With more than 6 million S Corporation returns filed each year, we'll break down the

6 min read

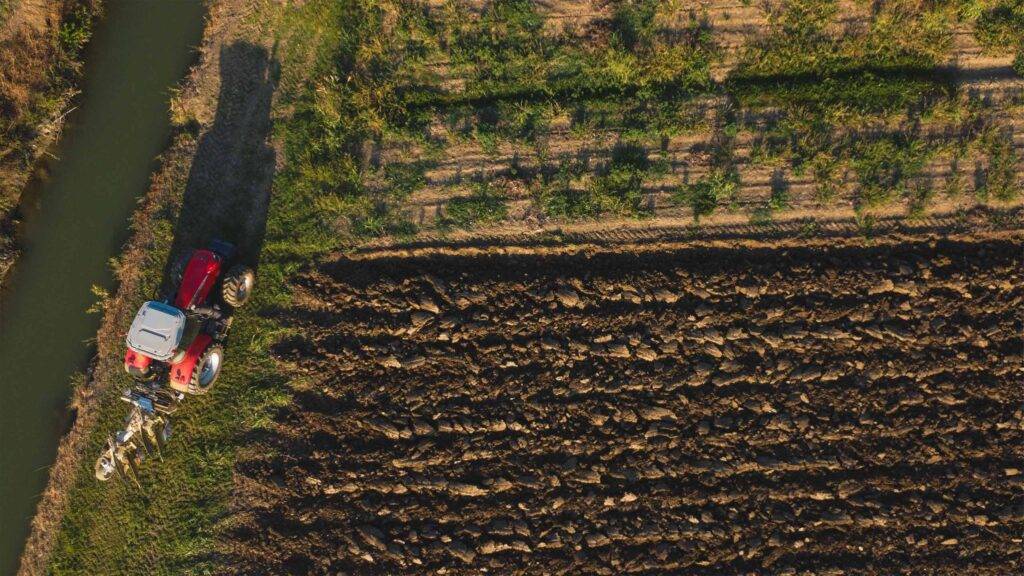

On November 20, 2025, the IRS released Notice 2025-71, providing much-needed clarity on the One, Big, Beautiful Bill Act’s (OBBBA) Section 139L granting 25% interest exclusion for agricultural loans. Here’s what lenders and borrowers need to know to determine whether a loan is secured by rural or agricultural property.

Section 139L, enacted on July 4, 2025 through the OBBBA, allows qualified lenders to exclude 25% of interest income on loans secured by rural or agricultural real property. Notice 2025-71 provides interim guidance on applying this exclusion.

Qualified lenders include FDIC-insured banks, state or federally-regulated insurance companies, entities owned by bank or insurance holding companies, and the Federal Agricultural Mortgage Corporation (Farmer Mac)—a federally chartered entity providing a secondary market for agricultural loans. Lenders don’t need to originate loans—secondary market participants qualify too.

The IRS’s most significant clarification is in addressing loan security requirements. A qualifying loan amount is limited to the fair market value of the agricultural property securing it. When a loan amount exceeds the property’s fair market value, only the portion up to that value qualifies for the exclusion.

However, the IRS created a safe harbor: if the agricultural property value equals at least 80% of the loan amount, the entire loan qualifies. For a $100,000 loan, property worth $80,000 or more allows the full loan to qualify under this safe harbor.

Lenders can add the value of farm equipment, machinery, and livestock to the real estate value when calculating total collateral, provided they hold security interests in this personal property and the loan remains substantially secured by the agricultural real estate. This allows for the counting of both land and operating assets in the calculation.

Lenders may use “any commercially reasonable valuation method,” which “includes a method the qualified lender uses in the ordinary course of its trade or business for valuing property that secures loans.” Formal appraisals aren’t required. Valuations may consider expected agricultural income, projected crop values, and future harvest revenue.

Section 139L excluded refinancings but the IRS issued clarification that partial refinancing qualifies. When a new loan refinances a pre-enactment loan (made on or before July 4, 2025) and provides additional funds, only the increment qualifies. A $250,000 loan refinancing a $200,000 pre-enactment balance? The $50,000 increment qualifies, with payments allocated pro rata.

Borrowings after July 4, 2025, under pre-existing lines of credit can qualify if not used to refinance old debt.

What doesn’t disqualify property:

What doesn’t qualify:

The standard is “substantial use” for agricultural production, fishing/seafood processing, or aquaculture. The IRS doesn’t define specific thresholds for what constitutes “substantial use” but clarifies properties must be meaningfully engaged in qualifying activities—minimal or token agricultural use doesn’t satisfy the requirement.

The guidance reduces administrative burden significantly. Once a lender determines a loan qualifies, retesting property values isn’t required unless there’s a significant loan modification.

Lenders can rely on a “reasonable, good-faith belief” that the security interest remains in place and the property continues qualifying use. The notice states lenders “may base this reasonable, good-faith belief on covenants or other certifications made by the borrower.” Ongoing investigations aren’t required—borrower certifications suffice.

A 90-day cure period exists if a loan loses qualified status.

Section 139L(d) subjects the exclusion to Section 265, which disallows deductions for interest expenses allocable to tax-exempt income. While lenders exclude 25% of interest income, they must include the 25% portion of the qualified loan’s adjusted basis when calculating disallowed interest expense deductions.

In practice, lenders cannot deduct a proportionate amount of their own borrowing costs. With today’s higher funding costs, this limitation meaningfully reduces the net tax benefit.

For tax professionals advising institutions with agricultural portfolios, now is the time to help clients evaluate and implement this exclusion. These institutions will need to establish systems for tracking qualified versus non-qualified loan portions and allocating payments on a pro rata basis, particularly for partial refinancings. Clients should document their commercially reasonable valuation methodologies and verify they hold valid, enforceable security interests in agricultural property. You can also help clients by calculating their actual net benefit after applying Section 265 interest expense disallowances and establish procedures for obtaining borrower certifications that support ongoing compliance under the good-faith standard.

For more information on the IRS’s clarification on interest exclusions for agricultural loans, please see the following from the IRS:

Subscribe to our news, analysis, and updates to receive 10% off your first purchase of an on-demand digital CPE course.