The Treasury and IRS have issued proposed regulations implementing the "No Tax on Car Loan Interest" provision, offering up to $10,000 in annual deductions for taxpayers financing new American-made vehicles for personal use through 2028.

Recent Taxbytes

2 min read

In a significant decision, the Sixth Circuit reversed a Tax Court ruling that had treated

2 min read

When Melissa Correll claimed her 16-year-old son as a dependent on her 2021 return even

2 min read

In a recent decision, the court granted summary judgment to the government in a case

4 min read

A nearly $188,000 personal tax liability struck board member Kristopher Dreyer when the Ninth Circuit

5 min read

Revenue Procedure 2025-10 provides updated guidance on Section 530 relief—the first update since 1985.

1 min read

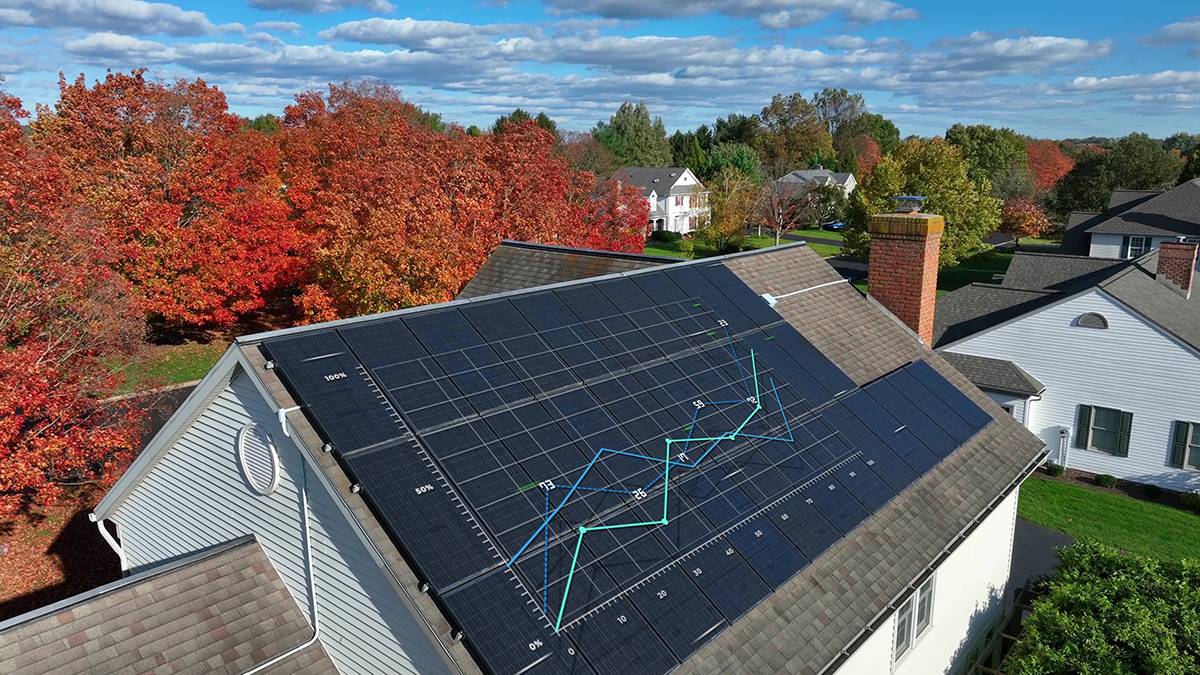

For 2025, The IRA22 introduces a new requirement that certain energy-efficient home improvements will need

11 min read

The U.S. Department of Education announced that its Office of Federal Student Aid (FSA) resumed