WESTERN CPE BLOG

Providing the latest tax news, information, and updates for tax and finance professionals

Know Your California Income Tax Brackets

It’s important to understand the income tax bracket you fall into within your state so you can pay your state income taxes accordingly. If you’re a California taxpayer, your state income tax has some of the highest rates in the United States. California state taxes aren’t the same for everyone, and a few different factors determine which CA tax bracket you fall into.

California income taxes are divided into nine income tax brackets. Where do you stand in the CA tax brackets? Read on to find out.

Who has to file California state taxes?

Let’s start with the basics. Are you subject to paying California state tax? As one would assume, California residents are required to file a California state tax return; however, residents are not the only ones who may owe California income taxes.

All who earn income from California sources or conduct business in California are subject to California taxes, regardless of their residency status. Those who pay California taxes include:

Residents of California, regardless of their taxable income

Non-residents who earn income in California, such as wages, salaries, commissions, bonuses, rental income, etc.

Part-year residents who move in or out of California during the year and earn income from California sources while they are residents

Even gambling winnings from California sources are subject to California state taxation. So, if you have the slightest bit of curiosity as to if you have taxable income in the state of California, it is recommended to consult with a tax professional or the California Franchise Tax Board (FTB) for more specific guidance on non-resident tax obligations in California.

California has its own tax rules and regulations, which may differ from federal tax laws. It is important to seek advice from a tax professional or the California FTB if you may have California taxable income. Let’s say you’re not required to file a federal tax return. Though you won’t pay federal income taxes, you may still be required to file a California state tax return if you meet the state’s filing requirements.

What is the California Franchise Tax Board?

The California Franchise Tax Board (FTB) is like the ruler of taxes in California. They have the power to collect taxes, prevent fraud, and ensure all residents pays their fair share. The FTB is able to conduct audits, issue tax liens and levies, and enforce penalties for non-compliance while possessing the authority to work with other state and federal agencies to investigate and prosecute tax crimes.

As the leader of California’s tax revenue, the board is responsible for maintaining the state’s tax system. With its wide variety of abilities, the board is able to act as a tax collector while providing taxpayer assistance and education, including including free tax preparation assistance, online tax filing, and a toll-free helpline for tax-related questions.

California personal income tax rates

CA tax brackets are based on a progressive income tax system. The higher the earner, the higher tax rate. The more the taxable income, the more the income tax owed.

There are currently nine CA income tax brackets ranging from 1.00% to 12.30%. The Tax Foundation’s 2023 State Business Tax Climate Index, designed to show how well states structure their tax systems, ranks the California tax system 48th overall.

CA income tax rates are based on a taxpayer’s taxable income and filing status. California residents must file a state tax return if their gross income exceeds certain thresholds, even if they do not owe any taxes. Taxpayer are able to claim various deductions and credits to reduce their state tax liability, such as the standard deduction, itemized deductions, and various credits for things like child care expenses and renewable energy investments.

Other forms of taxation in California include a 8.84 percent corporate income tax rate, 7.25 percent state sales tax rate, a max local sales tax rate of 2.50 percent, and an average combined state and local sales tax rate of 8.82 percent.

California Business tax rates

Tax rates for businesses in California vary by the type of entity they are registered as and are broken into five different categories. A corporation, other than banks and financials, has a rate of 8.84%. For any entity falling under the Alternative Minimum Tax (ATM), this entity would be set at 6.65%. The largest tax rate percentage is for banks and financials at 10.84%. Conversely, the S corporation bank and financial rate is set at 3.5%. Comparatively, the rate for S corporations is 1.5%.

How to Find your CA tax bracket

Filing Status

First determine your status from the five below:

Single

Married filing jointly

Married filing separately

Head of household

Qualifying widow(er)

Filing Forms for California State Income Taxes

The which form(s) you need to file will depend on the amount of your taxable income, filing status, and residency status. There are several forms that may be required for California income tax returns, but the three main forms are:

Form 540: This is the California Resident Income Tax Return and is used by residents to report their income, deductions, and credits. You will need to file this form if you are a California resident or part-year resident who earned income in California.

Form 540NR: This is the California Nonresident or Part-Year Resident Income Tax Return and is used by nonresidents and part-year residents who earned income in California. You will need to file this form if you are a nonresident who earned income in California or a part-year resident who earned income both in and out of California.

Form 540X: This is the Amended Individual Income Tax Return and is used to correct errors or make changes to a previously filed tax return. You will need to file this form if you need to make changes or corrections to your previously filed Form 540 or 540NR.

Some taxpayers may need to file additional forms or schedules required depending on individual circumstances, such as if you have certain deductions or credits. For more form details and access to a tax calculator, head to the FTB website.

2022 CALIFORNIA FEDERAL TAX RATE SCHEDULES

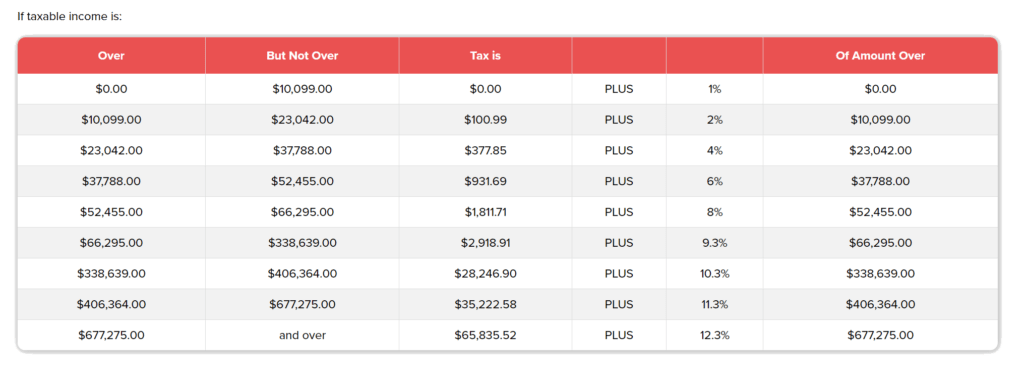

CA TAX BRACKETS: SINGLE/MARRIED FILING SEPARATE

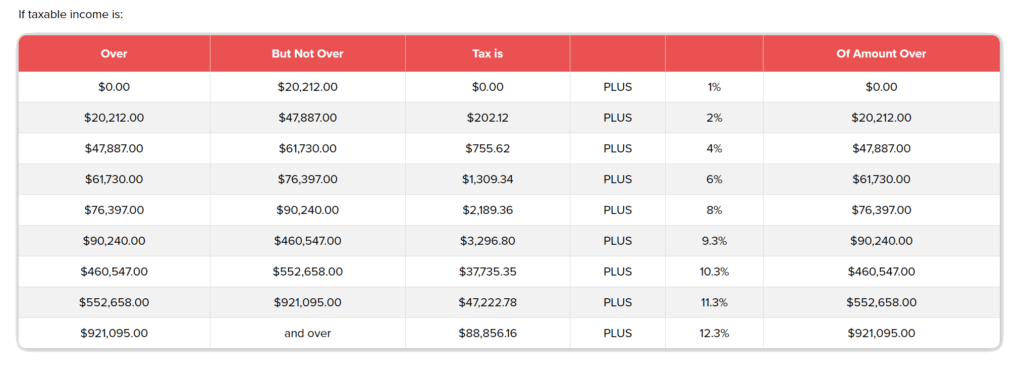

CA TAX BRACKETS: MARRIED FILING JOINTLY

CA TAX BRACKETS: UNMARRIED HEAD OF HOUSEHOLD

Need to keep these tables handy? No problem! Check out Western CPE’s Tax Basecamp. Here you’ll find current and past Federal Tax Rate Schedules, current and past California Tax Rate Schedules, tax calculator, and more additional resources.

2023 California Tax Dates

If you have yet to file your California tax forms, it’s time to get moving. This year’s deadline for filing taxes is April 15, 2024. If applicable, California is conforming with IRS disaster relief. California residents in San Diego county now have until June 17, 2024, to file various federal and California individual and business tax returns and make tax payments. This mean these resident do NOT have to file for an extension. To view those counties and more information, check out Jane Ryder’s “California Storm Relief Update.”

- "2023 Federal Tax Update: Summer Release (Complete Edition)" cannot be added to your cart. "2023 Federal Tax Update: Summer Release (Individual Edition)" cannot be purchased.