On April 13, Western CPE’s TaxByte released “IRS Adds Eight New FAQs on Schedules K-2 and K-3 But Questions Linger.”

Through examination of these new reporting requirements and the history of Subchapter S, reveals a distortion of the original objectives of this business form. What started out as a simple single tax entity is now governed by the most complex reporting needs of any shareholder. Schedules K-2 and K-3 reveal a “tail wagging the dog” approach that imposes inappropriate burdens on millions of closely-held businesses that have no reason to report, or even record, much of the requested information.

History of S Corporations

In 1958 Congress created the Subchapter S (Small Business) corporation. Among the goals of this legislation was to create a simple single tax entity, so that closely-held businesses could choose the liability shield of a corporation (the LLC was nearly 20 years in the future) without double tax. Several provisions, including number and type of shareholders and classes of stock, served to assure the simplicity of this business form. Fast forward to 2021, where the reporting needs of a few shareholders drive the reporting requirements for all S corporations.

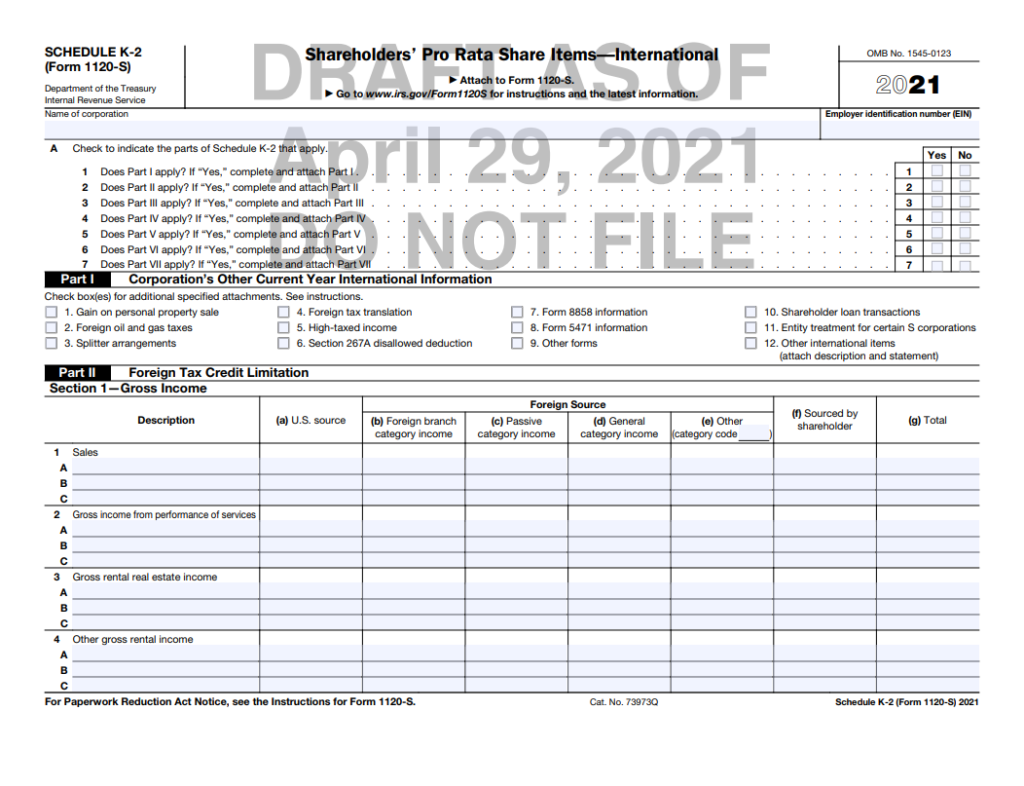

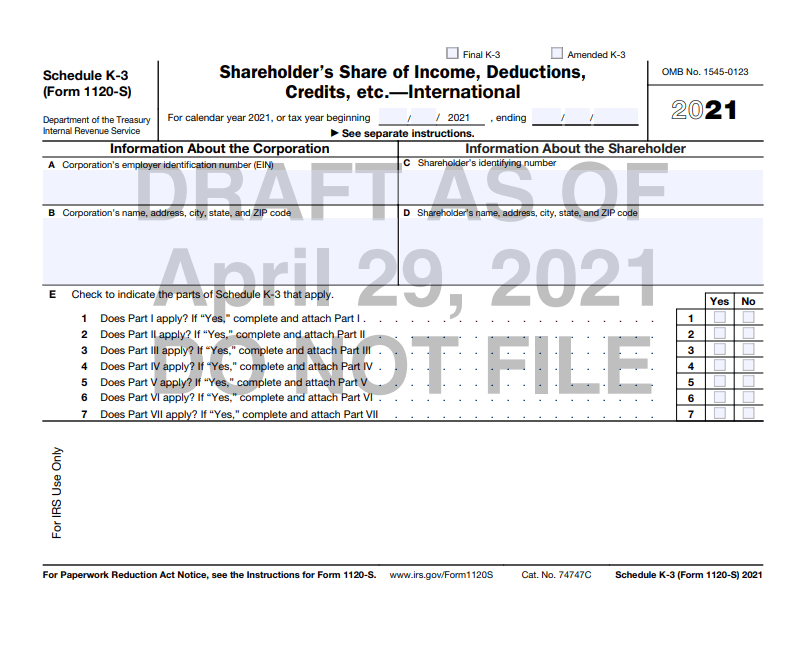

In 2021 the IRS introduced draft versions of Schedule K-2 and Schedule K-3, for inclusion with Form 1120S.

Initially it appeared that these forms, which are massive and in length and detail, would apply only to corporations with international dealings. However, in early 2022, when the final schedules arrived, it appeared that’s all S corporations would need to file these forms. For each Form 1120-S, the corporation would need to file Schedule K-2, which is 14 pages in length and has 2,062 data fields. (Form 1120-S is only 5 pages in length and has 378 data fields.) Moreover, the corporation must include with its return and provide each shareholder with a copy of Schedule K-3. Schedule K-3 is 15 pages long and has 2,101 fields for data entry.

Progression of Reporting

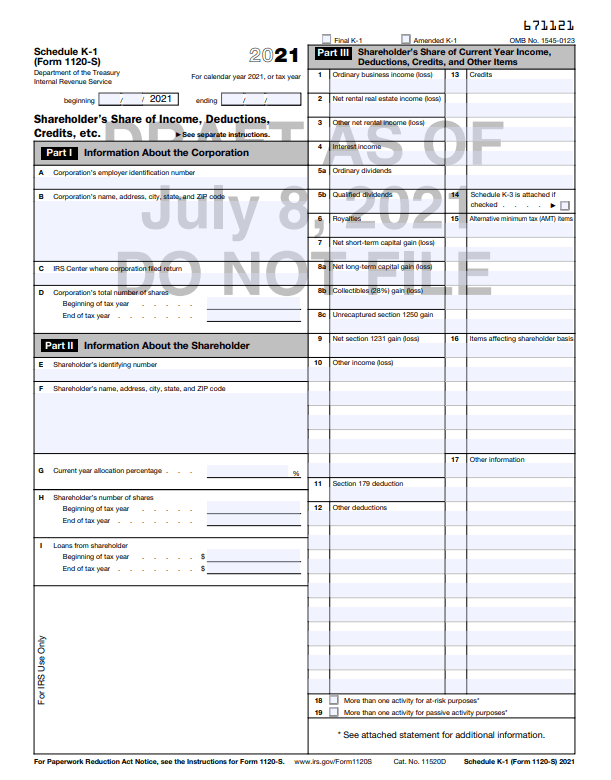

Why all this new reporting? Actually, it’s not entirely new. It’s just much more pervasive than it was for earlier years. Form 1120-S Schedule K and Schedule K-1 have each provided a line for reporting international tax information, and the corporation was obliged to provide a plain paper statement to each shareholder with the relevant information. Such information includes:

- Gross income from sales;

- Gross income from services;

- Gross income from real estate rents;

- Other gross rental income;

- Interest income;

- Nonqualified dividend income;

- Qualified dividend income;

- Gross income from royalties and license fees;

- Gains, further segregated into net short term capital gain, net long term capital gain, gains from collectibles, unrecaptured §1250 gain and net §1231 gain;

- Expenses allocable to sales;

- Expenses allocable to service;

- Losses, further segregated into net short term capital loss, net long term capital loss, loss from collectibles, and net §1231 loss;

- Other gains;

- Other losses;

- Rental expenses, other than depreciation;

- Depreciation allocable to rents;

- Royalty expenses, other than depreciation;

- Depreciation allocable to royalties;

- Other depreciation;

- Charitable contributions;

- Various categories of allocable interest; and,

- Special international items, under §§ 986, 987, 988, 951, 951A, etc.

View the full Form 1120-S (Schedule K-1) document, HERE.

Foreign Source Income

Even if the corporation has no foreign source income it must categorize each of its sources of income and allocable deductions. If the corporation has any income from foreign sources, it must fill each of the above categories into a matrix, and segregate each category by:

- S. source;

- Foreign branch category;

- Foreign passive category/Foreign general category; and,

- Other foreign category.

YOUR CPE CONFERENCE IS WAITING

Don’t wait to book your 2022 CPE Conference. Register for your location today.

There are also special rules for research and experimentation expenditure, which are no longer deductible under U.S. tax laws. The corporation must separate the gross receipts of the activities associated with research and experimentation by SIC code. The corporation must also apportion interest expenses, payments to some related parties, payments associated with business interest expense, investment interest expense, etc. To comply with interest allocation rules, the corporation must determine the average value of assets associate with these categories of income.

For 2021 returns, an S corporation is excused from filing these schedules, if it meets all of these conditions:

- In tax year 2021, the S corporation has no foreign activity, including foreign taxes paid or accrued or ownership of assets that generate, have generated or may reasonably expected to generate foreign source income.

- In tax year 2020, the S corporation did not provide to its shareholders nor did the shareholders request the information regarding Schedules K and K-1 line), and

- The S corporation has no knowledge that the shareholders are requesting such information for tax year 2021.

However, even if the S corporation meets all of these qualifications, it must provide this information to any shareholder who requests it, even if the S corporation has already filed its return.

what's next?

So, what’s next? Will there be Schedule K-2 equivalents for every Schedule C? Why not Schedule F, Schedule B, Schedule D, Form 4797 and Schedule E rent and royalty income?

Perhaps it’s time to reign in the zealotry for complete reporting of every detail and apply some standard of reasonableness. Subchapter S, once designed to provide a simple business alternative, has always fallen short of its goals. The latest filing requirements will not only burden closely-held businesses, but will flood the already overburdened IRS with virtual mountains of useless data. It’s time for some serious evaluation of business taxation and reporting.

Recent Stories

Senate Finance Committee Revisions to OBBBA

California Corner: FTB Experiencing Technical Issues

Next Up...

- |

- TaxByte

- |

- TaxByte