Webcast

Amplify Your Opportunities: From 9-to-5 to 24/7 Renown

Expand your visibility through speaking, writing, and content creation.

$49.00

Webcasts are available for viewing Monday – Saturday, 8am – 8pm ET.

Without FlexCast, you must start with enough time to finish. (1 Hr/Credit)

Please fill out the form below and we will reach out as soon as possible.

CPE Credits

1 Credits: Management Services

Course Level

Basic

Format

Webcast

Course Description

This course was recorded live at the 2023 New Money Summit.

Kelly Erb will be joined in conversation by Orumé Agbeyegbe Hays and Logan Graf to discuss taking your professional profile to the next level. They’ll share insights for developing new professional projects related to your field of expertise—things like speaking, writing, education, video content creation, and more. Amplify Your Opportunities: From 9-to-5 to 24/7 Renown will teach you how to elevate your profile, but how to use that to create new opportunities with clients, customers, and yourself.

Learning Objectives

Upon completion of this course, participants will be able to:

- Name at least three areas outside of the traditional space where tax professionals can add value;

- Identify potential ethical and practical pitfalls of working outside the traditional tax space; and

- Understand the importance of setting goals and finding your voice in the profession

Course Specifics

WC1623358922

January 25, 2024

None

None

Compliance Information

CMA Notice: Western CPE makes every attempt to maintain our CMA CPE library, to ensure a course meets your continuing education requirements please visit Insitute of Management Accountants (IMA)

CFP Notice: Not all courses that qualify for CFP® credit are registered by Western CPE. If a course does not have a CFP registration number in the compliance section, the continuing education will need to be individually reported with the CFP Board. For more information on the reporting process, required documentation, processing fee, etc., contact the CFP Board. CFP Professionals must take each course in it’s entirety, the CFP Board DOES NOT accept partial credits for courses.

Meet The Experts

Logan Graf, CPA, is the owner of The Graf Tax Co. PLLC, located in the Austin, TX area. He holds a Master of Science in Accounting with a focus on Tax from Texas Tech University. Logan’s primary mission is to assist others in building and expanding their firms in a manner that simplifies not only their clients’ lives but also those of the firm’s owner and staff. When Logan isn’t engaging with the #TaxTwitter community, he creates tax-related content on YouTube, enjoys mountain biking, and contemplates working on his 1965 Mustang project.

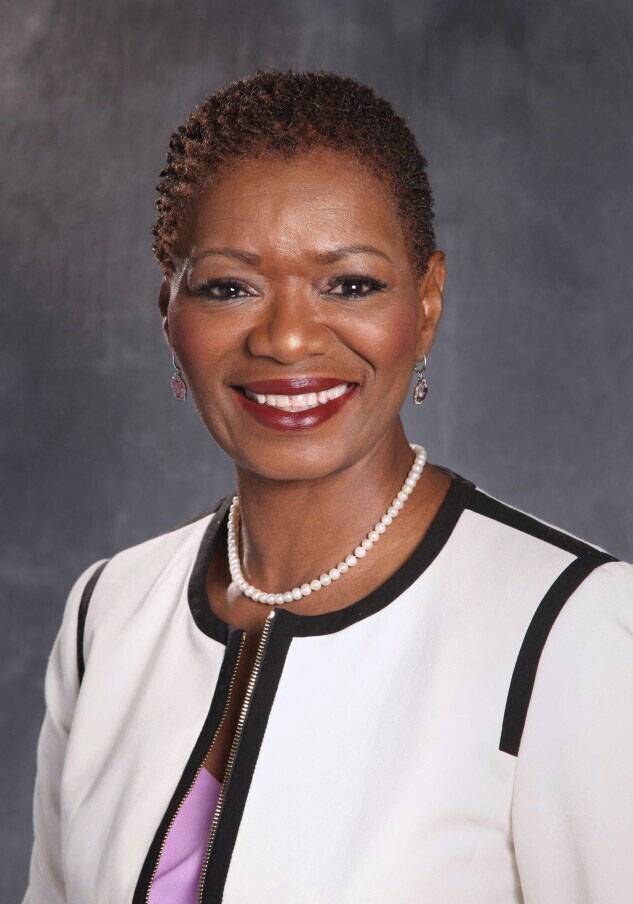

Orumé Hays, CPA, CGMA, MST, is the Founder and CEO of HAYS CPA LLC, a boutique client advisory and accounting services firm focusing on outsourced CFO services. She was named one of the 25 Most Powerful Women in Accounting for 2022 and 2023 by the AICPA and CPA Practice Advisor. Ignition also recognized her as a 2023 Top 50 Women in Accounting. Hays is an NYSSCPA statewide Director at Large, a past member of the Executive Committee, a past chair of NYSSCPA’s Small Firms Practice Management Committee, and a past President of the New York State Society of CPAs (NYSSCPA) Manhattan/Bronx …

Kelly Phillips Erb, J.D., LL.M, is Tax Counsel for White & Williams, LLP where her primary practice area is tax law including trusts and estates; domestic and international tax planning; and tax controversy matters including delinquencies. She likes to say that she helps taxpayers get and stay out of trouble. She earned her J.D. and LL.M. in Taxation from Temple University School of Law in Philadelphia, PA. While at law school, Kelly interned in the federal estate and gift tax attorney division of the IRS, where she participated in the review and audit of federal estate tax returns. This year, Kelly …