

YOUR CPE CONFERENCE IS WAITING

Don’t wait to book your 2022 CPE Conference. Register for your location today.

The safe harbor could also apply to countries which enact a “qualified domestic minimum top-up tax,” which collects taxes from domestic companies that would otherwise be paid to foreign jurisdictions under Pillar Two, some commenters said.

Ernst & Young LLP said the safe harbor could apply to taxpayers with high global effective tax rates. Those companies could be presumed to be outside of Pillar Two’s scope, unless a country can show otherwise.

“We continue to believe that [multinational groups] that have a high ETR at the group level should be recognized as representing a low risk of [base erosion and profit shifting] for governments,” EY said in its comment to the OECD. “We urge the Inclusive Framework to consider the development of a gateway test that would exclude MNE Groups from the Pillar Two rules based on a simplified ETR test linked to the Group’s global operations.”

Some stakeholders expressed concerns that a safe harbor’s requirements could end up being as complex as the rules themselves, only making the overall system more onerous.

“It is vital to focus on this underlying purpose of the rule and to make sure that the ETR and Top-up Tax calculations are not simply replaced by an equally complex alternative based on figures that most MNE Groups would again need to source, because they are not generally available,” wrote Siemens AG in its comment.

Recent Stories

Senate Finance Committee Revisions to OBBBA

California Corner: FTB Experiencing Technical Issues

Next Up...

- |

- TaxByte

- |

- TaxByte