Self-Study

Uniform Guidance Cost Principles

Learn to apply uniform federal cost principles for grants and manage expenses in government and nonprofit organizations.

$174.00 – $204.00

Webcasts are available for viewing Monday – Saturday, 8am – 8pm ET.

Without FlexCast, you must start with enough time to finish. (1 Hr/Credit)

Please fill out the form below and we will reach out as soon as possible.

CPE Credits

6 Credits: Auditing (Governmental)

Course Level

Basic

Format

Self-Study

Course Description

Uniform Guidance Cost Principles offers a comprehensive exploration of the uniform cost principles applicable to state and local governments and nonprofit organizations, as outlined in Subpart E of the Uniform Administrative Requirements, Cost Principles, and Audit Requirements for Federal Awards. Participants will learn to differentiate between principles applicable to various organizations, define key government regulators, and sequence the layers of rules governing grants. The governmental auditing CPE also provides in-depth knowledge on judging the allowability of specific cost items per cross-cutting principles, detecting violations of these principles, and distinguishing between direct and indirect costs. By understanding the nuances of cost allowability, participants will gain the ability to clarify compensation charges, professional service costs, and legal costs that are allowable under a federal award. The uniform guidance cost principles CPE course also covers the treatment of services donated in support of a federal award, recovery of building and equipment costs, and the distinction between allowable and unallowable costs in various scenarios. This governmental auditing CPE course is not just about theoretical learning; it equips participants with practical tools and understanding necessary for effective compliance and financial management within their organizations.

Learning Objectives

Upon successful completion of this course, participants will be able to:

- Differentiate between principles applicable to state and local governments and nonprofits

- Define key government regulators and their related acronyms

- Sequence the four layers of rules governing grants

- Judge whether an item of cost is allowable per the cross-cutting principles

- Detect which allowability principle has been violated

- Distinguish between an indirect cost and a direct cost

- Distinguish which costs are usually allowable and which are usually unallowable

- Clarify which compensation charges are allowable under a federal award and what documentation is required

- Judge which professional service costs are allowable under a federal award

- Judge which legal costs are allowable under a federal award

- Distinguish between lobbying costs and normal operating costs of a program

- Determine how to treat services donated in support of a federal award

- Determine how to recover building and equipment costs

- Distinguish between idle capacity and idle facilities and related allowable costs

- Identify which costs are allowable as rearrangement and alteration costs

- Assess which rental costs are allowable

- Identify under which conditions morale costs, fines and penalties, insurance, interest, and membership costs are allowable costs

- Distinguish between allowable and unallowable pre-award costs, taxes, and travel costs

Course Specifics

5216013

October 1, 2024

There are no prerequisites.

None

183

Compliance Information

CFP Notice: Not all courses that qualify for CFP® credit are registered by Western CPE. If a course does not have a CFP registration number in the compliance section, the continuing education will need to be individually reported with the CFP Board. For more information on the reporting process, required documentation, processing fee, etc., contact the CFP Board. CFP Professionals must take each course in it’s entirety, the CFP Board DOES NOT accept partial credits for courses.

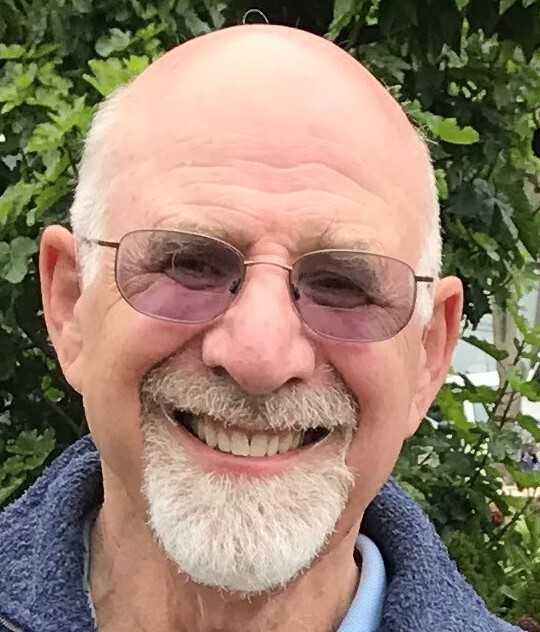

Meet The Experts

Until his retirement in October 1996, Sefton Boyars was the Department of Education’s Regional Inspector General for Audit in Regions IX and X. During his 35-year career, Sefton worked for a variety of federal and local government audit agencies. He is a member of the California CPA Society and was a long-time chair of his chapter’s combined committee on Accounting Principles and Auditing Standards and Government Accounting and Auditing. Sefton Boyars is a Certified Public Accountant, a Certified Government Financial Manager, a Certified Fraud Specialist, and a Certified Internal Auditor. He is a past chair of the Western Intergovernmental Audit …

Originally from the San Francisco Bay Area, Bill has 30 years of federal audit and contract monitoring and administration experience. He served as the U.S. Department of Education’s Regional Inspector General for Audit for Regions VII, VIII, and X. Mr. Allen also served as Region IX’s Assistant Regional Inspector General for Audit. In these capacities, he managed the planning, performing, and reporting for performance and compliance audits of public and private (nonprofit and for-profit) educational and health-related organizations. He also negotiated reimbursement contracts, and overhead expense for Medicare Providers and Intermediary organizations [Insurance organizations]. He has led a peer review …

Related Courses

-

Auditing (Governmental)

Auditing (Governmental)

Improving the Auditor and Auditee Relationship

Sefton Boyars & William T. Allen QAS Self-Study

Credits: 2 $58.00

QAS Self-Study

Credits: 2 $58.00$58.00 – $78.00

-

Auditing (Governmental)

Auditing (Governmental)

OMB Uniform Guidance Administrative Rules

Sefton Boyars & William T. Allen QAS Self-Study

Credits: 8 $232.00

QAS Self-Study

Credits: 8 $232.00$232.00 – $262.00

-

Auditing (Governmental)

Auditing (Governmental)

Subrecipient Monitoring

Sefton Boyars & William T. Allen QAS Self-Study

Credits: 4 $116.00

QAS Self-Study

Credits: 4 $116.00$116.00 – $136.00