- |

- TaxByte

The Department of Labor (DOL) takes a neutral stance on cryptocurrency being incorporated into 401(k)

3 min read

If you weren’t tuned into the 15 hours of Senate floor proceedings known as “vote-a-rama” over the weekend (good for you), you may have missed that the upper chamber on August 7 approved along party lines the Inflation Reduction Act (IRA) of 2022 (HR 5376). The sweeping climate and healthcare bill contains significant tax law changes and a steep IRS funding boost.

Although the IRA (that acronym will likely always feel weird, am I right?) contains several provisions originally seen in the much larger House-passed Build Back Better Act, I suppose Sharon Kreider’s suggested title revision to Congress of Build Back Barely Better didn’t have quite the same ring to it. Tough but fair.

The original draft of the IRA bill was released at the end of July but underwent some cuts and amendments before making it over the finish line. The measure now heads to the House. President Biden has said he intends to sign the legislation once it reaches his desk.

Let’s take just a bite of some of the notable tax changes.

See what I did there?

Generally, if enacted the IRA (still weird) would:

As expected, modifying the tax treatment of carried interest as originally proposed in the bill was removed in the eleventh hour per rebellion from Sen. Kyrsten Sinema, D-Ariz.

Notably, Sinema, along with Sen. John Thune, R-S.D., successfully pushed for exempting portfolio companies of investment funds from the 15% AMT. As the bill was originally drafted, small and medium-sized businesses that are owned by private equity firms could have been exposed to the tax. Thune and Sinema drafted an amendment, which was adopted by a 57-43 vote, to clarify that profits from subsidiaries would not be considered in determining whether a firm is subject to the new AMT.

Additionally, the IRA’s legislative text was changed to exempt depreciation deductions under section 167 for property to which section 168 applies. Further, the updated text includes a new carveout for section 197 deductions for wireless spectrum acquired by telecommunications companies after December 31, 2007, and before the IRA’s enactment.

The American Institute of CPAs (AICPA) sent an August 4 letter to Congress stating that the new corporate AMT would violate numerous elements of good tax policy. In addition to adding complexity to the tax code, imposing tax according to financial statement income takes the definition of taxable income out of Congress’s hands and transfers it to those of industry regulators and others, the AICPA said. “There are many key conceptual differences between financial income and taxable income, including the concept of materiality. Public policy taxation goals should not have a role in influencing accounting standards or the resulting financial reporting.”

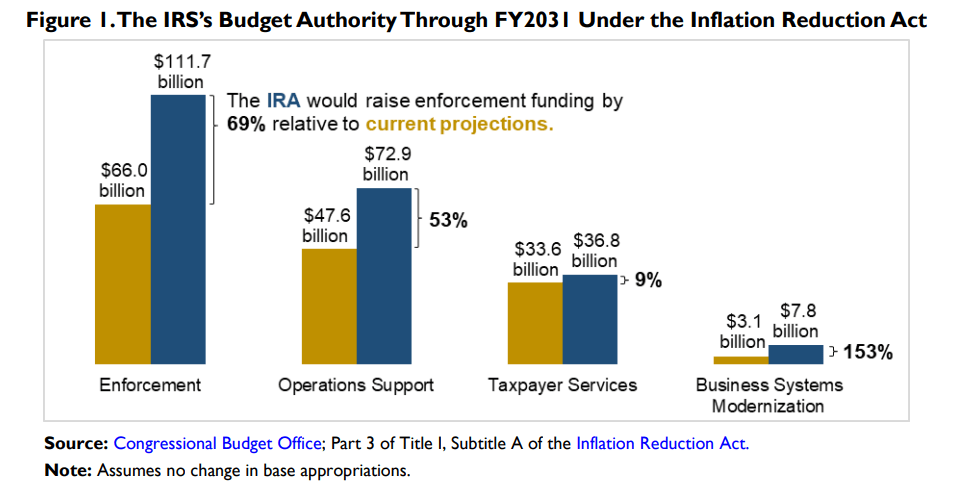

Under the IRA, the IRS will receive a nearly $80 billion boost in funding over a 10-year period. More than half of that funding is allocated for enforcement. The breakdown is as follows:

IRS Commissioner Charles “Chuck” Rettig in an August 4 letter thanked Congress for the significant increase in funding and assured lawmakers that the IRS’s intent was not to increase examinations on small businesses and middle-income taxpayers.

“These resources are absolutely not about increasing audit scrutiny on small businesses or middle-income Americans,” Rettig wrote. “As we’ve been planning, our investment of these enforcement resources is designed around the Department of the Treasury’s directive that audit rates will not rise relative to recent years for households making under $400,000.”

The letter, however, did not mention anything about an upgrade in hold music for the tax pros; I checked.

To view the full Congressional Research Service (CRS) Insight, click here.

Stay tuned for additional IRA insights when Jessica takes a deep dive into the legislation with our eTax Alert follow-up.

Subscribe to our news, analysis, and updates to receive 10% off your first purchase of an on-demand digital CPE course.