2025 Summer Sale

Use this summer to level up your tax practice.

2025 Conferences

Resort CPE Conferences

Our annual Summer Sale is the last chance to get Early Bird pricing—up to 40% off. This year’s conferences are better than ever, with dozens of course offerings and more flexibility than ever before. If you want to lock in your price now and choose your conference later, try Save Now Choose Later.

Get the best price on America's #1 Summer Federal Tax Update.

For the Summer Sale, we’re extending pre-order pricing for a few more weeks. The Summer Federal Tax Update is your opportunity to get early clarity on what’s already in motion—so you can begin advising clients, adjusting planning strategies, and managing risk with confidence.

- Annual inflation and cost of living adjustments for 2025

- What to know about the new Form 1099-DA

- Must-know federal disaster relief developments

- New Social Security identity verification requirements

- Form 1099-K Reporting Threshold changes

- Beneficial Ownership Reporting updates

- Updates to Commercial Clean Vehicle credits

- IRS Online Account: Identity Protection PIN info

- Proposed changes to Circular 230

- … And much more.

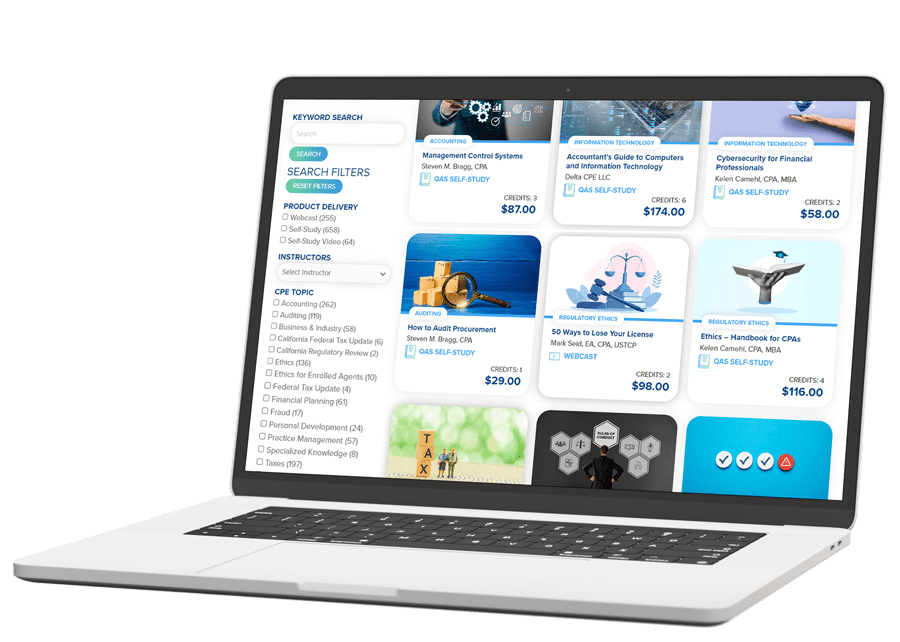

Credit Packages

Get All the On-Demand Courses You Could Ever Want.

Skip the all-you-can-eat CPE plans. Pay only for the credits you need. Use them for anything in the industry’s largest on-demand CPE library, with nothing hidden behind premium tiers.