WESTERN CPE BLOG

Providing the latest tax news, information, and updates for tax and finance professionals

Need-to-Know California LLC Fees: Your California LLC Guide:

Thinking of starting your own Limited Liability Company, better known as an LLC? There are California LLC fees associated with that. If you plan on starting a California business with a California LLC, some of these considering factors affect how much you’re going to spend.

This convenient handbook should serve as a helpful guide to walk you in the right direction of your new California business. Owning a California LLC will require the following: the California LLC filing fees, the California LLC fee, business license, and other optional or additional fees.

Fear not the fees, and we won’t forget to tell you about potential business write-offs!

Creating Your California LLC

Before we get to the nitty gritty, we’ll need to establish our California LLC. To create your limited liability company (LLC) in California, you’ll be paying two main filing fees:

Articles of Organization Filing Fee

Statement of Information Filing Fee

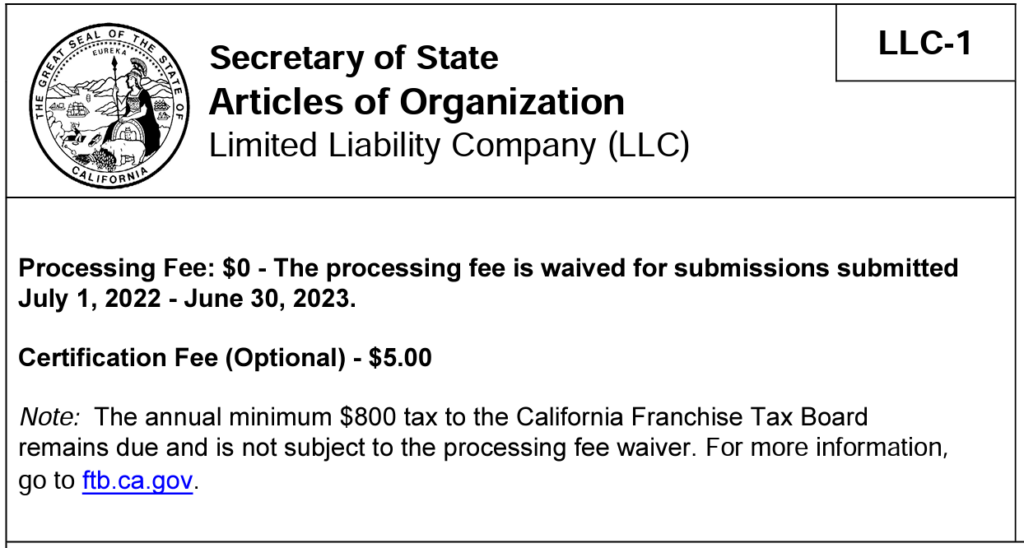

Articles of Organization (Form LLC-1)

Cost: $70

Currently, filing for a California LLC is free until end-of-day June 30, 2023 thanks to California’s Budget Act (Senate Bill 154). The Budget Act waives the registration fees for California LLCs formed between July 1st, 2022 and June 30, 2023.

Description: The California Articles of Organization are documents required to be completed with the California Secretary of State. This form, known as Form LLC-1, will officially create and register your business. The requirements may vary depending on type of business entity being formed or registered, but here’s some general information you should be ready to include:

Name of the entity: The legal name of your LLC. Be sure that the name you choose is unique to the state. Your LLC name cannot be the same as one already registered.

Type of entity: Specify the type of entity being your registering, in this case, it would be a limited liability company (LLC).

Purpose of the entity: Describe the primary purpose or business activity of your LLC.

Registered agent information: A registered agent is an individual designated to receive and forward legal documents and other important notices on behalf of the LLC.

In California, your registered agent must be located in the state and available during normal business hours to receive said legal and official documents. You can name yourself as the registered agent or choose: a California resident, a California-based business, or a commercial registered agent service. The registered agent’s name and address must be included in the form.

Company purpose: The purpose of your LLC and its time of operation.

Business address: Primary business address of your LLC.

Name and signature of the person filing the Articles of Organization: This should include the name and signature of the person who is filing form for the LLC.

Remember, the list above is not full-scale and other information may be required. For further guidance, consult with a qualified attorney or accountant for guidance on filing the California Articles of Organization.

Statement of Information (Form LLC-12)

Cost: $20

Description: The Statement of Information provides updated information about the LLC, such as the names and addresses of the LLC’s members and managers. The Statement of Information must be filed within 90 days of the formation of the LLC, and then every two years thereafter.

Annual Tax & California LLC Fee

Once you’ve registered your LLC, you’ll be responsible for annual fees including an annual franchise tax and your California LLC fees.

Annual franchise tax

If you have a California LLC you will be required to pay an annual franchise tax fee of $800. The annual tax is imposed on all California registered LLCs, regardless of whether the entity is active, inactive, or in a deficit. The tax must be paid until you cancel your LLC.

Once you’ve formed your new LLC and registered it with California Secretary of State, you have until the 15th day of the 4th month from the date of filing to pay your first-year annual tax. All future annual franchise tax payments will continue on 15th day of the 4th month of your taxable year.

NOTE: For tax years beginning on or after January 1, 2021, and before January 1, 2024, LLCs that organize, register, or file with the Secretary of State to do business in California are not subject to the annual tax of $800 for their first tax year, per the State of California Franchise Tax Board.

Califonia LLC Fee

In addition to the annual tax, California LLCs with total income of $250,000 or more during the taxable year may be subject to an additional LLC fee based on total income. The LLC is responsible for the estimated fee and paying it by the 15th day of the 6th month, of the current tax year.

Below you’ll find the current California LLC fee amounts, which can also be found of the California Franchise Tax Board website.

| LLC California Income (Rounde to the nearest dollar) | Fee Amount |

|---|---|

| $250,000 - $499,999 | $900 |

| $500,000 - $999,999 | $2,500 |

| $1,000,000 - $4,999,999 | $6,000 |

| $5,000,000 or more | $11,790 |

Other Optional or Additional California LLC Fees

Hiring a Registered Agent: If you decide to hire a registered agent instead of appointing yourself, you will be paying an addition fee for the service. Services will be on various pay scales depending on the hired individual or California business service.

Applying for and Obtaining Employer Identification Number (EIN): You’ll need this unique nine-digit number issued by the Internal Revenue Service (IRS) to identify your LLC for tax purposes if you are not a single-member LLC. Other needs for an EIN can include hiring employees, opening a business bank account, filing certain tax returns, changing your LLC’s classification, or acquiring an existing business that has an EIN.

Applying for an EIN is completely free and available on the IRS website.

Business License: Though California does not require a statewide business license, in most cases, a business license is required for an operating LLC. The specific requirements for a business license vary depending on the location and nature of the LLC’s business activities. For example, if your LLC is involved in food and beverage industry service, it may need to obtain a health permit.

Be sure to check with your local city or county government to determine the specific requirements for obtaining a business license. Failure to obtain the necessary licenses and permits can result in fines or other penalties, and may limit your LLC’s ability to conduct business in California.

California LLC Write Offs

We’ve reached the moment you’ve all been waiting for — write offs. And lucky for you, all the California LLC costs we listed above are tax-deductible on your federal taxes. You can deduct up to $5,000 of your LLC’s start-up costs in the first year of business. If your start-up costs exceed $5,000, you can amortize them over 15 years.

Other common expenses that can be written off by your California LLC are:

-

Office rent and utilities used for business purposes

-

Business-related travel expenses

-

Equipment and supplies to maintain business operations

-

Marketing and advertising costs

-

Legal and professional service fees

-

Employee wages and benefits

-

Depreciation

Now that we’ve covered all the necessary need-to-knows, get out there and start your California business to limit your personal liability. Owners with limited liability companies are not personally liable for the debts and obligations of the business. So, if your company incurs debts or is sued, your personal assets are generally protected.

- "2023 Federal Tax Update: Summer Release (Complete Edition)" cannot be added to your cart. "2023 Federal Tax Update: Summer Release (Individual Edition)" cannot be purchased.