Western CPE

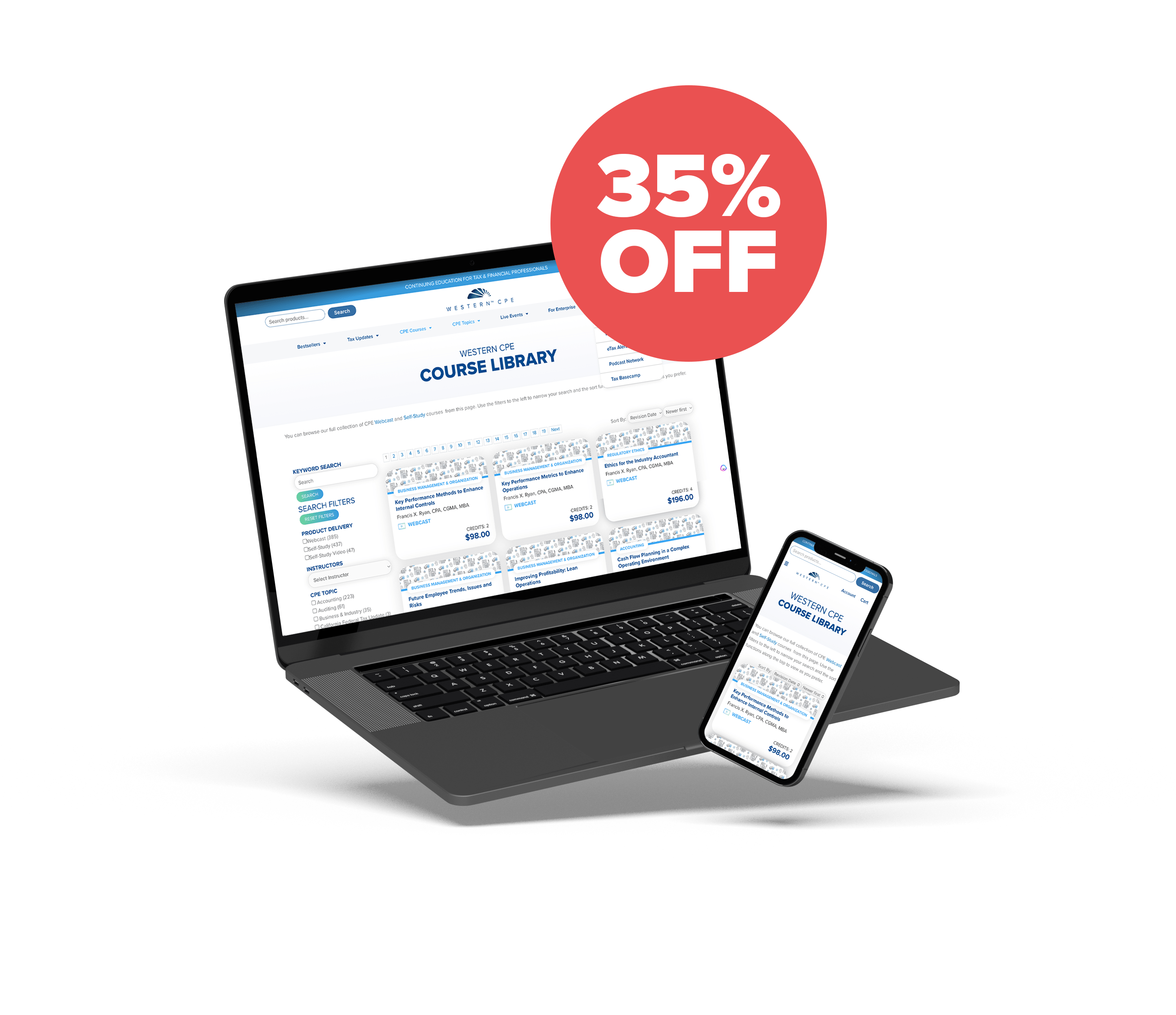

Course Library

20% OFF ALL DIGITAL CPE COURSES

All digital CPE courses are 20% off site-wide, including Webcasts, Self-Study, and Self-Study Video. (Discount is applied at checkout.)

20% OFF ALL DIGITAL CPE COURSES

CPE BUNDLE BUILDER

Choose any combination of CPE courses from our library totaling at least 4 CPE credit hours and receive 35% off.

You can browse our full collection of CPE Webcast and Self-Study courses from this page. Use the filters to the left to narrow your search and the sort functions along the top to view as you prefer.

Popular Topics:

-

Personal Development

Personal Development

Desired Traits of a Star Performer – Visualizing How to Become an Exceptional Staff Auditor

Jennifer F. Louis, CPA Webcast

Credits: 2 $98.00

Webcast

Credits: 2 $98.00$98.00

-

Personal Development

Personal Development

Client and Engagement Management – Managing the Black Holes That Erode Profitability

Jennifer F. Louis, CPA Webcast

Credits: 2 $98.00

Webcast

Credits: 2 $98.00$98.00

-

Finance

Finance

2024 Financial Planning Trends and Opportunities

Jeff Rattiner, CPA, CFP Webcast

Credits: 2 $98.00

Webcast

Credits: 2 $98.00$98.00

-

Auditing

Auditing

Cybersecurity Risk Management Trends (Self-Study Video)

Jennifer F. Louis, CPA QAS Self-Study Video

Credits: 2 $98.00

QAS Self-Study Video

Credits: 2 $98.00$98.00

-

Auditing

Auditing

Performing AUP and Examination Engagements Under the SSAEs

Jennifer F. Louis, CPA Webcast

Credits: 2 $98.00

Webcast

Credits: 2 $98.00$98.00

-

Auditing

Auditing

Adapting to the Engagement – Differentiating the Requirements of Preparations, Compilations, Reviews, and Audits

Jennifer F. Louis, CPA Webcast

Credits: 2 $98.00

Webcast

Credits: 2 $98.00$98.00

-

Accounting

Accounting

Leases Accounting under Topic 842 – Answers to FAQ After Implementation (Self-Study Video)

Jennifer F. Louis, CPA QAS Self-Study Video

Credits: 2 $98.00

QAS Self-Study Video

Credits: 2 $98.00$98.00

-

Accounting

Accounting

Preparing for Year-end in Accounts Payable

Mary S. Schaeffer, MBA QAS Self-Study

Credits: 2 $58.00

QAS Self-Study

Credits: 2 $58.00$58.00 – $78.00

-

Accounting

Accounting

Accounting Fraud: Recent Cases

Joseph Helstrom, CPA QAS Self-Study

Credits: 1 $29.00

QAS Self-Study

Credits: 1 $29.00$29.00 – $49.00

-

Regulatory Ethics

Regulatory Ethics

Accountant Ethics for Iowa

Steven M. Bragg, CPA QAS Self-Study

Credits: 4 $116.00

QAS Self-Study

Credits: 4 $116.00$116.00 – $136.00

-

Accounting

Accounting

Getting Paid Faster

Mary S. Schaeffer, MBA QAS Self-Study

Credits: 1 $29.00

QAS Self-Study

Credits: 1 $29.00$29.00 – $49.00

-

Behavioral Ethics

Behavioral Ethics

General Ethics for Business Professionals

Jennifer F. Louis, CPA Webcast

Credits: 2 $98.00

Webcast

Credits: 2 $98.00$98.00

-

Taxes

Taxes

Taxpayer Data Security

Steven M. Bragg, CPA QAS Self-Study

Credits: 2 $58.00

QAS Self-Study

Credits: 2 $58.00$58.00 – $78.00

-

Specialized Knowledge

Specialized Knowledge

Essentials of Disability Insurance

Steven M. Bragg, CPA QAS Self-Study

Credits: 1 $29.00

QAS Self-Study

Credits: 1 $29.00$29.00 – $49.00

-

Auditing

Auditing

Avoiding Legal Liability and Peer Review Deficiencies in Non-audit Services, Including Bookkeeping and Preparing Financial Statements

Jennifer F. Louis, CPA Webcast

Credits: 4 $196.00

Webcast

Credits: 4 $196.00$196.00

-

Auditing

Auditing

How to Audit Revenue

Steven M. Bragg, CPA QAS Self-Study

Credits: 2 $58.00

QAS Self-Study

Credits: 2 $58.00$58.00 – $78.00

-

Auditing

Auditing

Auditing Revenue Recognition – Grasping the Higher Risks and Special Audit Considerations

Jennifer F. Louis, CPA Webcast

Credits: 2 $98.00

Webcast

Credits: 2 $98.00$98.00

-

Auditing

Auditing

Auditing Revenue Recognition – Grasping the Higher Risks and Special Audit Considerations (Self-Study Video)

Jennifer F. Louis, CPA QAS Self-Study Video

Credits: 2 $98.00

QAS Self-Study Video

Credits: 2 $98.00$98.00

-

Auditing

Auditing

How to Evaluate Whether You (the Client) Are Getting the Most for Your Audit Dollars

Jennifer F. Louis, CPA Webcast

Credits: 2 $98.00

Webcast

Credits: 2 $98.00$98.00

-

Personnel/Human Resources

Personnel/Human Resources

Analytical Procedures And Critical Thinking Skills

Jeff Sailor, CPA Webcast

Credits: 2 $98.00

Webcast

Credits: 2 $98.00$98.00

-

Personal Development

Personal Development

CPAs….Who Are We? (Self-Study Video)

Frank Castillo, CPA QAS Self-Study Video

Credits: 1 $49.00

QAS Self-Study Video

Credits: 1 $49.00$49.00

-

Personal Development

Personal Development

CPAs….Who Are We?

Frank Castillo, CPA Webcast

Credits: 1 $49.00

Webcast

Credits: 1 $49.00$49.00

-

Auditing

Auditing

Case Studies In Fraud and Technology Controls

K2 Enterprises (Thomas G. (Tommy) Stephens, Jr., CPA, CITP, CGMA) Webcast

Credits: 4 $196.00

Webcast

Credits: 4 $196.00$196.00

-

Accounting

Accounting

Accounting Controls Guidebook

Steven M. Bragg, CPA QAS Self-Study

Credits: 12 $336.00

QAS Self-Study

Credits: 12 $336.00$336.00 – $376.00

-

Computer Software & Applications

Computer Software & Applications

Excel Functions and Formulas

Kevin Stratvert Webcast

Credits: 1 $49.00

Webcast

Credits: 1 $49.00$49.00

-

Accounting

Accounting

Oil and Gas Accounting

Steven M. Bragg, CPA QAS Self-Study

Credits: 9 $261.00

QAS Self-Study

Credits: 9 $261.00$261.00 – $291.00

-

Accounting

Accounting

Blockchain Essentials for CPAs: Core Principles and Uses

Kelen Camehl, CPA, MBA QAS Self-Study

Credits: 1 $29.00

QAS Self-Study

Credits: 1 $29.00$29.00 – $49.00

-

Taxes

Taxes

Hobby Loss Rules

A.J. Reynolds, EA Webcast

Credits: 1 $49.00

Webcast

Credits: 1 $49.00$49.00

-

Accounting

Accounting

Understanding Derivatives and Hedge Accounting: A Simplified Guide for CPAs

Kelen Camehl, CPA, MBA QAS Self-Study

Credits: 2 $29.00

QAS Self-Study

Credits: 2 $29.00$29.00 – $49.00

-

Accounting

Accounting

Hedge Accounting Basics: What You Need to Know

Kelen Camehl, CPA, MBA QAS Self-Study

Credits: 1 $29.00

QAS Self-Study

Credits: 1 $29.00$29.00 – $49.00

-

Information Technology

Information Technology

AI Confidential? Privacy and Artificial Intelligence

K2 Enterprises (Brian F. Tankersley, CPA, CGMA, CITP) Webcast

Credits: 1 $49.00

Webcast

Credits: 1 $49.00$49.00

-

Information Technology

Information Technology

Supercharging Your Spreadsheet Collaboration

K2 Enterprises (Brian F. Tankersley, CPA, CGMA, CITP) Webcast

Credits: 1 $49.00

Webcast

Credits: 1 $49.00$49.00

-

Accounting

Accounting

Demystifying Derivatives: Essential Concepts for CPAs

Kelen Camehl, CPA, MBA QAS Self-Study

Credits: 1 $29.00

QAS Self-Study

Credits: 1 $29.00$29.00 – $49.00

-

Accounting

Accounting

A Comparison of GAAP to IFRS Standards

Delta CPE LLC QAS Self-Study

Credits: 5 $145.00

QAS Self-Study

Credits: 5 $145.00$145.00 – $175.00

-

Accounting

Accounting

Earnings Management: Advanced Techniques

Kelen Camehl, CPA, MBA QAS Self-Study

Credits: 1 $29.00

QAS Self-Study

Credits: 1 $29.00$29.00 – $49.00

-

Accounting

Accounting

Accounting for Equity Investments Under Evolving U.S. GAAP (Self-Study Video)

Jennifer F. Louis, CPA QAS Self-Study Video

Credits: 2 $98.00

QAS Self-Study Video

Credits: 2 $98.00$98.00

-

Accounting

Accounting

Earnings Management: Foundation Techniques

Kelen Camehl, CPA, MBA QAS Self-Study

Credits: 1 $29.00

QAS Self-Study

Credits: 1 $29.00$29.00 – $49.00

-

Business Management & Organization

Business Management & Organization

Accountant’s Guide to Retail Management

Delta CPE LLC QAS Self-Study

Credits: 13 $351.00

QAS Self-Study

Credits: 13 $351.00$351.00 – $391.00

-

Accounting

Accounting

SEC Reporting Essentials: Climate Disclosures, Non-GAAP Measures, and MD&A

Kelen Camehl, CPA, MBA QAS Self-Study

Credits: 8 $232.00

QAS Self-Study

Credits: 8 $232.00$232.00 – $262.00

-

Accounting

Accounting

Beyond the Numbers: Understanding Earnings Management and Its Ethical Landscape

Kelen Camehl, CPA, MBA QAS Self-Study

Credits: 2 $58.00

QAS Self-Study

Credits: 2 $58.00$58.00 – $78.00

-

Taxes

Taxes

Rental Properties, with Deep Dive into Short-term Rentals

A.J. Reynolds, EA Webcast

Credits: 2 $98.00

Webcast

Credits: 2 $98.00$98.00

-

Taxes

Taxes

IRC Section 751 {Hot Assets}

A.J. Reynolds, EA Webcast

Credits: 1 $49.00

Webcast

Credits: 1 $49.00$49.00

-

Taxes

Taxes

Related Party Issues & Transactions

A.J. Reynolds, EA Webcast

Credits: 1 $49.00

Webcast

Credits: 1 $49.00$49.00

-

Regulatory Ethics

Regulatory Ethics

Regulatory Ethics – Independence

Frank Castillo, CPA Webcast

Credits: 1 $49.00

Webcast

Credits: 1 $49.00$49.00

-

Regulatory Ethics

Regulatory Ethics

Regulatory Ethics – Rules and Trends

Frank Castillo, CPA Webcast

Credits: 1 $49.00

Webcast

Credits: 1 $49.00$49.00

-

Regulatory Ethics

Regulatory Ethics

Regulatory Ethics – Clients (Self-Study Video)

Frank Castillo, CPA QAS Self-Study Video

Credits: 1 $49.00

QAS Self-Study Video

Credits: 1 $49.00$49.00

-

Regulatory Ethics

Regulatory Ethics

Regulatory Ethics – Clients

Frank Castillo, CPA Webcast

Credits: 1 $49.00

Webcast

Credits: 1 $49.00$49.00

-

Regulatory Ethics

Regulatory Ethics

Ethics

A.J. Reynolds, EA Webcast

Credits: 1 $49.00

Webcast

Credits: 1 $49.00$49.00