Clients had a break in 2020, they didn’t have to take Required Minimum Distributions (“RMDs”) from their retirement accounts. The RMDs come not just from IRAs but 403(b) arrangements, Keogh plans, and other profit-sharing plans. Failure to take the distribution can lead to a 50% penalty on the missed amount.

IRA custodians are required to either calculate the RMD for customers by assuming the uniform table applies to them or offering to calculate a personalized distribution amount. Those requirements do not apply if the IRA is inherited, however.

In this eTax Alert, we’ll talk about the return of RMD withholding, potential penalties your clients could face, qualified charitable distributions to sum up the benefits of early preparation over last-minute withdrawal. But first, let’s take a look at the Uniform Lifetime Table and calculate the minimum distribution.

Calculating your client's minimum distribution

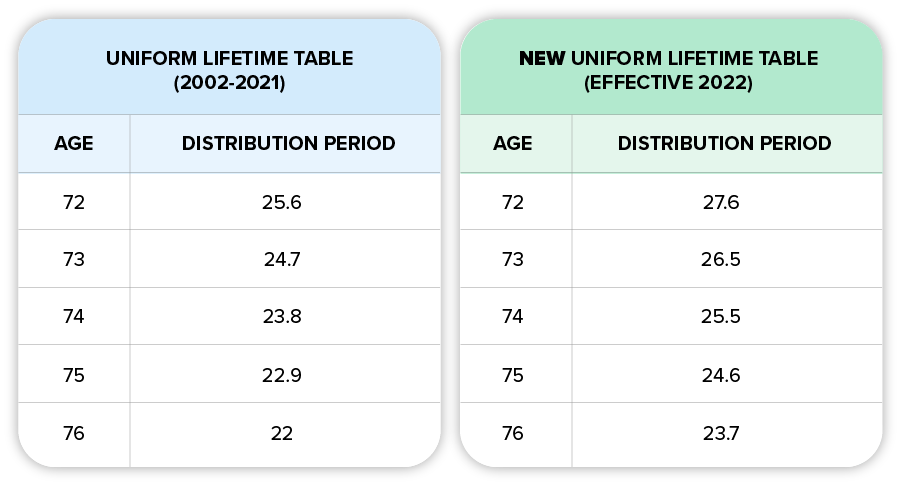

The IRS’s Uniform Lifetime Table is used for anyone having an IRA (that’s not inherited) unless there is only one beneficiary, and that beneficiary is a spouse more than ten years younger than the owner. In that case, a special table is used and the RMDs are smaller.

If the case of specialized tables and other cases, the following materials will help with determining required distribution amounts and payout periods:

- Required Minimum Distribution Worksheets

- Tables to calculate the RMD during the participant or IRA owner’s life:

- Uniform Lifetime Table

- Table I (Single Life Expectancy): for beneficiaries who are not the spouse of the IRA owner

- Table II (Joint Life and Last Survivor Expectancy): for owners whose spouses are more than 10 years younger and are the IRA’s sole beneficiaries

What About Withholding?

Income tax withholding from RMDs is optional but many custodians will withhold 10% federal tax unless notified differently. State income taxes are not so consistent. Some states require that state tax be withheld at a rate based on the percentage of federal withholding but it is still optional for most states.

RMD withholding can save your client from some underpayment penalties. You know that quarterly payments apply to taxes on the dates they’re paid but withholding (no matter how early or how late) is treated as being paid ratably during the year. If a client forgot to pay their June estimate for example, they could take an IRA distribution before year end and have that missed dollar amount withheld from it. Many custodians won’t allow 100% of an IRA distribution to be paid in as withholding, but 99% will work.

Penalty Avoidance

What if your client does not have liquid funds to withdraw the RMD before year-end?

- POSSIBLE SOLUTION 1: Have a distribution taken in kind. If the client also has a brokerage account with the custodian (or can open one), they can have a position that’s worth the amount of the unclaimed RMD transferred from the IRA to the after-tax account. The market value on the date of the transfer becomes the basis for that position and an immediate sale will be a short-term gain or loss though.

- POSSIBLE SOLUTION 2: Take a distribution from another IRA. So, if someone has already taken their distribution from custodian F and is short of funds in the IRA managed by custodian M, they can take an additional amount from the first IRA to be certain to take the total amount. The rule is that the taxpayer is to calculate the RMD from each IRA, add the RMDs together, and then take the total amount from any IRA that they own. That strategy also works with 403(b) arrangements – the full RMD can be taken from a combination of funds. Qualified plans are a different story however, you can’t take a Keogh plan RMD from an IRA or vice versa. Each qualified plan stands on its own.

What if penalty avoidance doesn’t work?

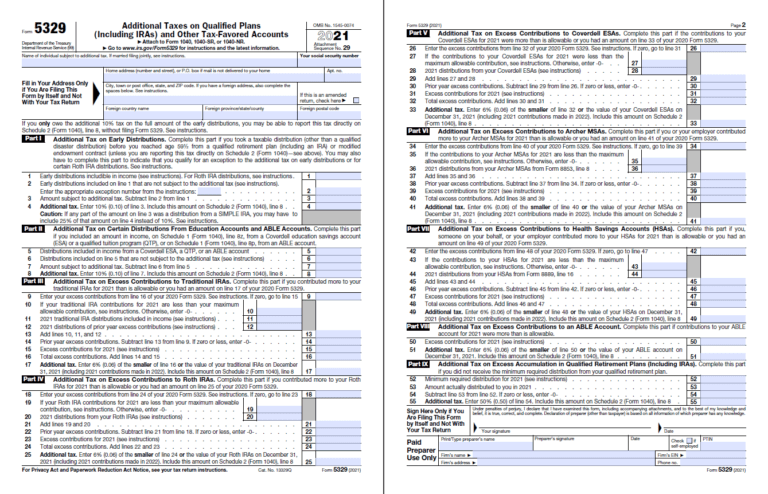

Your client may need to request a penalty abatement. This is accomplished by attaching Form 5329 to the return and at the bottom of the second page, telling IRS how much you were supposed to withdraw and how much was actually withdrawn. Here are some quick tips:

- The form wants you to pay a penalty of 50% of the difference. Instead, you put zero on the penalty line and indicate that there’s a schedule attached.

- The schedule must explain the circumstances, ask for the waiver of the penalty, and state that the missed distribution has already been taken. The IRS cannot waive the penalty if the missed RMD is still in the plan.

It’s important to report the RMDs in the year actually received. You do not get a penalty waiver by reporting the RMD in the year it was supposed to be received. The client should take the late RMD when discovered even though it means paying tax on two RMDs in one year.

Since custodians are not required to calculate RMDs for inherited accounts, those clients are most at risk for penalties and may need more guidance.

Qualified Charitable Distributions

Anyone over 70½ with an IRA (even an inherited IRA) can take up to $100,000 from the account each year that goes directly to the charity and not report the withdrawal as gross income. This transfer (“QCD”) can qualify as an RMD even if the RMD is less than $100,000. The IRA owner needs to have the acknowledgment from the charity that “no goods or services” were received if the amount is over $250. The charity must qualify for deduction under Sec. 170 and the transfer cannot be made to a private foundation or donor-advised fund.

Basis in an IRA is not used up in making a QCD. In addition, the charitable distribution from the IRA must be one that otherwise would have been eligible for a full charitable deduction. This “must have been eligible for a full deduction” rule means that the IRA donor does not receive any benefits for the donation (which would limit the donor’s deduction to only the net amount contributed and fail the “full deduction” QCD requirement).

The custodian has no responsibility to report QCDs to the IRS or the taxpayer. Form 1099-R will not show them as tax-free. The IRA owner is responsible for correct reporting and compliance with the full deduction and acknowledgment rules.

Final Dates & Take Away

The RMDs must be withdrawn each year by December 31. Some people wait until the last minute to claim them, hoping to maximize the tax-free income within the fund. The downside is that the custodians are very busy in late December, staff takes time off for the holidays and errors are more likely to happen than at any other time of the year.

Recent Stories

Next Up...

- |

- TaxByte

- |

- TaxByte

- |

- TaxByte