Sharon's RoundTable Special:

Corporate Tax Rate Increases

The Good, The Bad, and The Ugly

This new roundtable talk about raising corporate tax rates is proudly presented by our resident tax authority, Sharon Kreider, CPA.

We’re joined by guest experts Jessica Jeane, J.D., NSA’s Director of Public Policy, and Lisa Lopata, J.D., Expandopedia’s Tax Analyst & Editor.

LISTEN NOW TO THE ROUNDTABLE

Click the play button to listen for Free.

BACKGROUND DATA

Sharon Kreider:

Hi, I’m Sharon Kreider. I’m kindly known as the Resident Expert at Western CPE. Although today I’m not in Bozeman, Montana like I usually am when we film. I’m instead in Silicon Valley, I’m the neighbor of the big Apple Campus. And there is a great deal of interest in Silicon Valley on what’s happening to companies that are located here in the Valley, as well as the rest of the country. So today we have two guest experts with us. We have Jessica Jeane and Lisa Lopata. But our question of the day is, should we raise corporate taxes? Are we in favor of president Biden’s tax plan which raises corporate taxes? Are there unintended consequences to raising them? We really have two guests that will one, represent the, yes we should raise corporate taxes and one represents, no, we can’t raise corporate taxes because of the consequences to other parts of our economy. So that’s the question we’re going to work on today with our experts. And so Jessica Jeane, can you tell us a little bit about yourself?

Jessica Jeane:

Yes, yes. I’m very grateful to be here with you all talking about one of my favorite things, tax policy, which probably makes me a little bit of a nerd, but I’m okay with it. Right now I’m the Director of Pol… Public policy at the National Society of Accountants. And there I lead their Federal Taxation Committee as well as their Regulation Oversight Committee, which really just focuses on issues that affect our members’ right to practice. I’ve spent most of my career on Capitol Hill attending tax hearings, both, um, you know, House and Senate hearings as well as IRS public hearings on regulations. Before NSA… That’s how we refer to the National Society of Accountants. I was with the Wolter School of Tax and Accounting for over five years. And I was their Senior News Editor and Tax Analyst on Capitol Hill and I led their coverage of Washington and all the federal tax developments there.

Jessica Jeane:

And Bloomberg BNA before that, and I represented clients before the IRS on a variety of tax controversy matters before that. So that’s been my career from, from law school, from the get go is, is tax policy. And, and I love it. So, like I said, I’m, I’m really grateful to be here with you all and having this discussion.

Sharon Kreider:

Lisa Lopata, tell us about yourself.

Lisa Lopata:

I am working for a company called Expandopedia.com. Well, Expandopedia is an HR business solution. And I was brought on board to start creating and expanding on their tax content. And for the last 25 years, even before law school, I’ve been writing about tax. I’ve been writing about real estate, uh, tax, international tax law, State tax law, just every area of tax I have stepped into at some point during my professional career. And I, like Jessica, absolutely love tax and tax policy (laughs). I am also a tax nerd.

Sharon Kreider:

Well, it sounds like the three of us belong together since we’re all tax nerds-

Lisa Lopata:

(laughing).

Sharon Kreider:

… so that’s good. And I think our listeners are the kinds of people also who are really interested in tax policy and our conversation today. So president Biden’s plan would raise corporate taxes, um, to 28% from 21% reversing TCJA’s decrease from 35% down to 21% in, uh, 2018. The Biden plan would also impose a 10% tax penalty on corporations that ship jobs overseas when American workers could fill those jobs. Uh, the GILTI tax… Don’t you wonder how they came up with that? The GILTI tax, which is Global Intangible Low Taxed Income, making me very GILTI for moving things off shore is income earned by foreign affiliates of US companies from assets, such as patents, trademarks, and copyrights. The Biden tax plan doubles the rate for this income that has been paid under the TCJA from 10.5% to 21%.

Sharon Kreider:

And the Biden plan would create a 10% tax credit for companies that create jobs for Americans. Specifically, the credit would apply to businesses that revitalize closed manufacturing plants, retool plants important to American competitiveness, return overseas jobs to the US, expand US production, increase manufacturing payroll. And while I list out that tax credit, all of us, the three of us and our listeners would go, “Oh, that’s going to be complicated, we’re going to get 100’s of pages of regulations on returning overseas jobs and expanding US (laughs) production. And we’re back to maybe Section 199 and all of the complications and 100’s of pages that were involved there.”

Sharon Kreider:

The Biden plan would also create a 15% minimum tax on all corporations with book profits, non taxable income of 100 million or higher. So it is particularly important that our global companies are multinational companies. President Biden’s goal is to make sure all corporations pay some tax. And I think a lot of the media reports that the large corporations, our Fortune 500 are not paying tax lots and lots of them. I think the recent number is 60 or 80 was zero tax and there are top corporations. So from a public point of view, I think that the minimum tax is an interesting concept that we can get into as we talk about corporate rates also. Lisa, would you like to start and tell us why we should raise corporate taxes now?

Lisa Lopata:

Yes, we have gone through a year of serious economic strain, well here and globally because of the pandemic. And we’ve had an extraordinary amount of unexpected government expenses and a loss of business revenue and all sorts of really negative economic and financial impacts for people in businesses across the country. And I think it’s important that our tax plan going forward, look at ways to correct some of the issues and problems that have come up and prepare the country to get back to the economic status we were at, uh, a few years ago. And I think that’s going to require a lot of spending at the government level, especially with regards to creating jobs here domestically, and also pulling more jobs back and more profits back from overseas and abroad. So raising the corporate tax rate from 21% to 28% will effectively take us back to where we were pre TCJA or before the Tax Cuts and Jobs Act.

Lisa Lopata:

So we’re not looking at a significant change, you know, from a historical perspective for corporation tax costs. It will just take us back to where they were a few years ago. And the rates from a few years ago had been in effect for decades basically. So we’re not looking at dramatic change in increasing it. So I, I think that’s a huge factor to keep in mind is that this isn’t something that corporations are unused to, uh, planning for from a tax cost perspective. So I think that we should definitely increase the rate to 28% because that is a significant amount of funding that will come in for financing government plans to rebuild our crumbling infrastructure, which will create more jobs. And there are arguments and I addressed this in my blog post that one of the main arguments about, you know, having a high tax rate is that it negatively affects job creation or puts in a burden on labor income by, you know, if you have, um, a high corporate income tax rate in this country, you may want to invest abroad where there’s a lower corporate income tax rate.

Lisa Lopata:

You might move your capital from the US to another country, thereby reducing the capital available here in the US, capital investment would go down. Production would go down due to the lack of, uh, machinery or whatever else it is that is required worker production. And therefore that would result in lower wages for American workers. So that’s sort of the argument behind making sure that we keep a competitive corporate income tax rate because there is a burden on American workers and their wages. And in my post, I talk about several ways to look at how corporate income tax-cost, burdens capital and workers’ labor income. And there are a few methods, two basic methods that I cover. And one of them is used by the Congressional Budget Office. It looks at the investment of capital in corporations. So what is the effect of the corporate income tax rate on investors who intend to invest in corporations?

Lisa Lopata:

It’s determination based on economic formulas that it uses is that the burden of the tax rate on capital is between 60% and 85%. And as a result of that, when it’s doing its calculations and taking into effect the effect of the corporate income tax rate on wages income, or labor income, i-it goes with a 25% rate to sort of balance out the sort of like a mean or average. There are other ways to, uh, calculate what the burden is on labor income when you raise corporate or of the corporate income tax rates. And I believe I relied on the tax foundation whose formula takes a broader look at where capital may be invested rather than focusing on just investing capital in corporations.

Lisa Lopata:

It takes a look at where else investors could use their capital, including partnerships and LLCs pass through entities, which are of course taxed differently than corporations or real estate or any other number of places where you could put capital other than into owning shares or owning a corporation. And the results of that eco-economic formula places roughly a 50% burden of 50% of the burden of the income tax rate on labor and on capital. So the question is then we know, we know that there’s a burden on labor income because of the corporate income tax, right? And intuitively this makes sense, you know, the labor costs are part of the corporation, but it depends on, you know, which, you look at it how great that effect will be and how much that will impact labor wages.

Lisa Lopata:

So one argument is that, you know, if we raise our corporate income tax rates, that’s going to have a significant effect on wage income. And again, what I would say is we need to just go back a few years and look at our economy and how it grew and we experienced recessions to see what the actual effect of a 28% flat rate would look like on labor income. So we already kind of have an idea of how that would impact our economy and our wages.

Sharon Kreider:

You know, Lisa, although I think that, when Jessica joins in, we’ll have a lot more conversation on this. I was thinking about competitiveness-

Lisa Lopata:

Mm-hmm (affirmative).

Sharon Kreider:

… if we raise our rates to 28%, uh, we won’t be as competitive, uh, globally. And our US companies are impacted by that. And one of the things you said is maybe investment dollars move to a lower, um, taxed, um, jurisdiction. They’re not gonna move to Ireland anymore, I don’t think because I think EU is sort of straightening out Ireland, um, as they needed to, again, that was sort of a reference to what happened with Apple computers, but EO, EU has been decent on that. But don’t you think that maybe the industrialized countries, and particularly when we talk about Europe, that they’re going to have to raise their rates too? Something is wrong in our, in general, our whole worldwide economy because of the pandemic and maybe competitiveness is not really one of our top issues, because everybody’s going to have to raise their taxes a little bit.

Sharon Kreider:

Now I’m, I’m speaking from the CPA point of view, the tax practitioner and, and telling you what, what we think is you have to do something for domestic and the small business too. You can’t just bounce our small business from 21 to 28. We have a lot of companies that are not international. You know, they’re, they’re the neighborhood, um, C corporations for whatever reason. Now we do know that really small businesses are mostly S corporations and LLCs. So we’re looking for something again that hits the graduates. We may stick at 21% up to some amount like we used to have. That would be my thinking.

Sharon Kreider:

And I’m very disappointed being again, an accountant at heart as compared to policy that president Biden used this as part of a funding mechanism for infrastructure, rather than paying off my pandemic deficit, which we spent a lot of money on the pandemic and we needed to spend a lot money on the pandemic. So that sort of caught me up as I’ve read the blog posts. And I’m, I’ve read Lisa’s, Lisa Lopata’s blog posts, but I’m ahead on Jessica jeans, because I also have that in my hand. But before we have a conversation amongst us, Jessica, could you talk about the reasons not to raise our corporate tax rate?

Jessica Jeane:

Sure. You know what, I, I think there are a few main concerns that I would have, um, with raising the corporate tax rate. And Lisa made a great point about the economy and everything that, you know, just the country as a whole has been through over the last year or so with the pandemic. I would be particularly concerned about raising the corporate tax rate at this point, right? Um, I mean, I, I agree we do need to bounce back and the economy was doing great before the pandemic under the TCJA.

Jessica Jeane:

Unemployment levels were at record lows, particularly among African-Americans and Hispanics women. Um, so, you know, having the concerns that I do with raising the corporate tax rate, as far as the chain reaction that can occur with job loss and, and lower wages now more than ever to me screams, “Don’t do that (laughs).” Right? Um, just the timing. I, you know, gosh, when have we experienced a pandemic, right? Not in this century. So that is a big concern of mine. I also am an advocate for a simplified tax code, not an overly complicated tax code, and we have an overly complicated tax code right now.

Jessica Jeane:

And I worry that Biden’s proposal will make it even more complex. Of course, when we talk about raising the corporate tax rate and its effect on the economy and investment, it’s really hard to have that discussion and just talk about the rate, right? Because there’s a ton of other domestic policy and international policy that’s going to go into that equation and into our ability to accurately assess the effects and the outcomes that we’ll see from that. But, yeah, I’m very concerned about making it more complex.

Jessica Jeane:

And then also one of the most certain consequences of raising the corporate tax rate is just that you’re going to raise taxes on small businesses. I mean, there’s, there’s no other way around that. And I often think of a CRS report from the 2018 Congressional Research Service that I read a couple of years ago. And it made the excellent point that in tax policy discussions, it’s really not uncommon for the terms corporation and large business to be interchanged-

Sharon Kreider:

Hmm.

Jessica Jeane:

… or similarly, the terms pass through and small business to be interchanged. And that’s really just not an accurate understanding of the terms. 99% or somewhere around there of businesses in the US are small businesses and over, uh… Not over, but at least somewhere near a million, I think 980,000 corporations are small businesses. So, you know, we hear this line, “We want corporations to pay their fair share,” a lot. And I just don’t think that everybody has a real accurate understanding of the fact that you’re not just going to be affecting these, you know, huge corporations. The last number I saw was somewhere around 55 corporations, you know, these big, large corporations didn’t pay income tax.

Sharon Kreider:

Right.

Jessica Jeane:

You know, I understand theoretically the want for corporations to pay their fair share in that sense. But I just don’t think that raising the corporate tax rate blanket just across the board is the way to do that because you’re not just affecting those, those big corporations. And then of course we could go on and, you know, talk about all the other potential concerns that would, would come from that uncertainty in the tax code. Gosh, that’s a, that’s a big one. I mean, when you talk about investment, uncertainty has a really, really negative effect.

Jessica Jeane:

And we hear the word permanent, right? I think a lot of people criticize the TCJA for making the corporation or the corporate tax breaks permanent, and the individual income tax breaks temporary through some of them through 2025, but nothing in this life is permanent. And the tax code isn’t any different. And every time there’s a change in power, then there’s potentially a change in, in tax policy. So I just feel like it’s really hard on businesses, on the economy, on our tax pros out there to just constantly be changing the tax code in such a significant and substantial way.

Sharon Kreider:

I agree with you that we in the tax practice business need some certainty and some simplicity. And as I noted, when I was looking at some of President Biden’s suggestions on the tax credit, I was thinking, “Oh my heavens, that’s not going to be easy for my part of business to deal with.” And, and primarily when you know, our listeners are the practitioners that take care of that 980,000 small, um, C corporations or small businesses. I was wondering if raising corporate taxes though, I mean, one of our questions that we’ve discussed ahead of time is a tool for taxing people the US individuals tax can’t always reach, you know, we also have a discussion of raising individual taxes. I mean, that’s on the board over here, some places to raise individual taxes and, and make sure that there’s more paid on the individual tax.

Sharon Kreider:

I think Jessica, you wrote in your blog posts something about what the effective tax rate would be if we went up to 28% on the C corporation and then dividends were distributed and doesn’t make it about a 65% tax rate, is that the number I recall from the…

Jessica Jeane:

Yes, yes, that’s right. That’s right. So that is what we’re talking about there with that 65.1% would be what is the combined integrated corporate tax rate. So on its face, would that sort of rate undercut America’s economic competitiveness? No question. But like I said earlier, of course, to be fair, as well as accurate, we don’t know what other international domestic tax policy will for certain be enacted with a rate increase. So to really have a good understanding of the entire landscape, I think it’s important to remember that. But at the same time, you don’t have to be an expert in any field to understand just the general notion that if a corporation has a choice where to locate its business, it would do so in a low tax jurisdiction. But, but yes, just to clarify again, that’s 65.1% rate, which would be the combined integrated corporate tax rate.

Sharon Kreider:

Would be the corporate tax rate and does that take into consideration State taxes? We do know also that our federal tax system has often encouraged companies to move to lower tax jurisdictions. Particularly we have one of our large companies in the Valley has just moved to, I think Austin, Texas, because of its tax structure and its tax incentives. So we understand in tax practice and we advise people, “Oh, you have a big tax event coming up. Maybe you need to be in a lower tax jurisdiction. Maybe it’s Nevada, maybe it’s Washington State, maybe it is Texas.” And so we know that, and yet we in the public don’t understand very well that companies are doing the same thing.

Jessica Jeane:

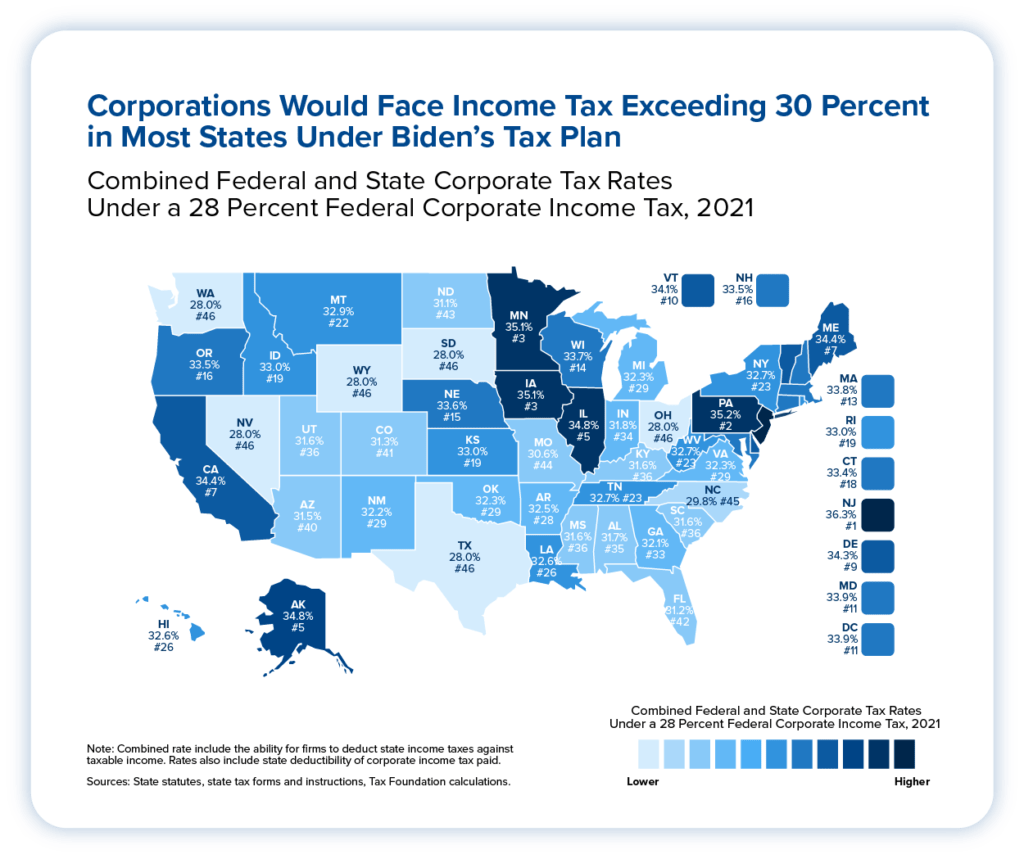

Sharon, that’s such a great point. You know, I think a lot of times when people have the discussion about raising the corporate federal income tax rate, they don’t think about the effect that State corporate tax rates have on that. Right? So if you start with Biden’s 28% federal tax rate on corporate income, then together with an average of applicable State corporate tax rates would result in roughly 32%.

Sharon Kreider:

Hmm.

Jessica Jeane:

It’s 32.4%, according to the Tax Foundation for our combined top corporate tax rate. And that would be the highest among OECD Nations. I mean, that, that concerns me from a variety of perspectives and, and, you know, potential consequences of, of the possible negative effects from that.

Sharon Kreider:

Somebody is going to pay the increased tax. And it’s often the consumer. I don’t, I don’t agree with the argument that our investment dollars US shareholders will change or even foreign shareholders investing in US companies will change because there’s not much to invest in right now. Right? I mean, there are only a limited number of places that the really upper income wealthy people invest in. They invest in stock, they invest in their own companies and they invest in real estate. And they might invest in cryptocurrency at the moment, but that seems like not, not long lasting or at least that’s what I thought until it hit 55,000 (laughs). And I believe it’s adjusting a little, a little bit right now. So we haven’t talked to Jessica and Lisa about GILTI and BEAT and SHIELD, you know (laughs), Lisa do you want to talk, could we leave the corporate tax rate lower? I believe Senator Manchin from West Virginia said, well, maybe he might agree to 25%, 28%. And maybe he would need something for smaller or domestic corporations without international choices.

Jessica Jeane:

Spoiler alert. I think 25% is where we’re gonna end up (laughing).

Sharon Kreider:

I hear (laughs) spoiler alert-

Jessica Jeane:

Yeah, (laughs).

Sharon Kreider:

… when, you know, this all started because I said to the company, you know, I want to put out what I would recommend to President Biden within the first 100 days, I want to be his advisor for 100 days. And we posted this two or three pages on what it would do. And, uh, spoiler alert-

Jessica Jeane:

Hmm.

Sharon Kreider:

… I said it can be 28. How about 25? How about doing a little less? I was very, I patted myself on the back, but one of our readers said, “Well, it’s just your opinion.” I thought, Uh-huh (affirmative), but it’s better-

Jessica Jeane:

You called it.

Sharon Kreider:

… a tax person’s opinion than I don’t know the bartender or, or some of the legislative assistants (laughs) who’ve been giving opinions. Why don’t I get to say something?

Jessica Jeane:

Right.

Sharon Kreider:

I was happy to have him give me his opinion, but that’s how this all started. “What would I, as a tax practitioner, say about advising President Biden from my client’s point of view?” Now to be fair, California is a culture, a tax policy center (laughs) on its own. Um, so I have different feelings than what might happen in the center of the country or in the Southeast of the country, even on tax policy, let alone other, other things. So Lisa, what do you think about GILTI? Could we leave our taxes alone? The corporate tax rate, not increased so much and maybe use the GILTI as some bandaid to bring in some more money. I think we need to bring in more funds. So let’s get that out. I don’t know where to get them from without affecting what we have a nice recovery in our economy. I think we can, well, we can read the news and know that the economy is recovering steadily. Not, not as it was, um, in 2018 pre pandemic, but coming out of a science fiction movies scene…

Lisa Lopata:

(laughing)… Yeah.

Sharon Kreider:

But what about GILTI, Lisa?

Lisa Lopata:

Well, I think that GILTI sort of addresses separate issues. Changes that Biden is proposing for GILTI are meant to address bringing jobs back to the United States, bringing in, you know, bringing intangible assets back, encouraging corporations to keep all of their capital investments here instead of moving them abroad. While we know that increasing the corporate tax rate does have an effect on where corporations may decide to locate their assets or their business operations, GILTI sort of backstops that. And I wouldn’t want to replace an increased corporate tax rate with just having GILTI out there because they sort of work in tandem. It’s like we will increase the corporate tax rate, but we’re also going to put this backstop on to prevent jurisdiction shopping and moving to tax havens.

Lisa Lopata:

You know, it’s true that putting the, uh, tax rate back up to 28% would give us one of the highest global corporate income tax rate burdens you know, when you add in the State as well, but as you noted, other, other countries are probably going to have to find ways to generate more revenue from their taxpayers in the next year or two to address the pandemic. And also, you know, tax haven shopping, or I shouldn’t call it tax haven shopping, but shopping jurisdictions, reducing the corporate tax rate is just one small piece of jurisdiction shopping.

Lisa Lopata:

And I think whether you keep it at 21% or 28%, it’s not, it’s just one small cost. And you also have to take into effect the average tax rate, you have to really consider what is the actual tax paid by corporations, you know? And then we’re, we’re, we’re going back to what you were discussing earlier about the largest corporations tend to, uh, pay the lowest of taxes.

Sharon Kreider:

While you’re talking about jurisdiction shopping. And, and I, I like the tax haven shopping because we know that the intellectual property has been stashed in zero tax havens. So, and that’s been a lot of the reason why the international high-tech companies are paying and making so much money on their books and have such different taxable income. But while you’re doing that, I have to read something from Jessica Jeane’s blog post, which is about to be published. And, and what we’re talking about between Jessica and Lisa are, are both at the Western CPE website. You can look in the archives and, and see Lisa’s writing on the topic of increasing the corporate tax. And you will soon be able to see Jessica’s writing on why we shouldn’t increase the corporate tax, but it’s about jurisdiction shopping that I particularly wanted to point out a quote from Jessica.

Sharon Kreider:

“It takes two to tango, US corporate taxes and OECD negotiations.” That’s the Organization of Economic Coordination and Development. Those are the sort of industrial successful nations. “Looking ahead, the Biden administration may be intending to create a bit of a dance between US corporate tax policy and ongoing international negotiations with the OECD. Indeed Treasury Secretary Janet Yellen during her January confirmation hearing alluded to such a tango in which OECD negotiations and corporate tax reform could be cheek to cheek.” Oh, Jessica, I love that quote about-

Jessica Jeane:

(laughs)… Thanks.

Sharon Kreider:

… the tango and the visual, cheek to cheek. So I think, while we might get cooperation from OECD that we don’t get cooperation from Panama and Isle of Wight in, in Bahamas or whatever the most popular, um, havens are now to stash our IP. So I want to talk a little bit about competitiveness and then would you talk a little bit about what you think on GILTI and BEAT since, “The BEAT goes on,” as they say?

Jessica Jeane:

Ladidadida (laughing).

Lisa Lopata:

With the tango (laughing).

Sharon Kreider:

Yeah, with the tango.

Lisa Lopata:

Well, I mean, I can talk about GILTI and that, that particular, the changes in that legislation are intended to… I don’t want to say punish, uh, US corporations, but I just did-

Jessica Jeane:

(laughs)

Lisa Lopata:

… for keeping and putting intangible assets in tax havens. But I think it’s fair to say that it’s designed to encourage them to move them out of tax havens. And, and back here, back to the, there the US. I mean, currently under the GILTI, uh, legislation that was enacted and the TCJA, there is a tax exemption for the first 10% of the return on foreign intangible assets in a foreign jurisdiction. So currently under the, uh, GILTI provisions, the first 10% of the return on foreign intangible assets is exempt from taxation. And then the remainder about half of the forte income over that 10% return is subject to tax in the US and it’s subject to tax at a lower rate. And I believe it’s 10.5% and Biden’s proposal would increase that to a 21% tax. And it would remove that tax exemption-

Sharon Kreider:

Hmm.

Lisa Lopata:

… that 10% tax exemption. So the overall burden on keeping your intangible assets in a low tax jurisdiction would be significantly increased and that, you know, would be the encouragement to return it here.

Sharon Kreider:

You know, Jessica, do you think that 10.5% GILTI brought IP back into the country?

Jessica Jeane:

Yeah, I do. I’m not going to say that the GILTI regime is perfect (laughs), so don’t get me wrong. But certainly Google, Facebook, you know, they’re, they absolutely brought, you know, their IP back into, to the US after, um, the GILTI. And how do you like to say, uh, FDII (laughs)-

Sharon Kreider:

Um, here (laughs). Yeah.

Jessica Jeane:

… regime. Um, Foreign derived intangible income, there’s different, uh, ways people like to pronounce that, but yeah, I, so I do think that, that you’ve seen some positives from that. I’m concerned with criticisms of the regime and I’m open to hearing them, like I said, you know, I’m here to listen, not just talk, right? My concern is that a lot of the arguments don’t provide precise numerical estimates or evidence and fail to take into consideration how this incentive compares to the offshoring incentives before the TCJA. So, to me, that would be a more complete assessment of, of its effect and, and perhaps bolstering any argument to, to be made against it.

Jessica Jeane:

Senator Portman actually, um, spoke (laughs) at the Senate Finance Committee hearing recently, but said that, you know, this proposal under Biden would essentially make it more costly for US companies to operate globally and in essence, penalize… You know, Lisa said punish, but penalize US companies and workers who support international sales, thus making it difficult for US companies to compete overseas.

Jessica Jeane:

Well, I would respond to that by saying it, it doesn’t punish companies for operating globally or, you know, reduce international sales. What it does is encourage the location of assets, even more strongly to be located in the US as opposed to these tax Haven jurisdictions. And I, you know, I also haven’t seen any data, you know, talking about, uh, how they come into this. I’ve done a lot of looking for it myself, but it does significantly increase the penalty for being abroad, but that wouldn’t stop companies from actually having manufacturing facilities in foreign countries, or, you know, service facility, software development in foreign countries to serve those foreign jurisdictions. And it wouldn’t stop sales from the US either. So I don’t know that I necessarily agree that his argument is a strong one for not having GILTI. Um, the strength of GILTI increased.

Jessica Jeane:

Biden wants to remove the FDII, but Wyden I believe in his, you know, he just released his, um, international tax reform proposal and said that he’s okay not removing that because you know, that we have that, that carrot and stick approach there with GILTI and FDII right? But he thinks that they should be the same rate-

Sharon Kreider:

Yeah.

Jessica Jeane:

… which I thought was interesting. Um, and, and Lisa, you know what, I would actually ask your opinion on that.

Lisa Lopata:

Well, ultimately these two provisions work in tandem and they both address the problem of US multinationals locating their intangible assets outside of the United States, which results in a huge amount of their profits. Basically any profits that don’t come from US sales, staying outside of the United States and away from US taxation. And so making, having these two provisions, you know, making the changes that Biden proposes here, the overall effect is to encourage those intangible assets to come back here and the profits from them, you know, be taxable here as opposed to foreign jurisdictions and increase the… Also by moving intangible assets here, you would have more manufacturing here. You know, it would create more jobs here as opposed to being abroad. But again, it wouldn’t stop actual manufacturing for local jurisdictions and sales in those other places.

Jessica Jeane:

Well, I guess what I was getting at is, you know, if, if Biden’s proposal were to be enacted, he would remove FDII, which really works with GILTI. Right? But I think, as I mentioned, Wyden recognizes that, that might be a mistake, but he thinks that they should at least have the same rates. And so I guess I was just wondering your perspective on getting rid of FDII or, or not. Wyden and Biden seem to, like I said, I have different points of views on that. So…

Lisa Lopata:

You know, I’m in favor of not allowing tax benefits for corporations that locate their intangible assets in foreign jurisdictions to try to avoid US tax. And to the extent that FDII does do that by allowing a deduction I’m in favor of disallowing it and removing FDII.

Jessica Jeane:

Yeah. And like I said earlier, though, it’s, you know, it also has to do with companies operating globally, US companies operating globally and competing globally. It’s, you know, a lot of times it’s posited as though the company is trying to avoid something. And that’s not necessarily always the case, which is why the stick, the carrot and stick approach was put into place. And that’s why FDII does compliment GILTI.

Sharon Kreider:

If we don’t raise corporate taxes, do we scrap an infrastructure plan?

Jessica Jeane:

No way. Why are we raising corporate taxes to fund infrastructure anyway (laughs)? That would be my question. I know people are reluctant to approach the gas tax, but that’s certainly been, um, you know, discussed among economists as, as a means an applicable one at that to infrastructure proposals. But even if we did raise, I, you know, I read an estimate that even if budget proposals are enacted and put into place, it’s still not enough. It’s still not enough money for his infrastructure proposal, and we’re calling it an infrastructure proposal, but there’s a lot of other things in there as well. So… (laughs).

Sharon Kreider:

True.

Jessica Jeane:

Yeah.

Sharon Kreider:

Um, I think some social programs are there as well as the family programs are in another bill that he’s hoping to finance with individual tax increases. And that can be our next conversation because, you know, it-it’s, is there something Lisa, you would like our listeners to particularly take away with sort of the key item on the pros to raising the corporate tax?

Lisa Lopata:

Going back to what I said at beginning of our conversation, I do think that our current state of the economy under the pandemic and the need to fund various things, including infrastructure, and I, I appreciate the idea that a gas tax could do that, although that would put a huge burden on individual taxpayers who are just trying to get back and forth from their jobs. But our infrastructure is seriously not in good condition right now.

Jessica Jeane:

I agree.

Lisa Lopata:

And that impacts moving goods, transporting goods across the country, and making sure that we have a viable transit system for, you know, our commercial activity. So to the extent that, you know, corporations should be helping to pay for that because they’re benefiting from that. So I think raising the corporate tax rate is a good way to go. It’ll add a significant amount of money to, uh, helping us achieve improvements that we desperately need.

Sharon Kreider:

And Jessica the big question to you-

Jessica Jeane:

Yeah, you know I (laughs)… I respectfully disagree with my friend Lisa here. I agree that the economy is in dire need, um, you know, of, of help. And I just, yeah, now that we’re there, we’re opening our doors, we’re, we’re seeing things bounce back and that’s great, but I really think, uh, you know, the timing couldn’t be worse to raise taxes, corporate taxes. And, and again, we’re not just, I really do think that there’s just this misunderstanding of that. It would just be a tax at the entity level and, you know, that’s just not how it works. Of course, shareholders then, you know, pay taxes, dividends, capital gains, and you see it.

Jessica Jeane:

And in jobs, like, as I mentioned earlier, you know, sort of those lower income jobs, you would see get cut and wage wages, you know, wouldn’t, wouldn’t continue to grow. And, and, and again, this just isn’t, I don’t think you have to be a tax policy expert to understand that if any business, any person even is all of a sudden having to pay more money, they’re, you know, they have to figure out how to keep their business afloat and, and how to keep things going the, the way they’ve always gone. And unfortunately that means cuts. That means whether it’s jobs or wages, or like we talked about seeing an increase in prices, retail prices for consumers. I just think that there’s a, just a myriad of, of potential negative effects that come from this.

Jessica Jeane:

And I think this is the worst time to do that. In addition to the uncertainty that it would cause with the tax code and the complexity that it would cause I think we need to be the way of simplicity, not, not making it more complex. And we need to remember that it’s, we’re not just talking about big rich multi-billion dollar corporations. We are talking about small businesses, but I’d also say that the most important takeaway. And I always like to make sure that’s really understood when we have these conversations is that we don’t have legislative text. And even after we do, even that stands to be amended. So as you know, I know people can get really excited one way or the other, um, about these issues, but it is important to remember that we don’t have a bill.

Lisa Lopata:

I agree, but I would, I’d like to also point out that, you know, when we’re talking about a 7% increase taking us back to where we were before, that’s not actually, you know, in an entirely huge corporate tax burden, that’s going to prevent people from, you know, corporations from continuing to invest. And also I do believe that we should have a much lower cap corporate tax rate for small companies and that they should not, not maybe not even raise it at all for them and-

Jessica Jeane:

That’s true,

Lisa Lopata:

… go back to sort of a tiered rates-

Jessica Jeane:

Interesting.

Lisa Lopata:

… yeah. [crosstalk] To protect the small business owners that use the corporate form that would encourage them to continue to be able to do what they’re doing under what they have right now.

Jessica Jeane:

Yeah. I mean, I certainly wouldn’t be opposed to that other than it’s just more complexity (laughs), but I also-

Lisa Lopata:

You know, I wanna make it clear that I wouldn’t prescribe to any dramatic side of either argument, but particularly due to, to the dramatics against raising corporate taxes. I don’t think that the result would be disastrous. And I mean, we’re not going to be Brazil or Venezuela, like that’s not going to happen. Right (laughs)? But if we’re looking at it from a growth standpoint, it’s not ideal.

Sharon Kreider:

… So certain that we just settled that absolutely and, uh, (laughing) Jessica Jeane and Lisa Lopata, it’s fun to have a discussion with policy experts. It really is good for all of us to hear. And following Jessica’s musical theme, Sonny and Cher, and the beat goes on-

Jessica Jeane:

(laughs)

Sharon Kreider:

… and it’s going to go on for, they’re going to be beating this drum for a while.

Jessica Jeane:

(laughs)

Sharon Kreider:

So thank you to our guests. Thank you to Western CPE for sponsoring our conversation. And I hope we can have more conversations (laughs) on tax policy. Thank you both.

Jessica Jeane:

Yeah, this was fun. Thank you for having us. Lisa, it was great chatting with you. You too, Sharon.

Lisa Lopata:

Yeah, thank you. Thank you very much.

MEET THE EXPERTS

Jessica has spent most of her career on Capitol Hill, analyzing federal tax policy and IRS administration. Currently, Jessica serves as the National Society of Accountants’ (NSA) director of public policy, leading its Right to Practice coalition, including NSA’s Federal Taxation, Regulation Oversight, and Accounting Standards Committees. Jessica holds a J.D., cum laude, from the UDC School of Law and a B.S. from the University of Maryland, College Park.

Lisa Lopata is an editor and tax analyst for Expandopedia.com. After getting a B.A. in English, Lisa wrote about real estate and tax law for a publishing company. She attended law school, graduating in 2001, and went into practice with a global law firm focusing on international tax planning for Fortune 50 corporations. After years of advising companies on lowering their global effective tax rate, Lisa shifted her career back to writing, this time focusing on state and federal tax law. Recently, Lisa took her position with Expandopedia.com, letting her refocus on U.S. international and foreign tax and corporate laws.