Audits are coming. If you read in the middle of the night like me, you might have read a working paper from the National Bureau of Economic Research (NBER) on the tax paid by the top 1% of households.

The top 1% of households failed to report 21% of their income with six points of that number due to strategies that were so sophisticated that even if that upper-income person’s tax return was randomly audited under the NRP audit, it didn’t detect them within six points of the 21%.

WATCH NOW TO LEARN MORE

Click the play button below to watch.

BACKGROUND

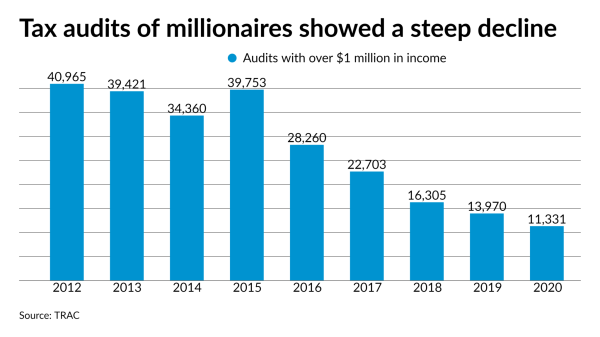

The report from Syracuse University’s Transactional Records Access Clearinghouse (TRAC) contends that the government allows billions of dollars in tax revenue to “slip through its fingers” due to budget and staffing cuts. Consequently, the IRS was unable to audit the 637,212 millionaires living in the U.S effectively.

TAX AVOIDANCE AT THE TOP

In their working paper, the National Bureau of Economic Research (NBER) seeks answers to the following questions: How much do high-income individuals evade in taxes? And what are the primary forms of tax noncompliance at the top of the income distribution?

End.

Recent Stories

Trump Accounts and New Form 4547

January 12, 2026

The ACA Enhanced Subsidy Expires

January 2, 2026

IRS Premium Tax Credit FAQ Update: What to Know for 2026

December 30, 2025

Next Up...

A family-friendly New Orleans CPE conference makes it easy to earn credits in the morning

4 min read

A New Orleans CPE getaway with Western CPE combines focused morning classes with open afternoons,

3 min read

Choosing the right hotel can shape your entire New Orleans CPE conference experience. Discover why

4 min read