IRS TAX RELIEF ANNOUNCED: California Storm Relief

IRS notices CA-2023-01 and IR-2023-03, issued January 10th and 11th, announced California residents of counties identified by FEMA as “federally declared disaster areas” due to the recent storms now have until May 15, 2023, to file various federal individual and business tax returns and make tax payments.

This tax relief postpones several tax filing and payment deadlines that occurred starting on January 8, 2023. As a result, affected individuals and businesses will have until May 15, 2023, to file returns and pay any taxes that were originally due during this period. See the exception below for payroll tax returns and Form 1099-MISC and Form 1099-NEC (also known as information returns).

Additionally, in conformity with the IRS, the Franchise Tax Board (FTB) has extended the filing and payment deadlines for individuals and businesses in California until May 15, 2023. The Governor’s January 13 press release can be viewed HERE; the FTB’s press release can be viewed HERE.

California offers paperless tax extensions for individual and business filers, therefore the postponed filing date to May 15, 2023, will mainly impact taxpayers who may owe taxes with their individual and business tax returns or extensions including PTET payments due on March 15, 2023. The California notice also confirms the 4th quarter 2022 California estimated tax payments and the 1st quarter 2023 estimated tax payments may be paid by May 15, 2023 without penalty.

NOTE: California has not released any information related to waiving California payroll tax filing or deposits or sales tax filing or paying deadlines. Its best to assume those deadlines are still in place for 4th quarter 2022 year-end obligations.

In addition, FTB will suspend the mailing of collection notices to affected taxpayers for the next 30 days, beginning January 13, 2023.

California Counties Listed as Federally Declared Disaster Areas

Individuals and businesses in the following counties qualify for federal tax relief:

- Alameda

- Colusa

- Contra Costa

- El Dorado

- Fresno

- Glann

- Humbolt

- Kings

- Lake

- Los Angeles

- Madera

- Marin

- Mariposa

- Mendocino

- Mered

- Momo

- Monterey

- Napa

- Orange

- Placer

- Riverside

- Sacramento

- San Benito

- San Bernadino

- San Diego

- San Francisco

- San Joaquin

- San Luis Obispo

- San Mateo

- Santa Barbara

- Santa Clara

- Santa Cruz

- Solano

- Sonoma

- Stanislaus

- Suter

- Tehama

- Tulare

- Ventura

- Yolo

- Yuba

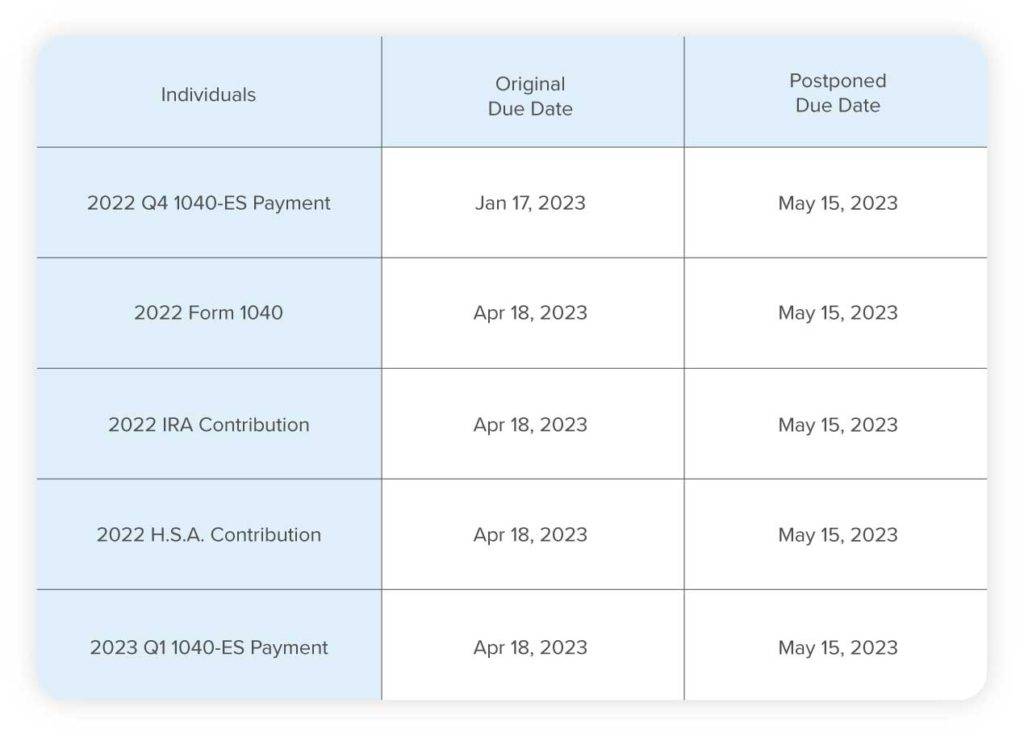

Individuals

Tax year 2022 individual income tax returns originally due April 18, 2023, are now due May 15, 2023, for taxpayers in declared California counties. Other individual deadlines extended to May 15, 2023, include 2022 contributions to IRAs and health savings accounts. Individual quarterly estimated tax payments, 4th quarter 2022 originally due January 17, 2023, may now be paid by May 15, 2023, or with Form 1040 or Form 1040 extension, if filed and paid by May 15, 2023, and 1st quarter 2023 quarterly estimated tax, originally due April 18, 2023, may also be paid by May 15, 2023, without penalty.

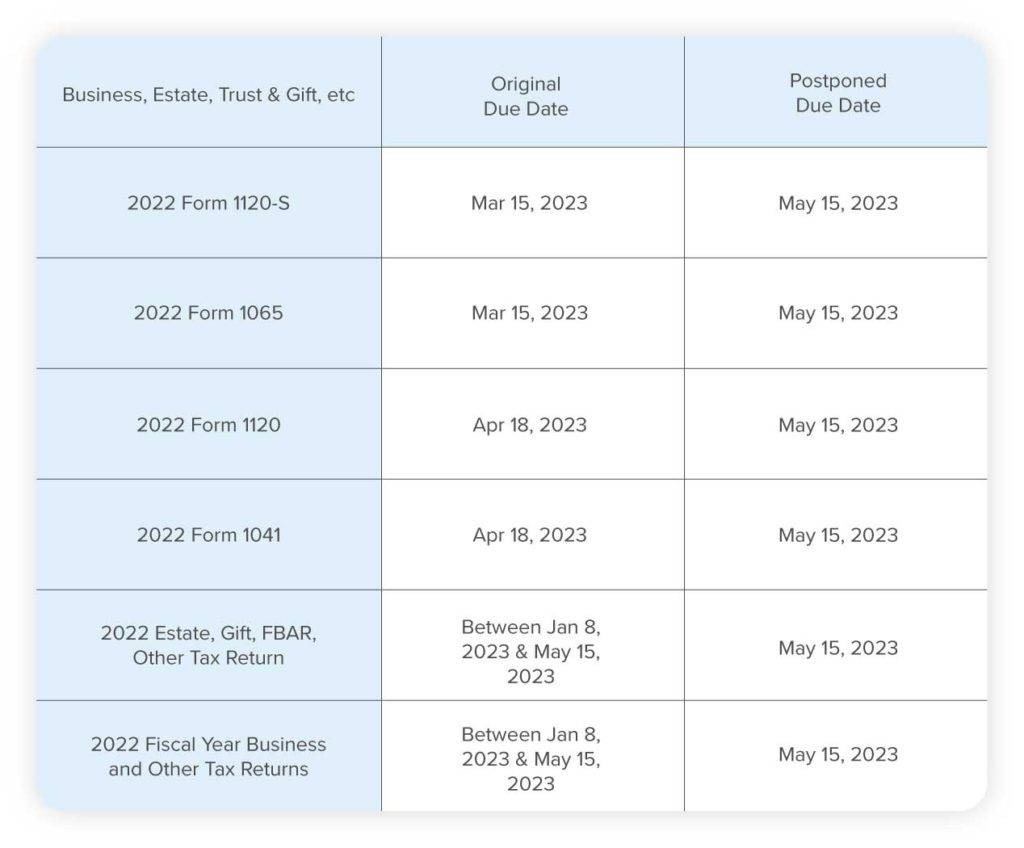

Businesses

This IRS disaster relief, under section 7508A, also applies to many business tax returns. Business taxpayers in the declared counties have until May 15, 2023, to file most business tax returns including employment tax returns, corporate, S corporation, partnership, non-profit, trust, estate, gift, generation-skipping transfer tax, and Form 5500 series returns that have either an original or extended due date occurring on or after January 8, 2023, and before May 15, 2023.

Affected taxpayers that have payments related to any of the above business or other tax filings originally due on or after January 8, 2023, and before May 15, 2023, are postponed through May 15, 2023, and will not be subject to penalties for failure to pay as long as such payments are paid on or before May 15, 2023.

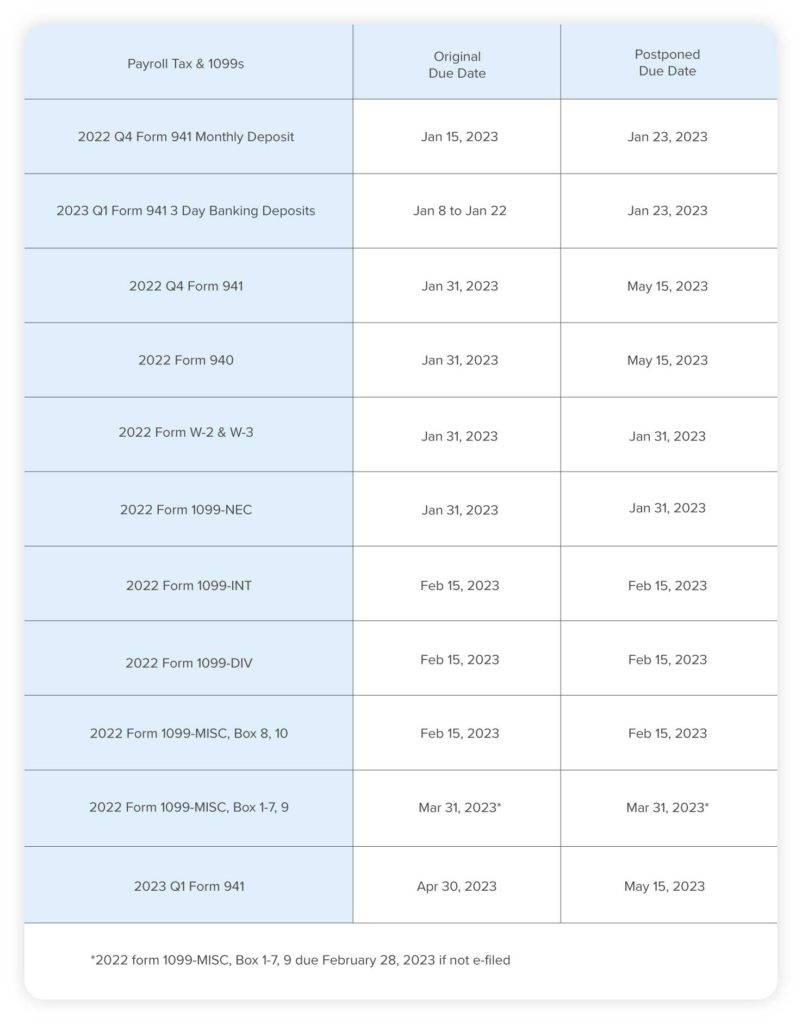

Payroll Tax, Form 1099s & Tax Filings

Other Federal Tax and Time Sensitive Deadlines

The IRS also gives affected taxpayers until May 15, 2023, to perform other time-sensitive actions described in Treas. Reg. § 301.7508A-1(c)(1) and Rev. Proc. 2018-58, 2018-50 IRB 990 (December 10, 2018), that are due to be performed on or after January 8, 2023, and before May 15, 2023. Rev. Proc. 2018-58, 139 pages, consists primarily of lists of all actions eligible for postponement related to a federally declared disaster, such as 1031 exchange (see Section 6 and Section 17), S corporation elections, tax court and bankruptcy deadlines, etc.

IRS Collections and Audits

Affected taxpayers who are contacted by the IRS on a collection or examination matter should explain how the disaster impacts them so that the IRS can provide appropriate consideration to their case.

Determining Eligible Taxpayers & Businesses

The IRS automatically provides filing and penalty relief to any taxpayer with an IRS address of record located in the disaster area. Therefore, taxpayers do not need to contact the IRS to get this relief.

In addition, all relief workers affiliated with a recognized government or philanthropic organization assisting in the relief activities in the covered disaster area and any individual visiting the covered disaster area who was killed or injured as a result of the disaster are entitled to relief.

Tax Practitioners within Eligible Counties Provide Relief to Taxpayers

Taxpayers not in the covered disaster area, but whose records necessary to meet a deadline listed in Treas. Reg. § 301.7508A-1(c) are in the covered disaster area, are also entitled to relief. For example, the taxpayer’s tax practitioner’s office, if located within a declared county, provides relief to the taxpayer. Taxpayers qualifying for relief who live outside the disaster area may contact the IRS at 866-562-5227 to notify the IRS of the applicable issues.

Penalties & Interest

If an affected taxpayer receives a late filing or late payment penalty notice from the IRS that has an original or extended filing, payment or deposit due date falling within the postponement period, the taxpayer should call the number on the notice to have the penalty abated.

Business or individual taxpayers who are unable to meet the new expanded postponement deadlines due to specific circumstances related to this federally declared disaster may also request additional penalty abatement from the IRS for reasonable cause.

Generally, the IRS will not waive interest on tax payment obligations even if the related penalty is waived.