- |

- TaxByte

The Department of Labor (DOL) takes a neutral stance on cryptocurrency being incorporated into 401(k)

3 min read

So you wanna be a CPA? Whether you’re a student, non-certified accountant, or just curious about getting a CPA license, becoming a certified public accountant can be a rewarding career path with many different opportunities.

As any other profession, there are steps to take to get your CPA requirements and become a certified public accountant. These steps may look a bit different depending on where you start so, let’s go over the essentials on how to get CPA certified.

CPAs are basically the Justice League of all things financial. In a more formal definition, A Certified Public Accountant, or CPA, is a professional accountant who has met certain CPA requirements, in addition to gaining educational development and additional experience in accounting. A CPA certification turns a regular, non-certified accountant into, essentially, an accounting superhero.

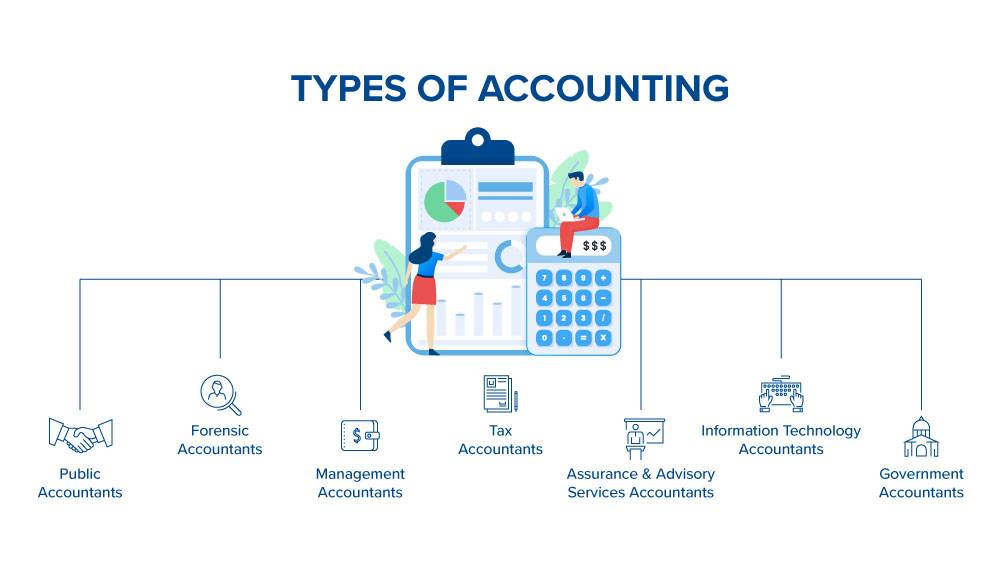

CPAs are highly trained in a wide range of accounting, auditing, tax, and consulting services. The profession can reside in various companies and organizations including public or private accounting firms, consulting firms, healthcare, real estate, non-profit organizations, government agencies, and more. So, although certified public accountants are all licensed under the same umbrella, they can pursue many different specializations.

Here are some examples:

There are several reasons to encourage an accountant or aspiring accountant to obtain their CPA license. Receiving and maintaining a certificate can provide a solid foundation for a successful and fulfilling career in the accounting industry. No matter what you’re looking to achieve in your accounting career, the furtherment of knowledge in your field could never be a disservice.

By becoming a certified accountant, you open yourself up to:

A CPA license is widely recognized by employers, superiors, and colleagues as a indication of professional achievement and competence in the accounting profession. It can assist in the advancement of your career by increasing chances of a promotion or increase in pay grade.

Most employers prefer, or even require, candidates to have a CPA license for positions in accounting, auditing, tax, consulting, and other financial services. A certification can increase your chances of being hired for these positions, or even applying to more advanced positions.

CPA credibility is highly acknowledged by clients, employers, and the public. As a CPA, your professional performance held to high ethical and professional standards, and your work is subject to scrutiny by state boards of accountancy. By providing your services, you provide a sense of trustworthiness and reliability within national and state standards.

Because the CPA exam covers a wide range of topics, passing the exam requires a high level of knowledge and expertise. By passing the CPA exam, the knowledge and skills from those various accounting and auditing topics can be applied in a variety of specialties. From here, an accountant can choose the route they’d like to take in their career.

To be considered a CPA, one must be licensed to practice public accounting. In the United States, the CPA exam is regulated by:

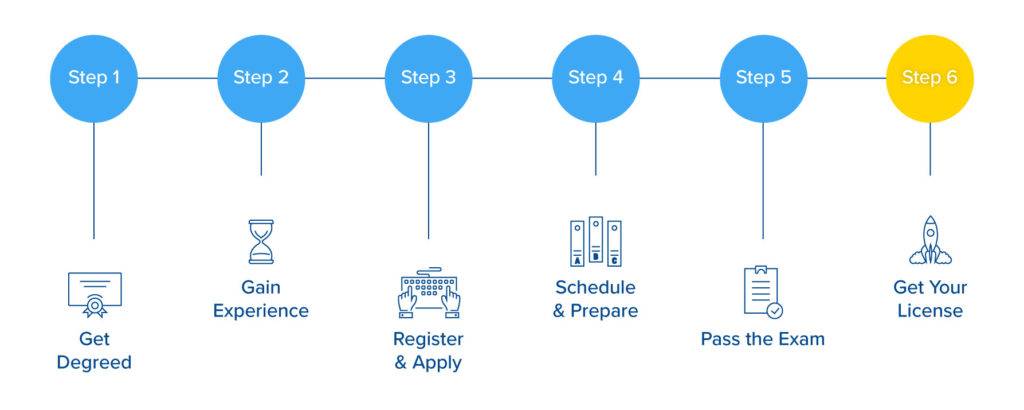

Here’s a glimpse into the journey to obtaining your CPA certification.

Though requirements vary from state to state, you’ll most likely need to earn a bachelor’s degree in accounting or a related field and generally include a minimum of 150 credits. Depending on the state, some may allow a certain number of years of work experience.

Depending on the state, you may need to complete a certain number of years of work experience. This can include working in public accounting, government accounting, or another related field. Some states also require that the work be supervised by a licensed CPA. Check with your state board of accountancy for specific requirements.

Complete the registration process by creating an account with NASBA’s CPA Examination Services (CPAES). You will need to provide personal information, such as your name, address, and social security number, as well as information about your education and work experience.

Once registered, you can apply to take the CPA exam through your state board of accountancy. To complete the application form, you’ll need pay the required fees, which will also vary by state.

Once you’ve submitted your application and fees, you will receive an Authorization to Test (ATT) from NASBA. Then, once your ATT is processed and accepted, you’ll receive your Notice to Schedule (NTS), allowing you to schedule your exam with a Prometric testing center.

The CPA exam consists of four sections, each of which is designed to test a specific set of skills and knowledge: Auditing and Attestation (AUD), Business Environment and Concepts (BEC), Financial Accounting and Reporting (FAR), and Regulation (REG). To prepare for the CPA exam, study for each section of the exam and take practice tests. Be sure to use available study material, including review courses, textbooks, and online resources.

To become a licensed CPA, you must pass both the Uniform CPA exam and an ethics exam. The CPA exam is scored on a scale of 0 to 99. To pass the CPA exam, you need to achieve a minimum score of 75 on each of the four sections of the exam. Then, you will need to have a good understanding of the ethical principles and rules that apply to CPAs to pass the ethics exam.

Both are scored by the AICPA.

It’s not all over yet! Of course celebrate your passing of the exam, but don’t forget to apply for your license. And before you ask, yes, unfortunately it does involve paying more fees. Once you’ve proven your completion of the requirements and paid your licensing fee, be sure to check the mail for your hard-earned CPA license.

According to a 2021 assessment conducted by the Bureau of Labor Statistics, there is a 6% projected growth in employment for accountants and auditors from 2021 to 2031. Make the accounting world your oyster. Find your niche and go for it!

Subscribe to our news, analysis, and updates to receive 10% off your first purchase of an on-demand digital CPE course.