WESTERN CPE BLOG

Providing the latest tax news, information, and updates for tax and finance professionals

What is Forensic Accounting?

Accounting is more than the Ben Wyatts and Chandler Bings that fill your television screen on an episode of your favorite sitcom. Beyond the lens of those outside of the industry are accountants with various skills that make up the many branches of accounting, including the sleuthhounds themselves — forensic accountants.

Today, we’re uncovering forensic accountants and their use of accounting, auditing, and investigative skills by digging into what do they, how they do it, and where to start.

What Is a Forensic Accountant?

In the words of Mystery Inc.’s Fred Jones, “It looks like we’ve got ourselves a mystery.” It may be far-fetched, but let’s think of forensic accountants as the Scooby Doo’s Mystery Incorporated of accounting. These are financial detectives who use their skills to solve legal mysteries by providing evidence that can be used in a court of law.

Forensic accounting is a branch of accounting that applies accounting principles and techniques within the legal field. By applying their distinctive qualifications, they expose fraud, embezzlement, and other financial crime within corporations, government agencies, and other organizations.

What Does a Forensic Accountant Do?

Forensic accountants are tasked to “follow the money.” They trace the money trail looking for any evidence that may raise suspicion or point to malpractice. Often, to back the evidence they’ve gathered, they may testify in court as expert witnesses to provide insight into financial evidence.

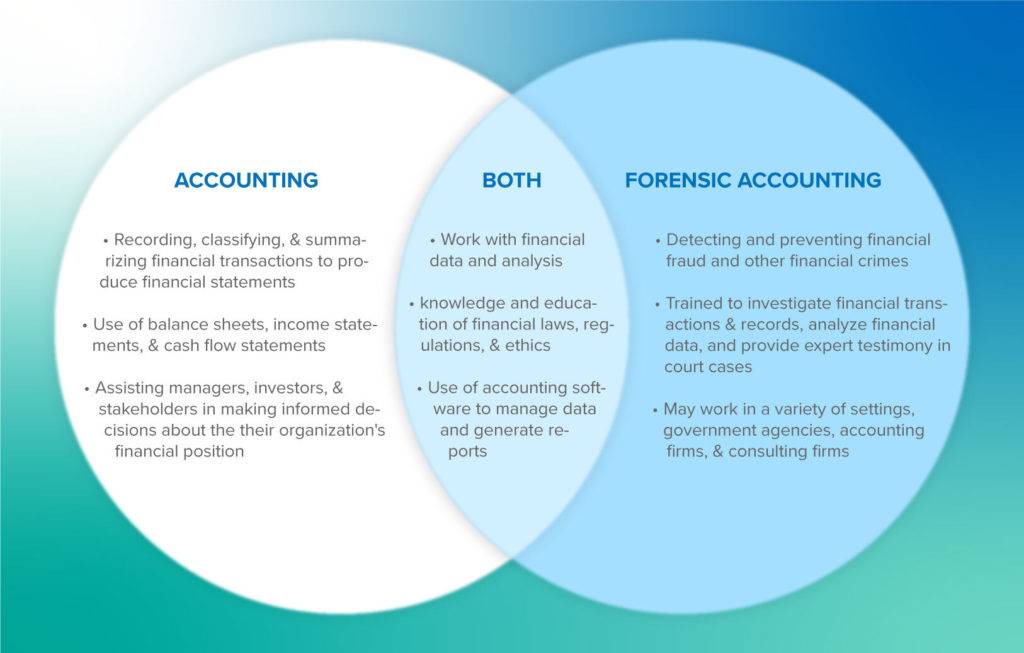

Although related to the broader field of accounting in general, forensic accounting is its own specialty. Let’s take a quick look at the differences and similarities between the two:

Forensic accounting plays a critical role in the legal system by providing impartial and accurate financial information to support legal decisions and to hold individuals and organizations accountable for their financial activities.

Different Types of Forensic Accountants

Forensic accountants might put their skills to use in several different contexts:

Financial Investigators

- Specialize in investigating financial crimes such as embezzlement, money laundering, & other white-collar crimes

- Use of accounting skills to trace money flows and identify suspicious financial activity.

- Typically work in government agencies, but will also be seen working in private firms and large corporations

Fraud Examiners

- Specialize in investigating and preventing fraud

- Use of accounting and auditing skills to analyze financial records, identify irregularities, and gather evidence for use in legal proceedings

- Typically work in government agencies, but will also be seen working in consulting firms, corporations, and non-profit organizations

Economic Damages Experts/Damage Analyst

- Specialize in calculating financial losses that have resulted from a legal dispute

- Use of accounting skills to give expert testimonies in court to support their calculations. Those case could include: personal injury, breach of contract, intellectual property infringement, and antitrust violations

- Typically work in accounting and consulting firms, law firms, large corporations, or as independent consultants

The Three Procedures of Forensic Accounting

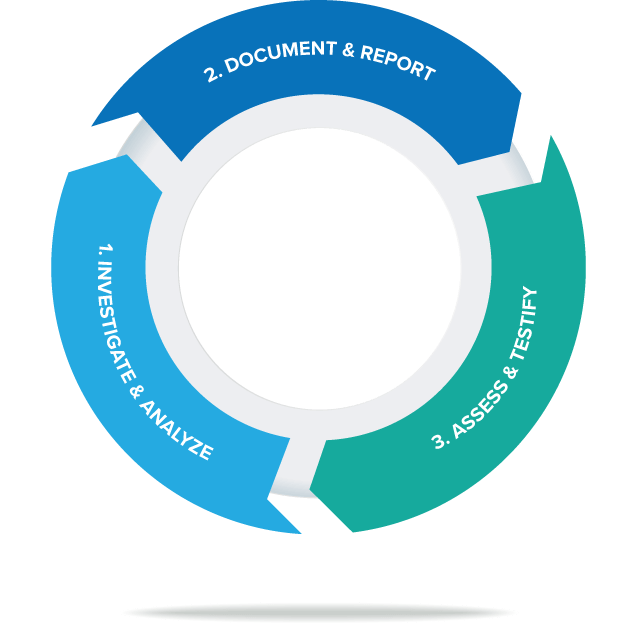

The amount of in-depth work done by forensic accounts can take a great deal of time and effort. Forensic accounting involves a range of procedures that come to play when investigating financial matters. Though the steps can be broken down in various ways, here’s an easy, three-step procedure to remember:

1. Investigate & Analyze

The forensic accountant will start by investigating and analyzing financial data and records to identify potential fraud, financial irregularities, or other financial discrepancies. This may involve interviewing company staff or reviewing financial statements, bank records, invoices, and other relevant documents.

2. Document & Report

After the initial investigation and analysis, the forensic accountant will prepare a report documenting conclusive evidence from their findings, with explanation. The report is then given to the head of the company, law enforcement, legal professionals, or other stakeholders to explain potential fraud and irregularities, help solve financial disputes, or provide information needed for future steps

3. Assess & Testify

Forensic accountants also have a role in the assessment and finalization of their documented findings. They may assist in financial recovery through mediation, negotiating, or in some cases, pressing criminal charges. They are trained to be an expert witness in legal proceedings to presenting their findings and recommendations based on the evidence they collected.

How to Become a Forensic Accountant

So, you’re curious about forensic accounting. Where would you start?

Now that we’ve established that there are different kinds of forensic accountants, each with their own expertise, researching those different areas of expertise may be a good start point. Once you know the specialty or specialties you’re most interested in, you can give your self a head start on what education route is best for you.

Next, you’ll want to highly consider obtaining a Bachelor’s Degree in Accounting or related field. By pursuing a degree, preferred by most employers, you’ll build a foundation in accounting principles, financial analysis, and business. Some institutions may offer specialized classes, degrees, or Master’s programs that concentrate on the niches of forensic accounting.

These specialized classes and/or secondary degrees could give you a leg up in advancing your career in forensic accounting. Another way to do this would simply be gaining experience in the accounting field. Gaining a few years of experience in public accounting or auditing is crucial when building experience and skills. You may even look into courses or specialized training in data analysis, financial analysis, and investigation techniques for further development.

Finally, the most important step is to obtain a Certification as a Certified Fraud Examiner (CFE), Certified Forensic Accountant (Cr.FA), and/or Certified Public Accountant (CPA). Though accountants are not all CPAs, achieving a certification displays your expertise and knowledge in the field of forensic accounting while proving you meet an employer’s professional requirements.

Once you’ve completed these steps, you’re ready to find the employer of your liking and grow your network.

Is Forensic Accounting For You?

Forensic accounting is predicted to be a fast-growing career field. The U.S. Bureau of Labor Statistics suggests that employment for accountants and auditors is expected to grow by 10% between 2016 and 2026, which is faster than the forecast average for jobs in other fields.

In addition, global forensic accounting market size was valued at $5.13 billion in 2021, and is projected to reach $11.68 billion by 2031, growing at a CAGR of 8.8% from 2022 to 2031, according to Allied Market Research.

If you find yourself drawn to solving mysteries and you have a knack for numbers, forensic accounting may be calling your name. Though it can be a challenging field, forensic accountants solve number mysteries and uncover monetary crimes to support the financial integrity of organizations.

And they would have gotten away with it too, if it weren’t for you meddling forensic accountants!

-

Self-Study

Ethics for California

$116.00 – $136.00 Select options This product has multiple variants. The options may be chosen on the product page -

Webcast

Q2 Critical Tax Updates

$98.00Original price was: $98.00.$49.00Current price is: $49.00. Add to cart -

Self-Study

Individual Income Tax Credits & Due Diligence Requirements

$145.00 – $175.00 Select options This product has multiple variants. The options may be chosen on the product page -

Self-Study

Become an Expert on Lookup Functions

$58.00 – $78.00 Select options This product has multiple variants. The options may be chosen on the product page -

Self-Study

Accountant Ethics for Delaware

$116.00 – $136.00 Select options This product has multiple variants. The options may be chosen on the product page -

Self-Study

Error-Proofing Excel Spreadsheets

$145.00 – $175.00 Select options This product has multiple variants. The options may be chosen on the product page