Western CPE Blog

4 min read

Starting January 1, 2026, meals provided for the convenience of the employer under §119 become 100% non-deductible under IRC §274(o). However, a 50% deduction on overtime meals remains under §132(e)(1) if they meet three important requirements.

Recent Blog Posts

6 min read

Thinking of starting your own Limited Liability Company, better known as an LLC? There are

3 min read

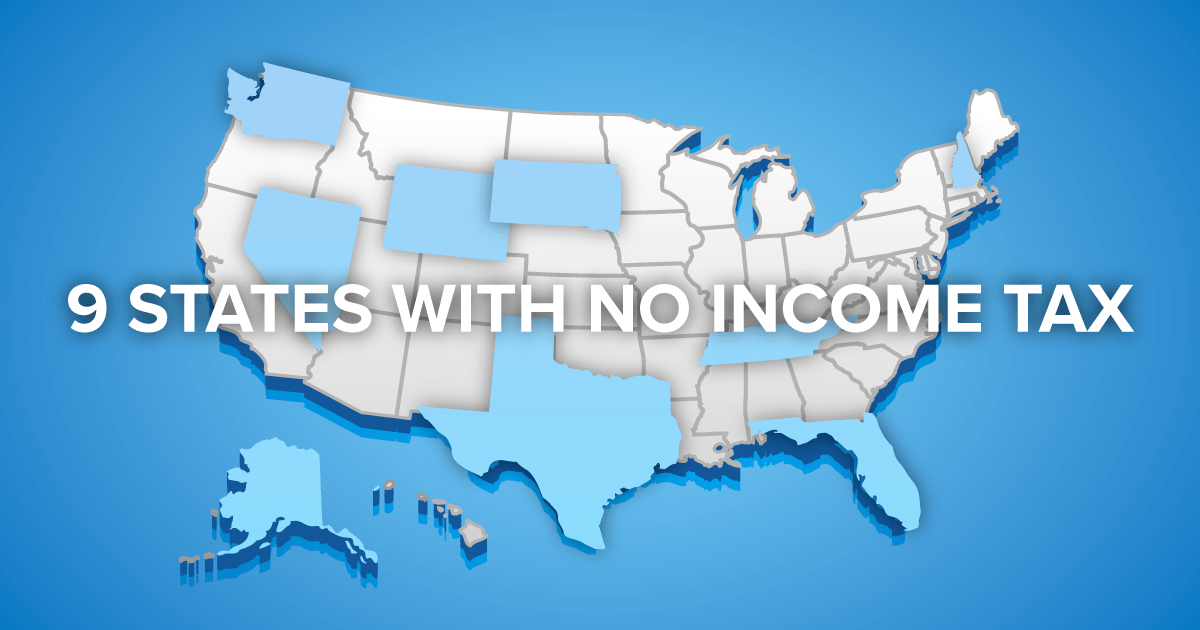

There are many factors people consider when choosing a place to live, including location, weather,

2 min read

The IRS announced today that taxpayers who filed their federal income taxes earlier in this

6 min read

It’s important to understand the income tax bracket you fall into within your state so

6 min read

Oh, the joy of receiving a paycheck without income tax taken out. Though it may

3 min read

Happy Friday, tax pros. Once again, we’re wrapping up the week by getting some of

2 min read

The California Franchise Tax Board (FTB) in an e-file news release today is aiming to

Don't Miss It

AI in Accounting: 5 Ways to Incorporate AI into Your Firm

November 13, 2025

Wrong Signature Invalidates Assessment Window (CCA 202505027)

October 22, 2025