IRS Releases 2023 Inflation Adjusted Amounts for HSAs

On April 29, 2022, in Revenue Procedure 2022-24, the IRS announced the 2023 inflation-adjusted amounts for Health Savings Accounts (HSAs).

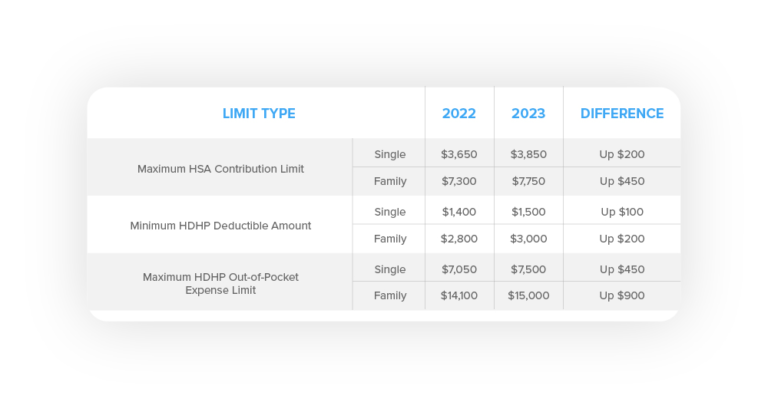

The contribution limits are $3,850 for individuals for self-only coverage and $7,750 for individuals with family coverage starting on January 1, 2023.

The Numbers

This is a substantial increase over the 2021 limits:

- $200 from 2021 to 2022, whereas it was a $50 increase from 2020 to 2021 for self-only coverage;

- $450 from 2021 to 2022 whereas it was a $100 increase from 2020 to 2021 for family coverage; and

- Contribution limits are $3,650 for self-only coverage and $7,300 for family coverage in 2022.

The $1,000 catch up contribution for over age 55 did not change because the catch up is not subject to inflation adjustments.

Note. If you have not contributed the maximum amount for 2022, you have until April 15, 2023, to top it off.

What to Look For

During the next upcoming Open Enrollment period, take a look at the HSA qualified medical plans. The HSA should be maxed out every year so it can build up a tax-free resource for past and future medical expenses.

Generally, taxpayers should consider holding onto all their out-of-pocket medical expenses to get reimbursed later. This will allow the money in the HSA account to grow tax-free. There is no time limit on taking distributions from HSA accounts.

YOUR CPE CONFERENCE IS WAITING

Don’t wait to book your 2022 CPE Conference. Register for your location today.

Besides the normal out-of-pocket medical expenses you expect to be reimbursable, the HSA money can also be used to pay for Medicare premiums, COBRA, and Long-Term Care premiums.

Also, there is a once-in-a-lifetime IRA rollover to fund an HSA. This certainly makes the most sense if an employee and employer have made NO contributions to the HSA and are over age 55. For example, in 2023, the maximum that can be rolled over from the IRA would be $8,750. This means $8,750 will no longer be taxable and reduces the Required Minimum Distribution from the IRA.