Western CPE

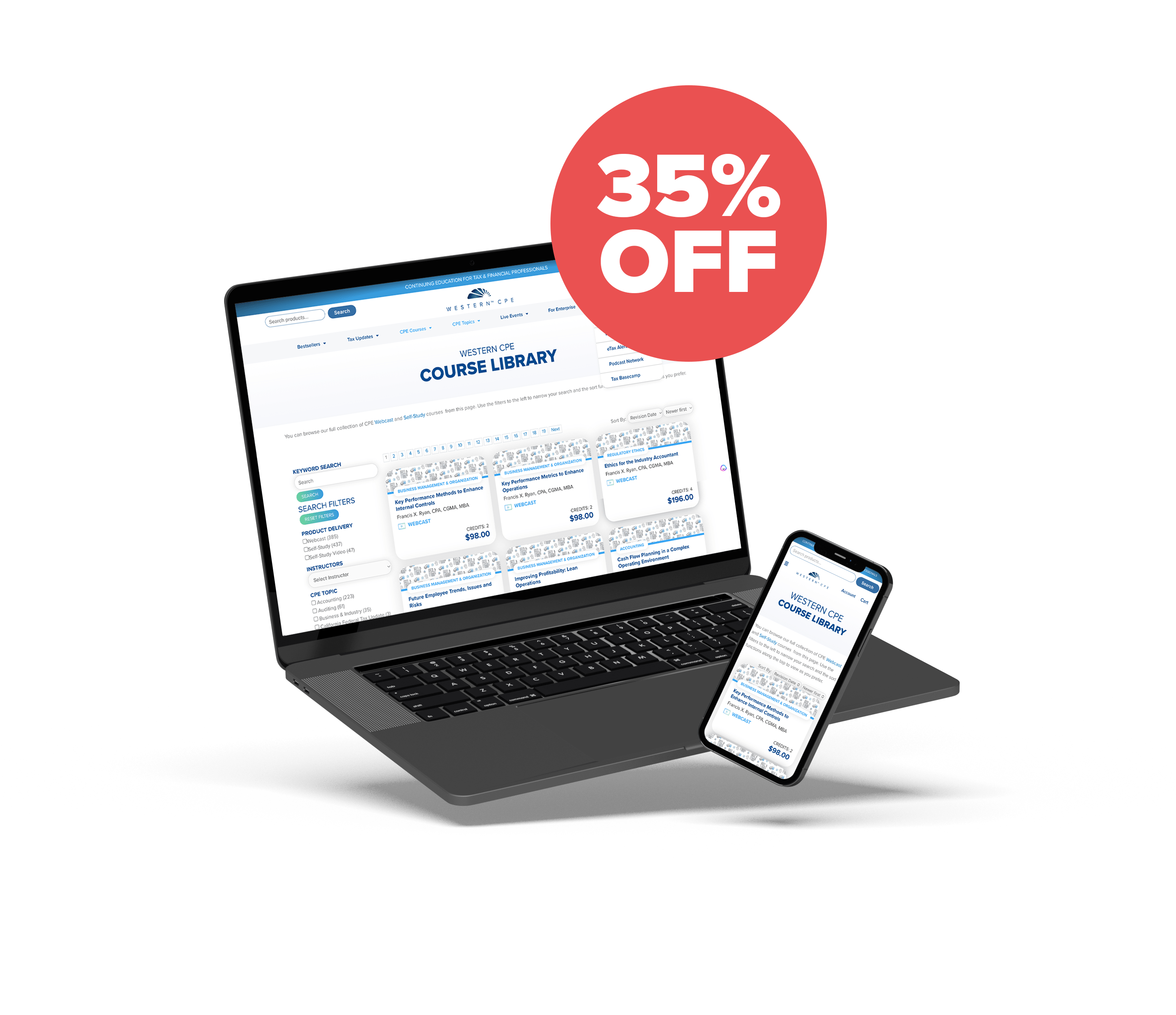

Course Library

20% OFF ALL DIGITAL CPE COURSES

All digital CPE courses are 20% off site-wide, including Webcasts, Self-Study, and Self-Study Video. (Discount is applied at checkout.)

20% OFF ALL DIGITAL CPE COURSES

CPE BUNDLE BUILDER

Choose any combination of CPE courses from our library totaling at least 4 CPE credit hours and receive 35% off.

You can browse our full collection of CPE Webcast and Self-Study courses from this page. Use the filters to the left to narrow your search and the sort functions along the top to view as you prefer.

Popular Topics:

-

Taxes

Taxes

S Corporations: Tax Returns – Basic

Robert W. Jamison, CPA, Ph.D. Webcast

Credits: 2 $98.00

Webcast

Credits: 2 $98.00$98.00

-

Taxes

Taxes

One Big Beautiful Bill H.R. 1

Jane Ryder, EA, CPA & Sharon Kreider, CPA Webcast

Credits: 1 $49.00

Webcast

Credits: 1 $49.00$49.00

-

Taxes

Taxes

Q2 Critical Tax Updates

Shannon Hall, EA, Arthur Joseph Werner, JD, MS & A.J. Reynolds, EA Webcast

Credits: 2 $98.00

Webcast

Credits: 2 $98.00$98.00Original price was: $98.00.$49.00Current price is: $49.00. -

Taxes

Taxes

2025 Federal Tax Update: Summer Release (Pro Edition)

Credits: 8 $325.00$325.00Original price was: $325.00.$245.00Current price is: $245.00. -

Taxes

Taxes

2025 Federal Tax Update: Summer Release (Self-Study Only)

QAS Self-Study

Credits: 8 $270.00

QAS Self-Study

Credits: 8 $270.00$270.00Original price was: $270.00.$215.00Current price is: $215.00. -

Taxes

Taxes

Installment Sales

Steven M. Bragg, CPA QAS Self-Study

Credits: 1 $29.00

QAS Self-Study

Credits: 1 $29.00$29.00 – $49.00

-

Taxes

Taxes

Charitable Contributions Tax Guide

Steven M. Bragg, CPA QAS Self-Study

Credits: 1 $29.00

QAS Self-Study

Credits: 1 $29.00$29.00 – $49.00

-

Taxes

Taxes

S Corporation Tax Guide

Steven M. Bragg, CPA QAS Self-Study

Credits: 2 $58.00

QAS Self-Study

Credits: 2 $58.00$58.00 – $78.00

-

Taxes

Taxes

Guide to Individual Retirement Accounts

Steven M. Bragg, CPA QAS Self-Study

Credits: 1 $29.00

QAS Self-Study

Credits: 1 $29.00$29.00 – $49.00

-

Taxes

Taxes

Guide to Gift Taxes

Steven M. Bragg, CPA QAS Self-Study

Credits: 1 $29.00

QAS Self-Study

Credits: 1 $29.00$29.00 – $49.00

-

Taxes

Taxes

Individual Income Tax Credits & Due Diligence Requirements

Paul J. Winn CLU ChFC QAS Self-Study

Credits: 5 $145.00

QAS Self-Study

Credits: 5 $145.00$145.00 – $175.00

-

Taxes

Taxes

Travel, Entertainment, & Auto Rules

Danny Santucci, JD QAS Self-Study

Credits: 15 $375.00

QAS Self-Study

Credits: 15 $375.00$375.00 – $415.00

-

Taxes

Taxes

Assets, Income & Cash

Danny Santucci, JD QAS Self-Study

Credits: 14 $364.00

QAS Self-Study

Credits: 14 $364.00$364.00 – $404.00

-

Taxes

Taxes

Making The Best of Bad Situations

Danny Santucci, JD QAS Self-Study

Credits: 14 $364.00

QAS Self-Study

Credits: 14 $364.00$364.00 – $404.00

-

Taxes

Taxes

Estate Elements & Tools

Danny Santucci, JD QAS Self-Study

Credits: 9 $261.00

QAS Self-Study

Credits: 9 $261.00$261.00 – $291.00

-

Taxes

Taxes

Fast Track Retirement Planning

Danny Santucci, JD QAS Self-Study

Credits: 17 $391.00

QAS Self-Study

Credits: 17 $391.00$391.00 – $431.00

-

Taxes

Taxes

Passive Losses

Danny Santucci, JD QAS Self-Study

Credits: 10 $290.00

QAS Self-Study

Credits: 10 $290.00$290.00 – $320.00

-

Taxes

Taxes

Essential Legal Concepts with Tax Analysis

Danny Santucci, JD QAS Self-Study

Credits: 29 $580.00

QAS Self-Study

Credits: 29 $580.00$580.00 – $620.00

-

Taxes

Taxes

Partnership Taxation

Danny Santucci, JD QAS Self-Study

Credits: 13 $351.00

QAS Self-Study

Credits: 13 $351.00$351.00 – $391.00

-

Taxes

Taxes

Concepts & Mechanics of Exchanges

Danny Santucci, JD QAS Self-Study

Credits: 13 $351.00

QAS Self-Study

Credits: 13 $351.00$351.00 – $391.00

-

Taxes

Taxes

Estate Planning Essentials

Danny Santucci, JD QAS Self-Study

Credits: 10 $290.00

QAS Self-Study

Credits: 10 $290.00$290.00 – $320.00

-

Taxes

Taxes

Guide to Federal Corporate & Individual Taxation

Danny Santucci, JD QAS Self-Study

Credits: 33 $660.00

QAS Self-Study

Credits: 33 $660.00$660.00 – $700.00

-

Taxes

Taxes

Matching Investments to Tax Saving Techniques

Danny Santucci, JD QAS Self-Study

Credits: 13 $351.00

QAS Self-Study

Credits: 13 $351.00$351.00 – $391.00

-

Taxes

Taxes

Corporate Tax Planning

Danny Santucci, JD QAS Self-Study

Credits: 21 $420.00

QAS Self-Study

Credits: 21 $420.00$420.00 – $460.00

-

Taxes

Taxes

Tax, Bankruptcy and Financial Problems

Danny Santucci, JD QAS Self-Study

Credits: 19 $399.00

QAS Self-Study

Credits: 19 $399.00$399.00 – $439.00

-

Taxes

Taxes

Getting Cash Out of Your Business

Danny Santucci, JD QAS Self-Study

Credits: 19 $399.00

QAS Self-Study

Credits: 19 $399.00$399.00 – $439.00

-

Taxes

Taxes

Business Taxation

Danny Santucci, JD QAS Self-Study

Credits: 24 $480.00

QAS Self-Study

Credits: 24 $480.00$480.00 – $520.00

-

Taxes

Taxes

Tax & Financial Planning for Retirement

Danny Santucci, JD QAS Self-Study

Credits: 18 $396.00

QAS Self-Study

Credits: 18 $396.00$396.00 – $436.00

-

Taxes

Taxes

Special Problems in Real Estate Taxation

Danny Santucci, JD QAS Self-Study

Credits: 11 $308.00

QAS Self-Study

Credits: 11 $308.00$308.00 – $348.00

-

Taxes

Taxes

Choice of Entity

Danny Santucci, JD QAS Self-Study

Credits: 22 $440.00

QAS Self-Study

Credits: 22 $440.00$440.00 – $480.00

-

Taxes

Taxes

Dealing with Debt & Interest

Danny Santucci, JD QAS Self-Study

Credits: 18 $396.00

QAS Self-Study

Credits: 18 $396.00$396.00 – $436.00

-

Taxes

Taxes

Estate Planning With Selected Issues

Danny Santucci, JD QAS Self-Study

Credits: 20 $400.00

QAS Self-Study

Credits: 20 $400.00$400.00 – $440.00

-

Taxes

Taxes

Small Business Tax Guide

Steven M. Bragg, CPA QAS Self-Study

Credits: 10 $290.00

QAS Self-Study

Credits: 10 $290.00$290.00 – $320.00

-

Taxes

Taxes

Home Office Deduction

Steven M. Bragg, CPA QAS Self-Study

Credits: 1 $29.00

QAS Self-Study

Credits: 1 $29.00$29.00 – $49.00

-

Taxes

Taxes

Form W-9 Compliance

Steven M. Bragg, CPA QAS Self-Study

Credits: 1 $29.00

QAS Self-Study

Credits: 1 $29.00$29.00 – $49.00

-

Taxes

Taxes

Real Estate Tax Guide

Steven M. Bragg, CPA QAS Self-Study

Credits: 2 $58.00

QAS Self-Study

Credits: 2 $58.00$58.00 – $78.00

-

Taxes

Taxes

Penalty Abatement for Fun and Profit

Mark Seid, EA, CPA, USTCP Webcast

Credits: 2 $98.00

Webcast

Credits: 2 $98.00$98.00

-

Taxes

Taxes

The Ultimate Guide to Retirement Planning

Danny Santucci, JD QAS Self-Study

Credits: 32 $640.00

QAS Self-Study

Credits: 32 $640.00$640.00 – $680.00

-

Taxes

Taxes

Family Tax Planning

Danny Santucci, JD QAS Self-Study

Credits: 24 $480.00

QAS Self-Study

Credits: 24 $480.00$480.00 – $520.00

-

Taxes

Taxes

Complete Guide to Estate and Gift Taxation

Danny Santucci, JD QAS Self-Study

Credits: 35 $700.00

QAS Self-Study

Credits: 35 $700.00$700.00 – $740.00

-

Taxes

Taxes

Bankruptcy Tax Guide

Steven M. Bragg, CPA QAS Self-Study

Credits: 1 $29.00

QAS Self-Study

Credits: 1 $29.00$29.00 – $49.00

-

Taxes

Taxes

Education Tax Benefits

Danny Santucci, JD QAS Self-Study

Credits: 2 $58.00

QAS Self-Study

Credits: 2 $58.00$58.00 – $78.00

-

Taxes

Taxes

Estate Tools & Trusts

Danny Santucci, JD QAS Self-Study

Credits: 2 $58.00

QAS Self-Study

Credits: 2 $58.00$58.00 – $78.00

-

Taxes

Taxes

Medical, Charitable & Casualty

Danny Santucci, JD QAS Self-Study

Credits: 2 $58.00

QAS Self-Study

Credits: 2 $58.00$58.00 – $78.00

-

Taxes

Taxes

Family Tax Planning

Danny Santucci, JD QAS Self-Study

Credits: 2 $58.00

QAS Self-Study

Credits: 2 $58.00$58.00 – $78.00

-

Taxes

Taxes

Making the Best of Bad Situations

Danny Santucci, JD QAS Self-Study

Credits: 2 $58.00

QAS Self-Study

Credits: 2 $58.00$58.00 – $78.00

-

Taxes

Taxes

Estate Planning

Danny Santucci, JD QAS Self-Study

Credits: 2 $58.00

QAS Self-Study

Credits: 2 $58.00$58.00 – $78.00

-

Taxes

Taxes

Getting Cash Out of Your Business

Danny Santucci, JD QAS Self-Study

Credits: 3 $87.00

QAS Self-Study

Credits: 3 $87.00$87.00 – $107.00