Electric Vehicle Credit Starts to Phase Out for Tesla and General Motors (IR-2019-57)

Section 30D provides a credit for Qualified Plug-in Electric Drive Motor Vehicles including passenger vehicles and light trucks. For vehicles acquired after Dec. 31, 2009, the credit is equal to $2,500 plus, for a vehicle which draws propulsion energy from a battery with at least 5 kilowatt hours of capacity, $417, plus an additional $417 for each kilowatt hour of battery capacity in excess of 5 kilowatt hours. The total amount of the credit allowed for a vehicle is limited to $7,500. The credit begins to phase out for a manufacturer’s vehicles when at least 200,000 qualifying vehicles have been sold for use in the United States.

Tax practitioner resource: Vehicles eligible for the credit and the amount of the qualifying credit can be found here.

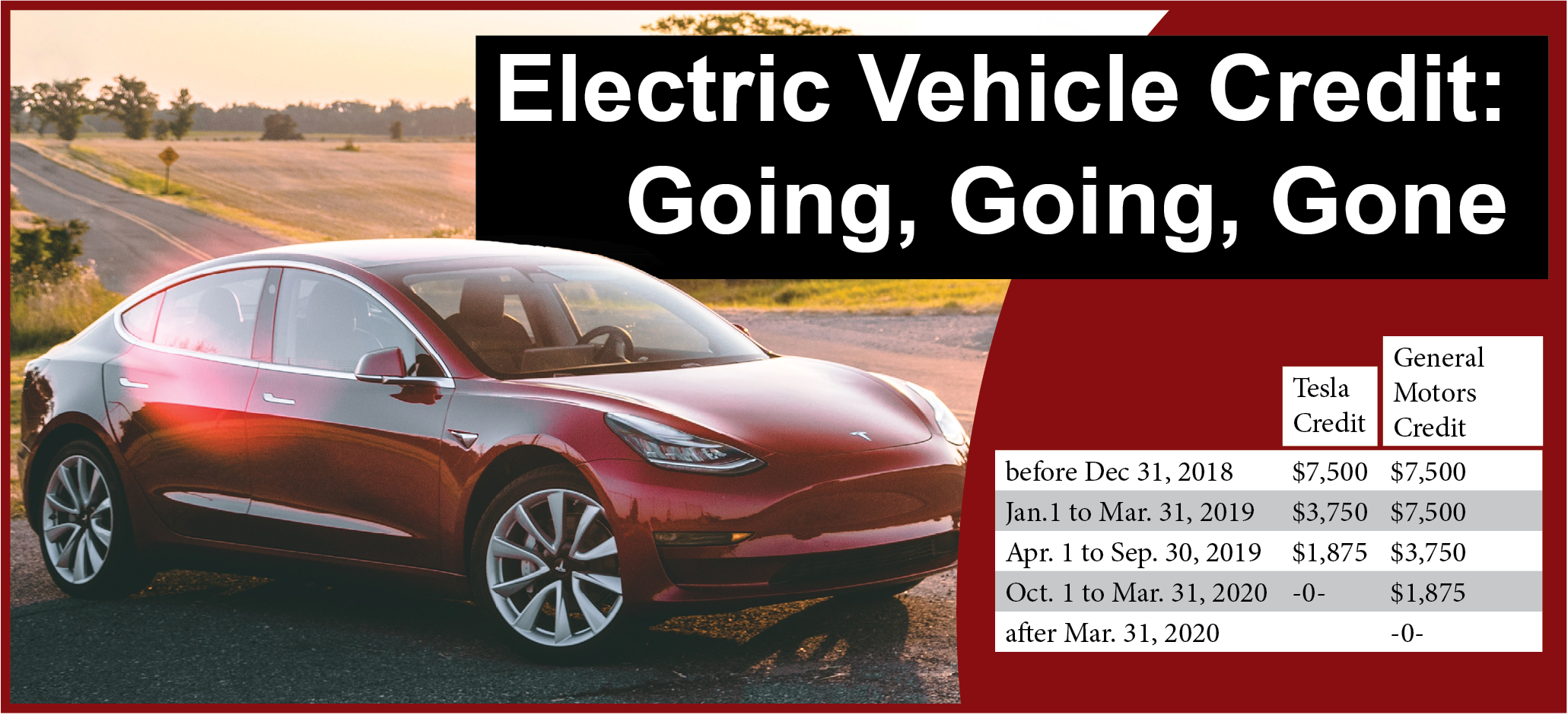

Tesla sold more than 200,000 vehicles eligible for the plug-in electric drive motor vehicle credit during the third quarter of 2018. This triggers a phase out of the tax credit available for purchasers of new Tesla plug-in electric vehicles beginning Jan. 1, 2019.

General Motors sold more than 200,000 vehicles eligible for the plug-in electric drive motor vehicle credit during the fourth quarter of 2018. This triggers a phase out of the tax credit available for purchasers of new General Motors plug-in electric vehicles beginning April 1, 2019.

Watch for a legislative fix. Because the phaseout affects early innovators in the electric vehicle industry, legislation has been proposed to allow up to a $7,000 credit for the next 400,000 vehicles sold. If your client is asking about the electric vehicle credit, suggest that they wait a few months to buy a Tesla or GMC vehicle to see if Congress gets around to extending the credit.

Tax classes at Western CPE’s resort conferences cover payroll tax developments as well as updates and news for individuals, businesses and real estate investors.

Recent Stories

Senate Finance Committee Revisions to OBBBA

California Corner: FTB Experiencing Technical Issues

Next Up...

- |

- TaxByte

- |

- TaxByte