THE GIFT TAX RETURN: EXPLORING SECTION 529

Do your clients have a child or grandchild that they want to provide funds for post-secondary education? Making use of a Section 529 plan, they can give five years’ worth of gifts at once. The 2022 annual exemption from gift tax is $16,000, a $80,000 gift to a 529 plan can be made before December 31, and the donor can elect to treat the gift as being made 1/5 per year for five years. The 2023 Gift tax exemption is $17,000, so you can give an additional $5,000 in 2023 and make another five-year election.

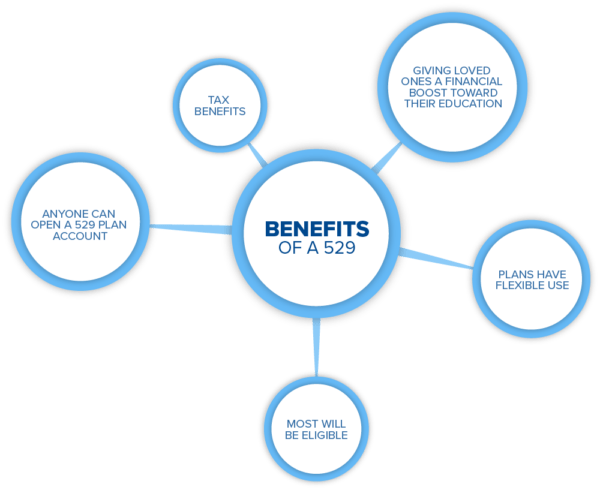

This eTax alert will show you the ropes of the new 529 plan, focusing on the definition of a gift tax return, what or who the funds can be used for, and penalties your client could face. After exploring Section 529 with me, you’ll be able to give your client the information needed to give the gift of higher education to their loved ones.

WHAT IS A GIFT TAX RETURN?

A gift tax return (Form 709) is required for the year gift that reports the new 529 plan. There’s a box on the top of page two of the form to check to make the 5-year election. If there are no other reportable gifts, Form 709 is not required for the remaining four years. I recommend that the returns be filed in any case. It’s a reminder that the annual exclusion for that person has already been used for the year and it keeps the client focused on estate planning issues.

WHAT CAN THE FUNDS BE USED FOR?

A Registered Apprenticeship Program or College. Qualifying apprenticeships are listed by the Department of Labor. Funds can be used for the books, tools and other required materials as well as the program itself. Colleges and universities are also eligible for the gift tax return.

Student Loans. Up to $10,000 per beneficiary of the 529 plan can be used to pay principal and interest on a student loan. In addition, $10,000 can be used for loans owed by a sibling of the beneficiary.

School tuition. Private elementary or secondary school tuition can be claimed from a 529 plan with a limitation of $10,000 per year.

PENALTIES & OTHER STIPLULATIONS

With every Form 1099-Q received each year, there is a distribution from a 529 plan, assuming that the withdrawal was for a non-qualifying purpose. It breaks down the distribution between earnings and return of principal.

A 10% penalty applies if the funds are used for a non-qualifying purpose. The funds excluded from income, in the 529 plan, cannot be used to support an education credit but often higher education is so expensive that qualifying educational expenses exceed the amounts available for credit.

For example, ...

If a grandparent pays for education directly, it’s not considered a gift and frees up that annual exemption for other ways to benefit the grandkids. That would involve paying that tuition invoice, reimbursing the cost does not qualify and would be a gift that’s reportable if the amount is greater than $17,000 this year.

Final Thoughts

Even if you don’t want to spend the big bucks, smaller contributions to the existing 529 plan of a grandchild, niece, or nephew would surely bring joy to the parents of that student. The 529 plans have a maximum value based on the state – for some of the larger states the maximum is $529,000 per plan; the lowest amount is $235,000 for Mississippi plans.

Mary Kay Foss CPA is a frequent lecturer for professional and business groups. She has over thirty years of practical experience advising about retirement, income and estate planning issues. Ms. Foss is a member of the AICPA Individual and Self-Employed Technical Resource Panel, past chair of the AICPA Trust Estate and Gift Tax Technical Resource Panel and past chair of both the Estate Planning and the Taxation Committee of CalCPA. She is also past president of the Estate Planning Councils of Diablo Valley and East Bay and the East Bay Chapter of CalCPA. She teaches classes for CalCPA and has been quoted in many publications.

DIG DEEPER:

How The $3.5 Trillion Budget Blueprint Could Impact Your Clients

The new reporting requirements on brokers are addressed in Section 80603 of the bill. “Broker,” by definition in Sec. 6045 (c)(1), is expanded to include “any other person who (for a consideration) regularly acts as a middleman with respect to property or services…A person shall not be treated as a broker with respect to activities consisting of managing a farm on behalf of another person.” In turn, the bill defines a “digital asset” as “any digital representation of value which is recorded on a cryptographically secured distributed ledger or any similar technology as specified by the Secretary.