Proposition 19 Impacts Property Tax Transfers

Article at a Glance:

- Proposition 19 adds new provisions for a base year value transfer of a primary residence for persons meeting several criteria.

- The new law changes provisions of the parent-child and grandparent-child exclusions.

- The new provisions are subject to “applicable procedures and definitions as provided by statute”.

- We anticipate that the California Legislature will clarify these procedures and definitions through future legislation.

- The base year value transfer provisions become operative on April 1, 2021.

- The parent-child and grandparent-grandchild exclusion provisions become operative on February 16, 2021.

On November 3, 2020, California voters approved Proposition 19. The new law provides two changes to the statutes for transferring existing property tax valuations:

- It adds new provisions for a base year value transfer of a primary residence for persons at least age 55 or severely disabled or victims of wildfires or natural disasters.

- It changes provisions of the parent-child and grandparent-child.

Base Year Value Transfer

Beginning on and after April 1, 2021: the law now provides that an owner of a primary residence, who is over 55 years of age, severely disabled, or a victim of a wildfire or natural disaster, may transfer the base year value of his or her primary residence to a replacement primary residence; primary residence must be located anywhere in California and purchased or newly constructed as that person’s principal residence, within two years of the sale of the original primary residence, regardless of the value of the replacement residence.

If the replacement residence is of equal or lesser value than the original primary residence, the taxable value of the original primary residence may be transferred to the replacement residence.

If the replacement residence is of greater value than the original primary residence, partial relief is available. The new base year value of the replacement residence is the sum of the factored base year value of the original primary residence plus the difference between the full cash values of the original primary residence and the replacement residence.

Example: Karen, who is over age 55, sells a primary residence on June 28, 2021, for a full cash value of $700,000. At the time of sale, the single-family residence has a factored base year value of $225,738. On July 22, 2021, a replacement primary residence is purchased for a full cash value of $800,000.

Since the full cash value of the replacement primary residence exceeds the full cash value of the original primary residence, the difference in full cash values must be calculated and added to the transferred factored base year value.

-

- $800,000 – $700,000 = $100,000 (difference in full cash values)

- $225,738 + $100,000 = $325,738 (add difference to factored base year value)

- New base year value of replacement primary residence is $325,738.

Under Proposition 19, a person who is over 55 years of age or severely disabled may transfer the base year value of a primary residence three times. However, the language in Proposition 19 is not clear as to whether the “three times” would include a previously transferred base year value or if the “three times” would be in addition to this.

These provisions are subject to “applicable procedures and definitions as provided by statute,” so we anticipate that the Legislature will clarify these procedures and definitions through future legislation.

Parent-Child and Grandparent-Child Exclusion

Beginning on and after February 16, 2021, the new law provides that the terms “purchased” and “change in ownership” do not include the purchase or transfer of a family home of the transferor in the case of a transfer between parents and their children, if the property continues as the family home of the transferee. Partial relief is available if the value of the family home exceeds a specified value test.

These provisions also apply to a purchase or transfer of a family home between grandparents and their grandchildren, provided all parents of those grandchildren, who qualify as children of the grandparents, are deceased as of the date of the purchase or transfer.

Family Home. A “family home” means a principal residence that must be eligible for the homeowner’s or disabled veteran’s exemption. The law allows the purchase or transfer of a “family home of the transferor” to be excluded from reassessment if the property “continues as the family home of the transferee.” Thus, the family home must be the principal residence of both the transferor and the transferee.

A “family home” also includes a family farm that contains a principal residence.

$1 Million Limit. The law requires adjustment of the taxable value if the assessed value of the family home exceeds the sum of the taxable value plus $1 million.

If the fair market value of the family home is less than the sum of the factored base year value plus $1 million, then the factored base year value need not be adjusted.

If the fair market value of the family home is equal to or more than the sum of the factored base year value plus $1 million, an amount equal to the fair market value of the family home upon purchase by, or transfer to, the transferee, minus the sum of the factored base year value plus $1 million, is added to the factored base year value.

Example: A single-family residence has a factored base year value of $425,738. The parent dies on March 1, 2021, and property is inherited by the parent’s only child. The residence was the principal residence of both parent and child. On the parent’s date of death, the property has a fair market value of $1,750,000.

- Calculate the sum of the factored base year value plus $1,000,000.

$425,738 + $1,000,000 = $1,425,738

- Determine whether the assessed value exceeds the sum of the factored base year value plus $1,000,000.

$1,750,000 is greater than $1,425,738

- Calculate the difference.

$1,750,000 – $1,425,738 = $324,262

- Add difference to factored base year value,

$425,738 + $324,262 = $750,000

- New combined base year value = $750,000

Effective Date.

- The base year value transfer provisions become operative on April 1, 2021.

- The parent-child and grandparent-grandchild exclusion provisions become operative on February 16, 2021.

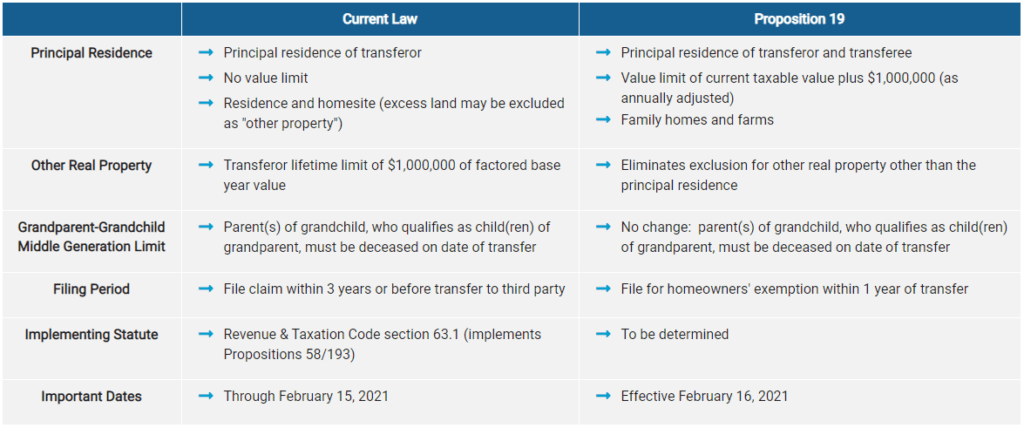

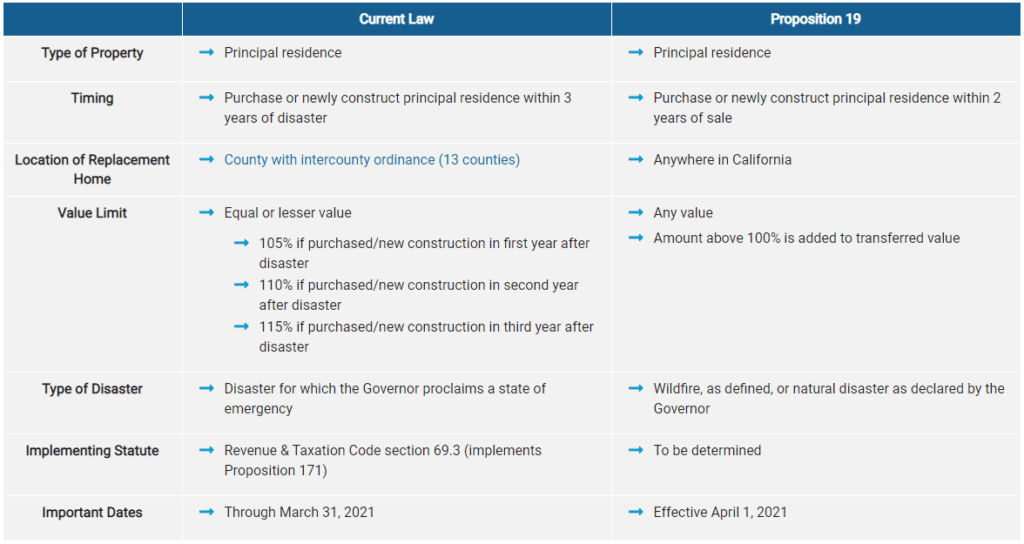

BOE Comparison Charts

Parent-Child & Grandparent-Grandchild Exclusion

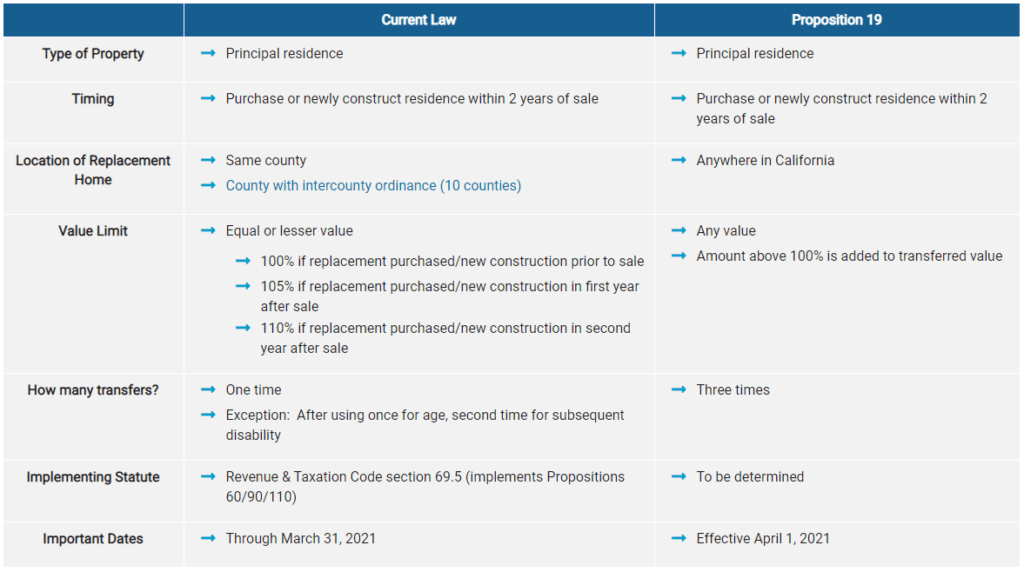

Base Year Value Transfer – Persons At Least Age 55/Disabled

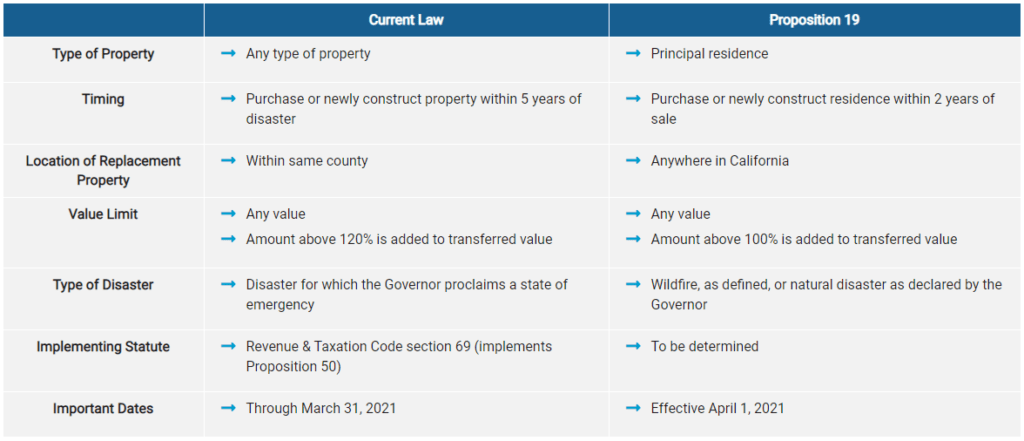

Base Year Value Transfer – Intracounty Disaster Relief

Base Year Transfer – Intercounty Disaster Relief

Note: The above charts are intended to provide general and summary information about Proposition 19. It is not intended to be a legal interpretation, official guidance, or relied upon for any reason but instead be a presentation of summary information. If there is a conflict between the information above and the text of the proposition or its implementation, the text of the proposition or legal interpretation will prevail. The above is intended as general information only.

More information about Proposition 19 here…