Western CPE

Course Library

20% OFF ALL DIGITAL CPE COURSES

All digital CPE courses are 20% off site-wide, including Webcasts, Self-Study, and Self-Study Video. (Discount is applied at checkout.)

20% OFF ALL DIGITAL CPE COURSES

CPE BUNDLE BUILDER

Choose any combination of CPE courses from our library totaling at least 4 CPE credit hours and receive 35% off.

You can browse our full collection of CPE Webcast and Self-Study courses from this page. Use the filters to the left to narrow your search and the sort functions along the top to view as you prefer.

Popular Topics:

-

Computer Software & Applications

Computer Software & Applications

Office Scripts – The New Macros

K2 Enterprises (Thomas G. (Tommy) Stephens, Jr., CPA, CITP, CGMA) Webcast

Credits: 2 $98.00

Webcast

Credits: 2 $98.00$98.00

-

Computer Software & Applications

Computer Software & Applications

Excel Best Practices and Features

K2 Enterprises (Thomas G. (Tommy) Stephens, Jr., CPA, CITP, CGMA) Webcast

Credits: 2 $98.00

Webcast

Credits: 2 $98.00$98.00

-

Information Technology

Information Technology

Paperless Office

K2 Enterprises (Thomas G. (Tommy) Stephens, Jr., CPA, CITP, CGMA) Webcast

Credits: 8 $392.00

Webcast

Credits: 8 $392.00$392.00

-

Computer Software & Applications

Computer Software & Applications

Excel Charting and Visualizations

K2 Enterprises (Thomas G. (Tommy) Stephens, Jr., CPA, CITP, CGMA) Webcast

Credits: 4 $196.00

Webcast

Credits: 4 $196.00$196.00

-

Accounting

Accounting

QuickBooks for Accountants

K2 Enterprises (Thomas G. (Tommy) Stephens, Jr., CPA, CITP, CGMA) Webcast

Credits: 8 $392.00

Webcast

Credits: 8 $392.00$392.00

-

Computer Software & Applications

Computer Software & Applications

Excel Essentials for Staff Accountants

K2 Enterprises (Thomas G. (Tommy) Stephens, Jr., CPA, CITP, CGMA) Webcast

Credits: 8 $392.00

Webcast

Credits: 8 $392.00$392.00

-

Accounting

Accounting

Excel PivotTables for Accountants

K2 Enterprises (Thomas G. (Tommy) Stephens, Jr., CPA, CITP, CGMA) Webcast

Credits: 8 $392.00

Webcast

Credits: 8 $392.00$392.00

-

Accounting

Accounting

Excel Tips, Tricks, and Techniques for Accountants

K2 Enterprises (Thomas G. (Tommy) Stephens, Jr., CPA, CITP, CGMA) Webcast

Credits: 8 $392.00

Webcast

Credits: 8 $392.00$392.00

-

Information Technology

Information Technology

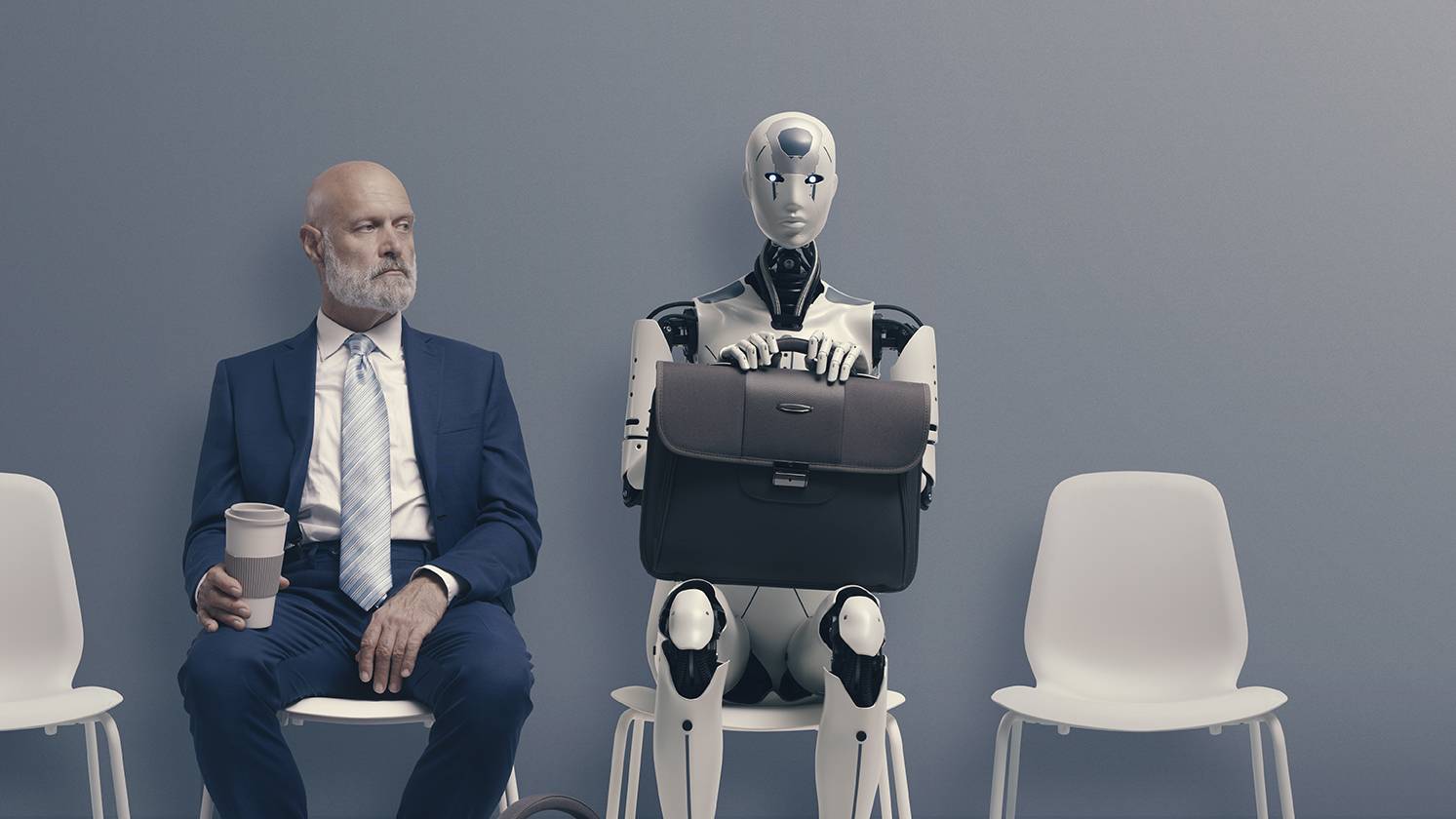

Getting Started with Artificial Intelligence

K2 Enterprises (Thomas G. (Tommy) Stephens, Jr., CPA, CITP, CGMA) Webcast

Credits: 2 $98.00

Webcast

Credits: 2 $98.00$98.00

-

Information Technology

Information Technology

Harnessing ChatGPT

K2 Enterprises (Thomas G. (Tommy) Stephens, Jr., CPA, CITP, CGMA) Webcast

Credits: 1 $49.00

Webcast

Credits: 1 $49.00$49.00

-

Auditing

Auditing

Case Studies in Fraud and Technology Controls

K2 Enterprises (Thomas G. (Tommy) Stephens, Jr., CPA, CITP, CGMA) Webcast

Credits: 8 $392.00

Webcast

Credits: 8 $392.00$392.00

-

Regulatory Ethics

Regulatory Ethics

Ethics – Mastering the Conceptual Framework Process

Kelen Camehl, CPA, MBA QAS Self-Study

Credits: 1 $29.00

QAS Self-Study

Credits: 1 $29.00$29.00 – $49.00

-

Computer Software & Applications

Computer Software & Applications

Accessing Your Company’s Data with Power Query and Power BI

K2 Enterprises (Thomas G. (Tommy) Stephens, Jr., CPA, CITP, CGMA) Webcast

Credits: 2 $98.00

Webcast

Credits: 2 $98.00$98.00

-

Computer Software & Applications

Computer Software & Applications

Accountant’s Guide to QuickBooks Online

K2 Enterprises (Thomas G. (Tommy) Stephens, Jr., CPA, CITP, CGMA) Webcast

Credits: 8 $392.00

Webcast

Credits: 8 $392.00$392.00

-

Accounting

Accounting

Advanced Excel

K2 Enterprises (Thomas G. (Tommy) Stephens, Jr., CPA, CITP, CGMA) Webcast

Credits: 8 $392.00

Webcast

Credits: 8 $392.00$392.00

-

Computer Software & Applications

Computer Software & Applications

Advanced QuickBooks Tips and Techniques

K2 Enterprises (Thomas G. (Tommy) Stephens, Jr., CPA, CITP, CGMA) Webcast

Credits: 4 $196.00

Webcast

Credits: 4 $196.00$196.00

-

Computer Software & Applications

Computer Software & Applications

Better Productivity Through AI and Automation Tools

K2 Enterprises (Thomas G. (Tommy) Stephens, Jr., CPA, CITP, CGMA) Webcast

Credits: 4 $196.00

Webcast

Credits: 4 $196.00$196.00

-

Accounting

Accounting

Better Reporting with QuickBooks Online

K2 Enterprises (Thomas G. (Tommy) Stephens, Jr., CPA, CITP, CGMA) Webcast

Credits: 1 $49.00

Webcast

Credits: 1 $49.00$49.00

-

Accounting

Accounting

Budgeting and Forecasting Tools and Techniques

K2 Enterprises (Thomas G. (Tommy) Stephens, Jr., CPA, CITP, CGMA) Webcast

Credits: 8 $392.00

Webcast

Credits: 8 $392.00$392.00

-

Accounting

Accounting

Business Intelligence, Featuring Microsoft’s Power BI Tools

K2 Enterprises (Thomas G. (Tommy) Stephens, Jr., CPA, CITP, CGMA) Webcast

Credits: 8 $392.00

Webcast

Credits: 8 $392.00$392.00

-

Business Law

Business Law

Identity Theft and Protection

Delta CPE LLC QAS Self-Study

Credits: 4 $116.00

QAS Self-Study

Credits: 4 $116.00$116.00 – $136.00

-

Regulatory Ethics

Regulatory Ethics

Enjoyable Ethics: General Ethics & Accounting Ethics

Jeff Sailor, CPA Webcast

Credits: 1 $49.00

Webcast

Credits: 1 $49.00$49.00

-

Regulatory Ethics

Regulatory Ethics

Enjoyable Ethics: The Conceptual Framework & Independence

Jeff Sailor, CPA Webcast

Credits: 1 $49.00

Webcast

Credits: 1 $49.00$49.00

-

Accounting

Accounting

Key SEC Regulations Accountants Should Know About

Kelen Camehl, CPA, MBA QAS Self-Study

Credits: 2 $58.00

QAS Self-Study

Credits: 2 $58.00$58.00 – $78.00

-

Regulatory Ethics

Regulatory Ethics

Enjoyable Ethics: AICPA Code of Professional Conduct

Jeff Sailor, CPA Webcast

Credits: 1 $49.00

Webcast

Credits: 1 $49.00$49.00

-

Business Management & Organization

Business Management & Organization

Key Performance Indicators

Steven M. Bragg, CPA QAS Self-Study

Credits: 1 $29.00

QAS Self-Study

Credits: 1 $29.00$29.00 – $49.00

-

Specialized Knowledge

Specialized Knowledge

Investing in Alternative Assets

Steven M. Bragg, CPA QAS Self-Study

Credits: 2 $58.00

QAS Self-Study

Credits: 2 $58.00$58.00 – $78.00

-

Accounting

Accounting

Accounting & Reporting for Crypto Assets

Kelen Camehl, CPA, MBA QAS Self-Study

Credits: 1 $29.00

QAS Self-Study

Credits: 1 $29.00$29.00 – $49.00

-

Accounting

Accounting

Accounting for Clubs

Steven M. Bragg, CPA QAS Self-Study

Credits: 3 $87.00

QAS Self-Study

Credits: 3 $87.00$87.00 – $107.00

-

Auditing

Auditing

Guide to Audit Working Papers

Steven M. Bragg, CPA QAS Self-Study

Credits: 1 $29.00

QAS Self-Study

Credits: 1 $29.00$29.00 – $49.00

-

Auditing

Auditing

Guide to Audit Sampling

Steven M. Bragg, CPA QAS Self-Study

Credits: 3 $87.00

QAS Self-Study

Credits: 3 $87.00$87.00 – $107.00

-

Personnel/Human Resources

Personnel/Human Resources

How to Create an Employee Handbook

Steven M. Bragg, CPA QAS Self-Study

Credits: 1 $29.00

QAS Self-Study

Credits: 1 $29.00$29.00 – $49.00

-

Auditing

Auditing

Accounting Estimates, Including Fair Value – Evaluating the Propriety of Areas within Uncertainty

Jennifer F. Louis, CPA Webcast

Credits: 2 $98.00

Webcast

Credits: 2 $98.00$98.00

-

Auditing

Auditing

Effective and Efficient SSARS Engagements

Jennifer F. Louis, CPA Webcast

Credits: 4 $98.00

Webcast

Credits: 4 $98.00$98.00

-

Information Technology

Information Technology

Information Security for CPAs

Steven M. Bragg, CPA QAS Self-Study

Credits: 1 $29.00

QAS Self-Study

Credits: 1 $29.00$29.00 – $49.00

-

Finance

Finance

Guide to the Financial Markets

Steven M. Bragg, CPA QAS Self-Study

Credits: 3 $87.00

QAS Self-Study

Credits: 3 $87.00$87.00 – $107.00

-

Accounting

Accounting

Forensic Accounting – 5 Steps to Successful Performance

Kelen Camehl, CPA, MBA QAS Self-Study

Credits: 1 $29.00

QAS Self-Study

Credits: 1 $29.00$29.00 – $49.00

-

Accounting

Accounting

Credit Controls

Steven M. Bragg, CPA QAS Self-Study

Credits: 2 $58.00

QAS Self-Study

Credits: 2 $58.00$58.00 – $78.00

-

Communications & Marketing

Communications & Marketing

It’s All About Trust

Frank Castillo, CPA Webcast

Credits: 1 $49.00

Webcast

Credits: 1 $49.00$49.00

-

Production

Production

Purchasing Guidebook

Steven M. Bragg, CPA QAS Self-Study

Credits: 14 $364.00

QAS Self-Study

Credits: 14 $364.00$364.00 – $404.00

-

Information Technology

Information Technology

AI Essentials for CPAs – Exploring Cutting – Edge Technology

Kelen Camehl, CPA, MBA QAS Self-Study

Credits: 8 $232.00

QAS Self-Study

Credits: 8 $232.00$232.00 – $262.00

-

Information Technology

Information Technology

Understanding the Basics of Robotic Process Automation (RPA)

Kelen Camehl, CPA, MBA QAS Self-Study

Credits: 1 $29.00

QAS Self-Study

Credits: 1 $29.00$29.00 – $49.00

-

Computer Software & Applications

Computer Software & Applications

Introduction to Excel

Steven M. Bragg, CPA QAS Self-Study

Credits: 3 $87.00

QAS Self-Study

Credits: 3 $87.00$87.00 – $107.00

-

Regulatory Ethics

Regulatory Ethics

Yellow Book Ethics

Jennifer F. Louis, CPA Webcast

Credits: 2 $98.00

Webcast

Credits: 2 $98.00$98.00

-

Auditing

Auditing

Auditing Liabilities, Including Long-Term Debt

Jennifer F. Louis, CPA Webcast

Credits: 2 $98.00

Webcast

Credits: 2 $98.00$98.00

-

Auditing

Auditing

Substantive Analytic Procedures – Strengthening Evidence to Satisfy Audit Objectives

Jennifer F. Louis, CPA Webcast

Credits: 2 $98.00

Webcast

Credits: 2 $98.00$98.00

-

Personal Development

Personal Development

Coaching the Next Generation of CPAs: Tips for Developing Millennials and Beyond

Jennifer F. Louis, CPA Webcast

Credits: 2 $98.00

Webcast

Credits: 2 $98.00$98.00

-

Information Technology

Information Technology

AI & Accounting – What You Need to Know

Kelen Camehl, CPA, MBA QAS Self-Study

Credits: 4 $116.00

QAS Self-Study

Credits: 4 $116.00$116.00 – $136.00