New Schedules K-2/K-3 Requirements

The IRS has released new 2022 instructions for Form 1065 and 1120-S, Schedules K-2 & K-3. The Schedules K-2 and K-3 new for 2021 tax returns, are intended to provide partners and shareholders with information necessary to complete their tax returns with respect to Form 1116 or Form 1118 and other international tax provisions of the Internal Revenue Code.

Domestic Filing Exception

The 2022 instructions provide a new exemption from filing Schedules K-2 and K-3 for partnerships and S corporations with little or no foreign activity. The new Domestic Filing Exception is available for partnerships and S corporations with $300 or less in foreign income tax, paid or accrued, which is reported on a US information statement, 1099-INT, 1099-DIV, 1099-B, K-1, or other document. And all partners or shareholders are US citizens or US residents.

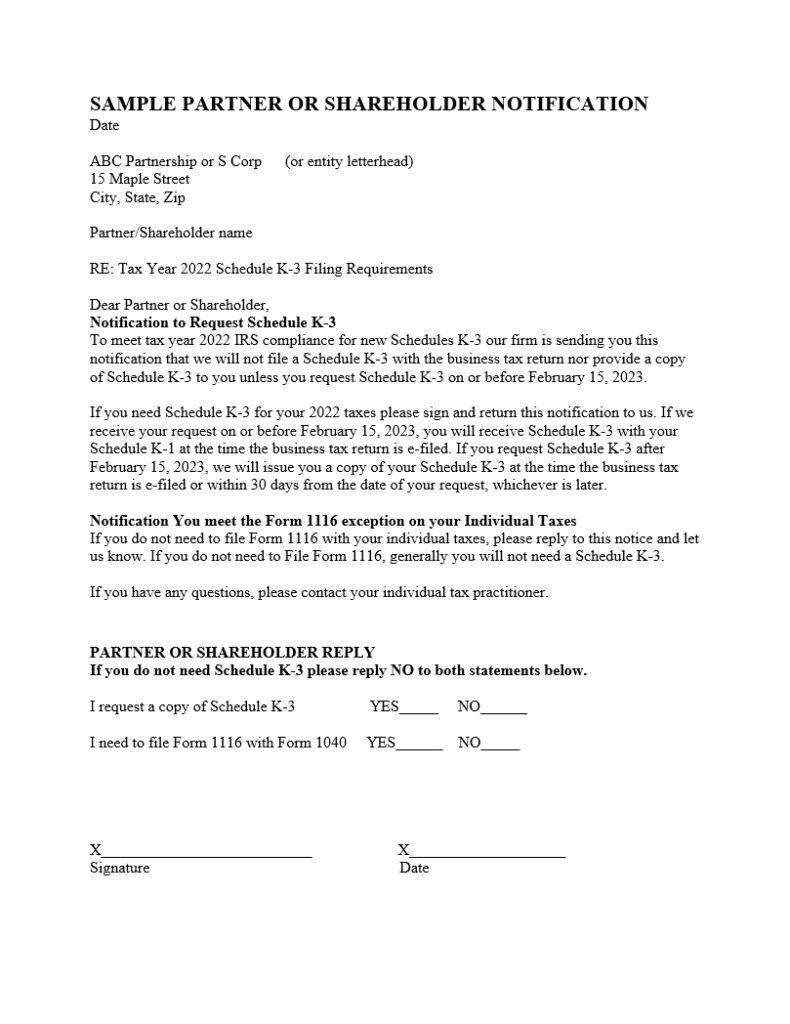

To take advantage of the K-2 & K-3 Domestic Filing Exception a partnership or S corporation must issue written or electronic (email) notices to all partners and shareholders no later than January 15, 2023. The notification must state that each partner or shareholder will not receive Schedule K-3 from the partnership or S corporation unless a partner or shareholder requests Schedule K-3 from the entity.

If the entity does not receive any notices requesting Schedule K-3 from partners or shareholders by February 15, 2023, (the 1-month date) then the partnership or S corporation is exempt from filing Schedules K-2 and K-3 for the 2022 tax year. If any notices requesting Schedule K-3 are received by a partner or shareholder by February 15, 2023 (the 1-month date) then the entity is required to prepare and file Schedule K-2 for the entity and prepare, file, and issue Schedule K-3 only for the requesting partners or shareholders.

This new Domestic Filing Exception is only relief from filing Schedules K-2 and K-3 with the federal tax return. It is not relief from the obligation to prepare Schedules K-2 and K-3 and then issue Schedule K-3 to any partners or shareholders who request Schedule K-3 after the 1-month date.

Form 1116 Exemption Exception

Another exception to filing Schedules K-2 and K-3 which is available to partnerships and S corporations is the Form 1116 exemption exception. If the entity did not issue timely partner and shareholder notifications by January 15, 2023, or does not meet other criteria for the Domestic Filing Exception then Schedules K-2 and K-3 must be completed unless the entity has been notified that:

(a) the partnership or S corporation does not have a partner or shareholder that is eligible to claim a foreign tax credit, or

(b) no partner or shareholder would have to file a Form 1116 or Form 1118 to claim the foreign tax credit.

A domestic partnership or S corporation is not required to complete and file Schedules K-2 and K-3 if all partners or shareholders are eligible for the Form 1116 exemption and the partnership or S corporation receives notification of the partners’ eligibility for such exemption by the 1-month date (February 15, 2023).

Example: Partnership Notified All Partners Meet Form 1116 Exception

For tax year 2022, a calendar year partnership with more than $300 of foreign tax paid, therefore not meeting the Domestic Filing Exception, qualifies for the Form 1116 exemption exception if notified by all partners or shareholders no later than February 15, 2023 (the 1-month date) that they do not need Schedule K-3 under the individual Form 1116 exemption.

NOTE: Form 1116 Exception for Individuals

Individuals may qualify for an exception to filing Form 1116 to claim the foreign tax credit reported on Form 1040, Schedule 3, if foreign tax paid is $600 or less for married filing jointly or $300 or less for other filing statuses. In which case taxpayers may enter foreign tax paid directly on Schedule 3, to claim the full credit for an amount up to $600 for married filing joint or $300 for all other filing statuses.

Practitioner Note. Consider Filing Schedules K-2 and K-3 with Minimum Basic Entries for all Entities

Tax practitioners may want to consider filing Schedules K-2 and K-3 with a few minimum entries to meet basic filing requirements for domestic entities with little or no foreign activity. This would eliminate the need to meet the compliance requirements for the available exceptions. If a domestic partnership or S corporation files Schedules K-2 and K-3 with basic minimum entries they will not need to rely on the exceptions for compliance.

SAMPLE LETTER FOR VIEWING