Good News for PPP Loan Forgiveness

Article at a Glance:

- SBA and Treasury stepped up and issued new forgiveness rules for small PPP loans

- In a new interim final rule issued 8, 2020, the SBA and Treasury announced a simplified application for the forgiveness of PPP loans of $50,000 or less

- SBA Form 3508S : The simplified application is a page and a half

- FTE (Full-Time Equivalent) and wage reduction limits removed for small loans

- There are approximately 3.57 million outstanding PPP loans of $50,000 or less

- Even though the forgiveness application is simplified, documentation of payroll and non-payroll costs must still be submitted to the lender

We have all (borrowers, lenders, and business advisers) been waiting for a simplification of the PPP loan forgiveness process. While legislation had been proposed to allow a simple attestation for PPP loan of $150,000 or less, Congress disagreed on many items, this one included. SBA and Treasury stepped up and issued new forgiveness rules for small PPP loans — not as good as $150,000, but better than nothing.

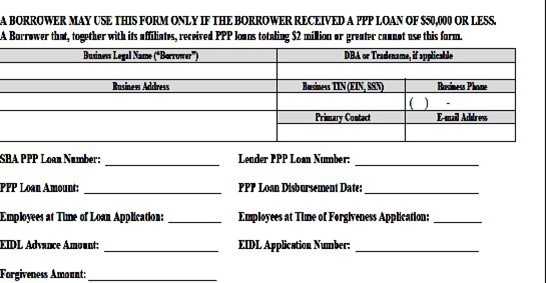

SBA Form 3508S. In a new interim final rule issued Oct. 8, 2020, the SBA and Treasury announced a simplified application for the forgiveness of PPP loans of $50,000 or less. A borrower of a PPP loan of $50,000 or less, other than any borrower that, together with its affiliates, received loans totaling $2 million or greater, may use SBA Form 3508S (or lender’s equivalent form) to apply for loan forgiveness. The simplified application is a page and a half. The basic information required is shown below. The borrower, or authorized representative, must initial seven representations and certifications, and sign and date the first page of the form.

FTE and wage reduction limits removed for small loans. A borrower that uses SBA Form 3508S (or lender’s equivalent form) is exempt from any reductions in the borrower’s loan forgiveness amount based on reductions in full-time equivalent (FTE) employees or reductions in employee salary or wages that would otherwise apply.

3.57 million PPP loans are $50,000 or less. There are approximately 3.57 million outstanding PPP loans of $50,000 or less, totaling $62 billion of the $525 billion in PPP loans. About 1.71 million PPP loans of $50,000 or less were made to businesses that reported having zero employees (presumably not counting the owner as an employee) or one employee.

Documentation required. Even though the forgiveness application is simplified, documentation of payroll and non-payroll costs must still be submitted to the lender. SBA Form 3508S instructions detail the documents required to be submitted with the simplified application.

For payroll costs: Documentation verifying the eligible cash compensation and non-cash benefit payments from the Covered Period or the Alternative Payroll Covered Period consisting of each of the following:

- Bank account statements or third-party payroll service provider reports documenting the amount of cash compensation paid to employees.

- Tax forms (or equivalent third-party payroll service provider reports) for the periods that overlap with the Covered Period or the Alternative Payroll Covered Period:

- Payroll tax filings reported, or that will be reported, to the IRS (typically, Form 941); and

- State quarterly business and individual employee wage reporting and unemployment insurance tax filings reported, or that will be reported to the relevant state.

- Payment receipts, canceled checks, or account statements documenting the amount of any employer contributions to employee health insurance and retirement plans that the Borrower included in the forgiveness amount.

Nonpayroll: Documentation verifying the existence of the obligations/services before Feb. 15, 2020, and eligible payments from the Covered Period.

- Business mortgage interest payments: Copy of lender amortization schedule and receipts or canceled checks verifying eligible payments from the Covered Period; or lender account statements from Feb. 2020 and the months of the Covered Period through one month after the end of the Covered Period verifying interest amounts and eligible payments.

- Business rent or lease payments: Copy of current lease agreement and receipts or canceled checks verifying eligible payments from the Covered Period; or lessor account statements from Feb. 2020 and from the Covered Period through one month after the end of the Covered Period verifying eligible payments.

- Business utility payments: Copy of invoices from Feb. 2020 and those paid during the Covered Period and receipts, canceled checks, or account statements verifying those eligible payments

2020-2021 Federal & California Tax Update: Individual & Business Pre-Order

Coming Early Fall 2020 | Pre-Order Now

- Instructor: Sharon Kreider, CPA & Karen Brosi, CFP, EA

- Credits: 16

- NASBA Category: Taxes FedCal