Western CPE

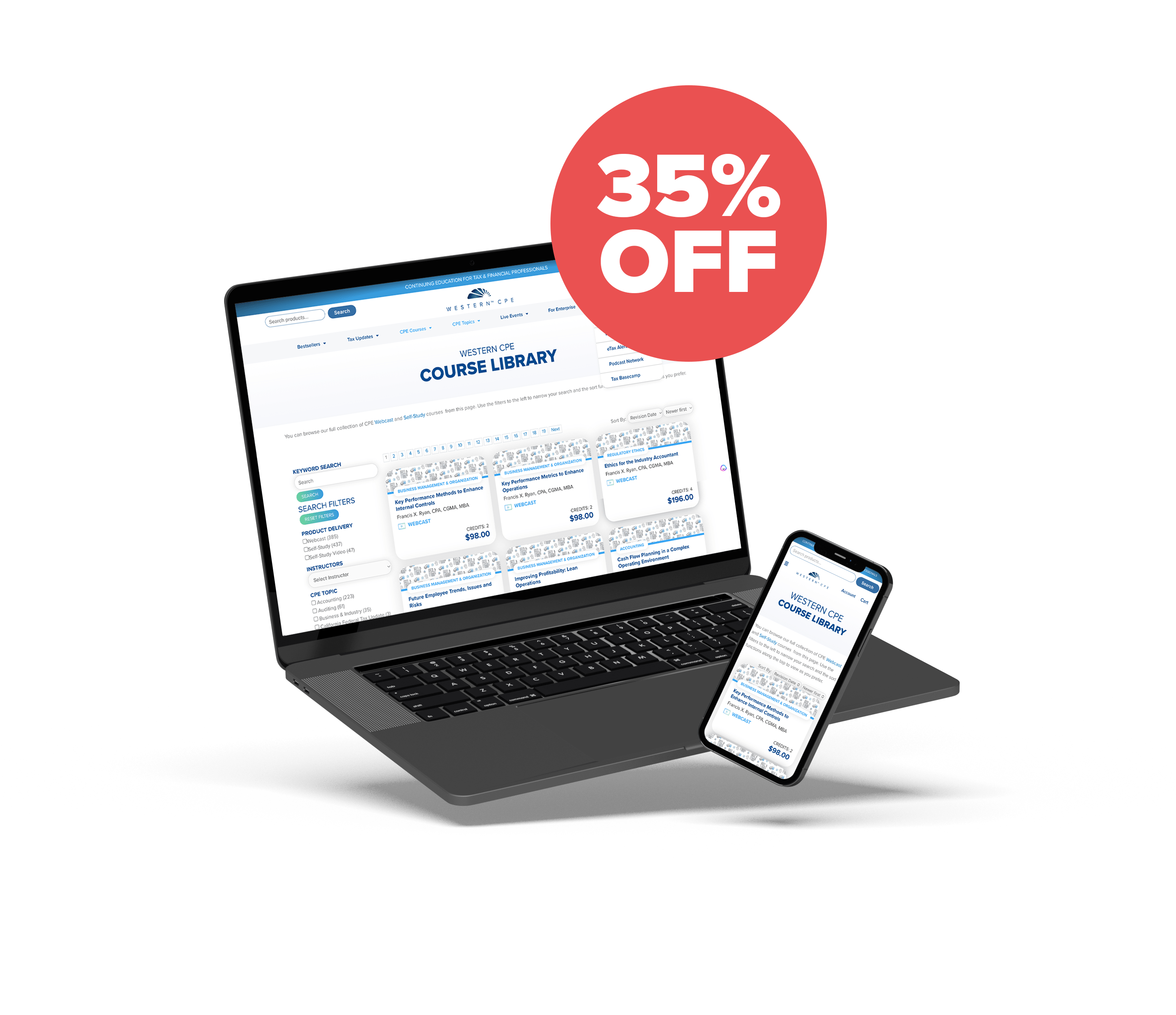

Course Library

20% OFF ALL DIGITAL CPE COURSES

All digital CPE courses are 20% off site-wide, including Webcasts, Self-Study, and Self-Study Video. (Discount is applied at checkout.)

20% OFF ALL DIGITAL CPE COURSES

CPE BUNDLE BUILDER

Choose any combination of CPE courses from our library totaling at least 4 CPE credit hours and receive 35% off.

You can browse our full collection of CPE Webcast and Self-Study courses from this page. Use the filters to the left to narrow your search and the sort functions along the top to view as you prefer.

Popular Topics:

Sort By:

-

Accounting

Accounting

Recognizing and Accounting for Imputed Interest – A Practical Guide

Kelen Camehl, CPA, MBA QAS Self-Study

Credits: 1 $29.00

QAS Self-Study

Credits: 1 $29.00 -

Accounting

Accounting

Evaluating Going Concern – What Accountants Need to Know

Kelen Camehl, CPA, MBA QAS Self-Study

Credits: 1 $29.00

QAS Self-Study

Credits: 1 $29.00 -

Accounting

Accounting

Understanding Capitalized Interest – When and How to Apply It

Kelen Camehl, CPA, MBA QAS Self-Study

Credits: 1 $29.00

QAS Self-Study

Credits: 1 $29.00 -

Accounting

Accounting

Imputing and Capitalizing Interest – What You Need to Know

Kelen Camehl, CPA, MBA QAS Self-Study

Credits: 2 $58.00

QAS Self-Study

Credits: 2 $58.00 -

Accounting

Accounting

The Use of Specialists – What CPAs Need to Know

Kelen Camehl, CPA, MBA QAS Self-Study

Credits: 2 $58.00

QAS Self-Study

Credits: 2 $58.00 -

Accounting

Accounting

Understanding the Accounting for Advertising Costs

Kelen Camehl, CPA, MBA QAS Self-Study

Credits: 1 $29.00

QAS Self-Study

Credits: 1 $29.00 -

Taxes

Taxes

Advanced Trust Tax Return Preparation

Mary Kay Foss, CPA Webcast

Credits: 2 $98.00

Webcast

Credits: 2 $98.00 -

Accounting

Accounting

Subsequent Events – What Accountants Need to Know

Kelen Camehl, CPA, MBA QAS Self-Study

Credits: 1 $29.00

QAS Self-Study

Credits: 1 $29.00 -

Accounting

Accounting

The Conceptual Framework – Essential Knowledge for Accounting Professionals

Kelen Camehl, CPA, MBA QAS Self-Study

Credits: 2 $58.00

QAS Self-Study

Credits: 2 $58.00 -

Accounting

Accounting

Research and Development Accounting – What You Need to Know About ASC 730

Kelen Camehl, CPA, MBA QAS Self-Study

Credits: 2 $58.00

QAS Self-Study

Credits: 2 $58.00 -

Regulatory Ethics

Regulatory Ethics

Understanding and Applying the AICPA Code of Professional Conduct

Kelen Camehl, CPA, MBA QAS Self-Study

Credits: 2 $58.00

QAS Self-Study

Credits: 2 $58.00 -

Regulatory Ethics

Regulatory Ethics

Nevada Professional Ethics

Joseph Helstrom, CPA QAS Self-Study

Credits: 2 $58.00

QAS Self-Study

Credits: 2 $58.00 -

Accounting

Accounting

Metrics Which Everyone Should Know

Jeff Sailor, CPA Webcast

Credits: 2 $98.00

Webcast

Credits: 2 $98.00 -

Auditing

Auditing

Risk Assessment of IT Systems

Jeff Sailor, CPA Webcast

Credits: 1 $49.00

Webcast

Credits: 1 $49.00 -

Auditing

Auditing

Getting Control of Internal Control

Jeff Sailor, CPA Webcast

Credits: 2 $98.00

Webcast

Credits: 2 $98.00 -

Accounting

Accounting

A Closer Look at Guarantees and Commitments under U.S. GAAP

Kelen Camehl, CPA, MBA QAS Self-Study

Credits: 2 $58.00

QAS Self-Study

Credits: 2 $58.00 -

Accounting

Accounting

Accounting for Exit or Disposal Cost Obligations – What CPAs Need to Know

Kelen Camehl, CPA, MBA QAS Self-Study

Credits: 1 $29.00

QAS Self-Study

Credits: 1 $29.00 -

Accounting

Accounting

Accounting for Software to Be Sold or Licensed – What CPAs Need to Know

Kelen Camehl, CPA, MBA QAS Self-Study

Credits: 2 $58.00

QAS Self-Study

Credits: 2 $58.00 -

Accounting

Accounting

Accounting for the Unexpected – A Guide to Subsequent Events

Kelen Camehl, CPA, MBA QAS Self-Study

Credits: 2 $58.00

QAS Self-Study

Credits: 2 $58.00 -

Accounting

Accounting

Know the Differences Between an Asset Acquisition vs. Business Combination

Kelen Camehl, CPA, MBA QAS Self-Study

Credits: 1 $29.00

QAS Self-Study

Credits: 1 $29.00 -

Accounting

Accounting

Accounting for Restructuring – Workforce and Contract Termination Costs

Kelen Camehl, CPA, MBA QAS Self-Study

Credits: 2 $58.00

QAS Self-Study

Credits: 2 $58.00 -

Accounting

Accounting

Accounting for R&D – A Quick Guide to ASC 730

Kelen Camehl, CPA, MBA QAS Self-Study

Credits: 1 $29.00

QAS Self-Study

Credits: 1 $29.00 -

Auditing

Auditing

Malpractice Issues for CPAs

Steven M. Bragg, CPA QAS Self-Study

Credits: 3 $87.00

QAS Self-Study

Credits: 3 $87.00 -

Accounting

Accounting

AI for Accountants: Tools, Trends and Transformations

Steven M. Bragg, CPA QAS Self-Study

Credits: 2 $58.00

QAS Self-Study

Credits: 2 $58.00 -

Personal Development

Personal Development

Coaching the Next Generation of CPAs: Tips for Developing Millennials and Beyond

Jennifer F. Louis, CPA Webcast

Credits: 2 $98.00

Webcast

Credits: 2 $98.00 -

Auditing

Auditing

Auditing Cash – Applying Basic Skills to the Starting Point of Any Audit

Jennifer F. Louis, CPA Webcast

Credits: 2 $98.00

Webcast

Credits: 2 $98.00 -

Auditing

Auditing

Crossing the Line: Cases in Financial Statement Fraud and Auditor Deception

Joseph Helstrom, CPA QAS Self-Study

Credits: 1 $29.00

QAS Self-Study

Credits: 1 $29.00 -

Auditing

Auditing

2025 Hot Topics Audit & Attest Update

Jennifer F. Louis, CPA Webcast

Credits: 2 $98.00

Webcast

Credits: 2 $98.00 -

Accounting

Accounting

The FASB Conceptual Framework

Jeff Sailor, CPA Webcast

Credits: 2 $98.00

Webcast

Credits: 2 $98.00 -

Behavioral Ethics

Behavioral Ethics

2025 Focus On Fraud

Jeff Sailor, CPA Webcast

Credits: 1 $49.00

Webcast

Credits: 1 $49.00 -

Auditing

Auditing

Auditing Top-Ten List: Analytics

Sunish Mehta, CPA, CGMA Webcast

Credits: 1 $49.00

Webcast

Credits: 1 $49.00 -

Taxes

Taxes

One Big Beautiful Bill Business Provisions

Jane Ryder, EA, CPA Webcast

Credits: 1

Webcast

Credits: 1$49.00$39.00 -

Taxes

Taxes

Types of Business Entities

Steven M. Bragg, CPA QAS Self-Study

Credits: 2 $58.00

QAS Self-Study

Credits: 2 $58.00 -

Personal Development

Personal Development

How to Run a Meeting

Steven M. Bragg, CPA QAS Self-Study

Credits: 2 $58.00

QAS Self-Study

Credits: 2 $58.00 -

Accounting

Accounting

Accounting for Intangible Assets

Steven M. Bragg, CPA QAS Self-Study

Credits: 1 $29.00

QAS Self-Study

Credits: 1 $29.00 -

Taxes

Taxes

One Big Beautiful Bill An Overview

Sharon Kreider, CPA Webcast

Credits: 2

Webcast

Credits: 2$98.00$69.00 -

Production

Production

Quality Management Fundamentals

Steven M. Bragg, CPA QAS Self-Study

Credits: 3 $87.00

QAS Self-Study

Credits: 3 $87.00 -

Computer Software & Applications

Computer Software & Applications

Introduction to Excel

Steven M. Bragg, CPA QAS Self-Study

Credits: 3 $87.00

QAS Self-Study

Credits: 3 $87.00 -

Auditing

Auditing

Guide to Audit Working Papers

Steven M. Bragg, CPA QAS Self-Study

Credits: 1 $29.00

QAS Self-Study

Credits: 1 $29.00 -

Taxes

Taxes

Taxpayer Data Security

Steven M. Bragg, CPA QAS Self-Study

Credits: 2 $58.00

QAS Self-Study

Credits: 2 $58.00 -

Auditing

Auditing

Auditing Top-Ten List: Internal Controls

Sunish Mehta, CPA, CGMA Webcast

Credits: 1 $49.00

Webcast

Credits: 1 $49.00 -

Auditing

Auditing

Auditing Top-Ten List: The Audit Risk Model

Sunish Mehta, CPA, CGMA Webcast

Credits: 1 $49.00

Webcast

Credits: 1 $49.00 -

Auditing

Auditing

Auditing Top-Ten List: Tests of Controls

Sunish Mehta, CPA, CGMA Webcast

Credits: 1 $49.00

Webcast

Credits: 1 $49.00 -

Taxes

Taxes

One Big Beautiful Bill

Mark Seid, EA, CPA, USTCP Webcast

Credits: 1

Webcast

Credits: 1$49.00$39.00 -

Taxes

Taxes

2025 California Tax Update: Summer Release (Pro Edition)

Karen Brosi, CFP, EA & Sharon Kreider, CPACredits: 4$109.00$80.00 -

Taxes

Taxes

2025 California Tax Update: Summer Release (Self-Study Only)

Karen Brosi, CFP, EA & Sharon Kreider, CPA QAS Self-Study

Credits: 4

QAS Self-Study

Credits: 4$90.00$70.00 -

Finance

Finance

CPA Firm Mergers and Acquisitions

Steven M. Bragg, CPA QAS Self-Study

Credits: 3 $87.00

QAS Self-Study

Credits: 3 $87.00 -

Computer Software & Applications

Computer Software & Applications

Excel Formulas and Functions

Steven M. Bragg, CPA QAS Self-Study

Credits: 2 $58.00

QAS Self-Study

Credits: 2 $58.00