The 2021 tax season is officially here, come Monday. The IRS announced the nation’s tax season will start on Monday, January 24, 2022. With tax season, quickly on its way, here’s what you’ll need to know before they begin accepting and processing 2021 tax year returns and the obstacles that came with the pandemic. It’s never too early to get ahead.

IMPORTANT DATES

January 24

- Start date for 2021 Individual Tax Return filers

Start date for 2021 Individual Tax Return filers

January 28

- Earned Income Tax Credit Awareness Day to raise awareness of valuable tax credits available to many people – including the option to use the prior-year income to qualify.

April 18

- The filing deadline for 2021 tax return submissions

- Taxpayers in Maine or Massachusetts have until April 19 to file their returns due to the Patriots’ Day holiday, in those states.

October 17

- The deadline for taxpayers requesting an extension for 2021 returns

USE ONLINE RESOURCES

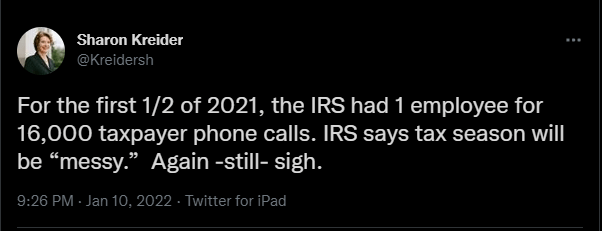

Expert Sharon Kreider, CPA explains that for the first half of 2021, the IRS had 1 employee for 16,000 taxpayer phone calls, and this year we could be looking at the same delays. The IRS is encouraging people to use online resources before calling as well as utilizing its free options available to help taxpayers, including:

- Free assistance at Volunteer Income Tax Assistance (VITA) and Tax Counseling for the Elderly (TCE) locations across the country.

- Free File program, available on January 14, 2022.

- Interactive Tax Assistance (ITA) is a tool that provides answers to tax law questions specific to individual circumstances

- MilTax is a free tax resource through the Department of Defense, available to the military community. It was specifically designed to fit the realities of military life with personalized support.

- Creating an online account to access your latest information.

Follow in-house tax authority, Sharon Kreider, on Twitter @Kreidersh.

Encourage Clients to Create an IRS Online Account

Expert Mark Seid EA, CPA, USTCP suggests that advisors have their clients create an IRS Online Account. The IRS Online Account will allow clients to get the three items that cause the most errors on 2021 tax returns:

- Accurate EIP information

- Advance child tax credit payments

- Estimated tax payment information

Getting them right when you prepare the 2021 return will save countless hours of dealing with the IRS trying to resolve problems we could have prevented. And remember, having the IRS Online Account will allow your client to authorize a power of attorney (POA/TIA) that is processed in real-time (rather than weeks or months).

Set Deadlines for Clients

Expert Karen Brosi, CFP, EA advises, “Don’t let the latent procrastinators run you.” For example, adjust your practice workflow by adopting an engagement letter to keep your clients informed of deadlines.

Deadlines could include:

- Feb. 15 – bulk of pass-through information submitted (no extension)

- March 1 – Pass-through data submitted for extension

- March 15 – bulk of individual data submitted (no extension)

- April 1 – Individual data submitted for extension

Consider wording in your engagement letter “If you do not submit data by March 1 (pass-throughs) or April 1 (individuals), we cannot prepare a timely extension for you. If we do not prepare your extension, we will not be able to prepare your returns.”

THE PRE-SEASON TAX SALE

Get the latest content and best deals when you shop the inaugural Pre-Season Sale. Prepare for the arrival of this year’s tax season with the learning experience of your choice. Save up to 30% off today.

PREPARE PAPERWORK EARLY

Ask your clients to start organizing and gathering their 2021 tax records including Social Security numbers, Individual Taxpayer Identification Numbers, Adoption Taxpayer Identification Numbers, and this year’s Identity Protection Personal Identification Numbers, valid for the calendar year 2022.

The IRS also sent an information letter to Advance Child Tax Credit (ACTC) recipients starting in December. Additionally, they will send a letter to recipients of the third round of the Economic Impact Payments (EIP) by the end of January. Remind clients when you send organizers, or otherwise contact clients asking for 2021 tax documents, they should include with their records any (and all) IRS correspondence, including:

- Letter 6419 will show advanced child tax credit payments

- Letter 6475 will show the third round Economic Impact Payment.

If your client received either, or both, payments, you’ll want to obtain their letters. If your client has already lost their letters, you can get the necessary information from a transcript, giving you more time.

GET AHEAD BY FILING ELECTRONICALLY

Always file electronically if you can. The IRS is drowning in paper. The latest numbers are that the IRS has more than 2.5 million of unprocessed refund claims in its service centers.

Filing electronically will help to speed funds when linked with direct deposit information.

The IRS strongly encourages people to file their tax returns electronically to minimize errors and for faster refunds – as well having all the information they need to file an accurate return to avoid delays.

PREPARE AHEAD FOR MAIL-IN

If you mail the return, always take the time to register or certify the mail. A stamp isn’t good enough and is probably going to cost this tax preparer $134,000. If you hand the client a paper return to mail, put in writing that they should send the return by registered or certified mail.

Recent Stories

Next Up...

- |

- TaxByte

- |

- TaxByte

- |

- TaxByte