Audits are coming. If you read in the middle of the night like me, you might have read a working paper from the National Bureau of Economic Research (NBER) on the tax paid by the top 1% of households.

The top 1% of households failed to report 21% of their income with six points of that number due to strategies that were so sophisticated that even if that upper-income person’s tax return was randomly audited under the NRP audit, it didn’t detect them within six points of the 21%.

WATCH NOW TO LEARN MORE

Click the play button below to watch.

BACKGROUND

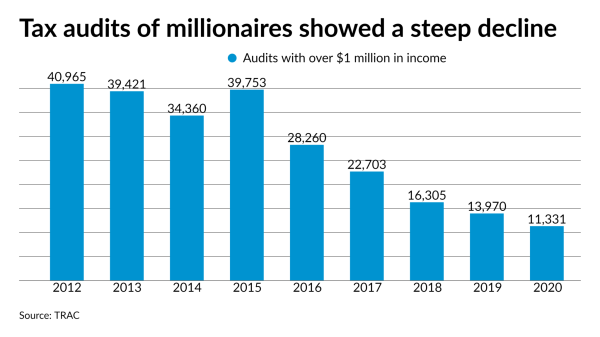

The report from Syracuse University’s Transactional Records Access Clearinghouse (TRAC) contends that the government allows billions of dollars in tax revenue to “slip through its fingers” due to budget and staffing cuts. Consequently, the IRS was unable to audit the 637,212 millionaires living in the U.S effectively.

TAX AVOIDANCE AT THE TOP

In their working paper, the National Bureau of Economic Research (NBER) seeks answers to the following questions: How much do high-income individuals evade in taxes? And what are the primary forms of tax noncompliance at the top of the income distribution?

End.

Recent Stories

Senate Finance Committee Revisions to OBBBA

June 24, 2025

California Corner: FTB Experiencing Technical Issues

June 11, 2025

Next Up...

- |

- TaxByte

The Senate Finance Committee's version of the One Big Beautiful Bill Act (OBBBA) passed in

5 min read

- |

- TaxByte

The Senate Finance Committee's release of their version of the One Big Beautiful Bill Act

5 min read