Self-Study

OMB Uniform Guidance Administrative Rules

Understand federal grant regulations through comprehensive compliance training around OMB Uniform Guidance Admin Rules in Title 2: Part 200 of the Code of Federal Regulations.

$232.00 – $262.00

Webcasts are available for viewing Monday – Saturday, 8am – 8pm ET.

Without FlexCast, you must start with enough time to finish. (1 Hr/Credit)

Please fill out the form below and we will reach out as soon as possible.

CPE Credits

8 Credits: Auditing (Governmental)

Course Level

Basic

Format

Self-Study

Course Description

Before attending this governmental auditing CPE course, understanding the full scope of administrative rules for managing federal grants can be overwhelming, especially considering the potential for unexpected clauses and detailed regulatory requirements. This governmental auditing CPE course acts as a bridge, providing a comprehensive understanding of the OMB Uniform Guidance Admin Rules in Title 2: Part 200 of the Code of Federal Regulations. After completion, participants will be proficient in differentiating among the layers of regulations regarding federal award administration, defining key terms, and identifying pre-and post-award requirements. The auditing CPE course also covers aspects such as property and procurement standards, performance and financial monitoring, reporting, and record retention. Additionally, attendees will learn about subrecipient monitoring and management, noncompliance remedies, and the processes involved in award closeout. OMB Uniform Guidance Administrative Rules is essential for professionals seeking to enhance their expertise in federal grant administration and ensure compliance with all relevant regulations.

Learning Objectives

Upon successful completion of this course, participants will be able to:

- Describe the regulations underlying the uniform administrative requirements applicable to state and local governments and nonprofits

- Identify key government regulators and their related acronyms

- Differentiate among the four layers of regulations regarding federal award administration

- Define terms used in the uniform administrative requirements

- Identify the pre-federal award requirements in 2 CFR 200

- Identify the contents of federal awards as set out in 2 CFR 200

- Describe the post federal award requirements regarding property standards

- Examine the post federal award requirements regarding procurement standards

- Identify the requirements regarding performance and financial monitoring and reporting

- Differentiate among the rules related to recipient record retention and access

- Contrast the characteristics of a subgrantee with those of a contractor for the purposes of subrecipient monitoring and management

- Identify remedies for noncompliance

- Determine when an award may be closed out and what is affected by the award closeout

Course Specifics

5216014

October 2, 2024

There are no prerequisites.

None

210

Compliance Information

CFP Notice: Not all courses that qualify for CFP® credit are registered by Western CPE. If a course does not have a CFP registration number in the compliance section, the continuing education will need to be individually reported with the CFP Board. For more information on the reporting process, required documentation, processing fee, etc., contact the CFP Board. CFP Professionals must take each course in it’s entirety, the CFP Board DOES NOT accept partial credits for courses.

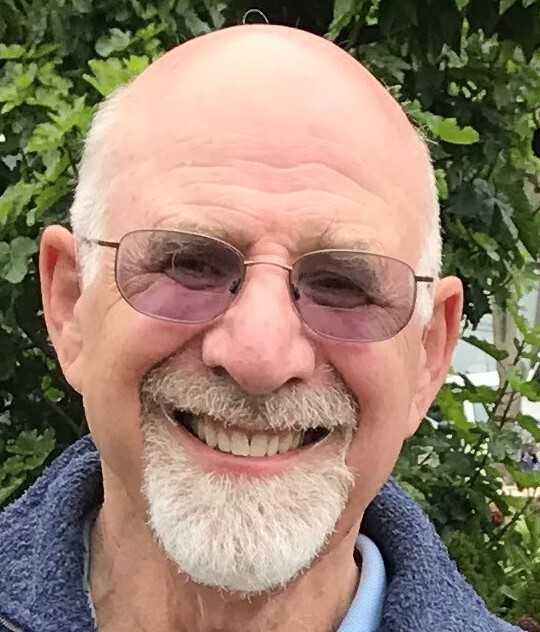

Meet The Experts

Until his retirement in October 1996, Sefton Boyars was the Department of Education’s Regional Inspector General for Audit in Regions IX and X. During his 35-year career, Sefton worked for a variety of federal and local government audit agencies. He is a member of the California CPA Society and was a long-time chair of his chapter’s combined committee on Accounting Principles and Auditing Standards and Government Accounting and Auditing. Sefton Boyars is a Certified Public Accountant, a Certified Government Financial Manager, a Certified Fraud Specialist, and a Certified Internal Auditor. He is a past chair of the Western Intergovernmental Audit …

Originally from the San Francisco Bay Area, Bill has 30 years of federal audit and contract monitoring and administration experience. He served as the U.S. Department of Education’s Regional Inspector General for Audit for Regions VII, VIII, and X. Mr. Allen also served as Region IX’s Assistant Regional Inspector General for Audit. In these capacities, he managed the planning, performing, and reporting for performance and compliance audits of public and private (nonprofit and for-profit) educational and health-related organizations. He also negotiated reimbursement contracts, and overhead expense for Medicare Providers and Intermediary organizations [Insurance organizations]. He has led a peer review …

Related Courses

-

Auditing (Governmental)

Auditing (Governmental)

Improving the Auditor and Auditee Relationship

Sefton Boyars & William T. Allen QAS Self-Study

Credits: 2 $58.00

QAS Self-Study

Credits: 2 $58.00$58.00 – $78.00

-

Auditing (Governmental)

Auditing (Governmental)

Uniform Guidance Cost Principles

Sefton Boyars & William T. Allen QAS Self-Study

Credits: 6 $174.00

QAS Self-Study

Credits: 6 $174.00$174.00 – $204.00

-

Auditing (Governmental)

Auditing (Governmental)

Subrecipient Monitoring

Sefton Boyars & William T. Allen QAS Self-Study

Credits: 4 $116.00

QAS Self-Study

Credits: 4 $116.00$116.00 – $136.00