Millionaire Audits, IRS Resources, Trump’s Taxes, OH MY

1 Audit, 2 Audits, No Audits, Few Audits:

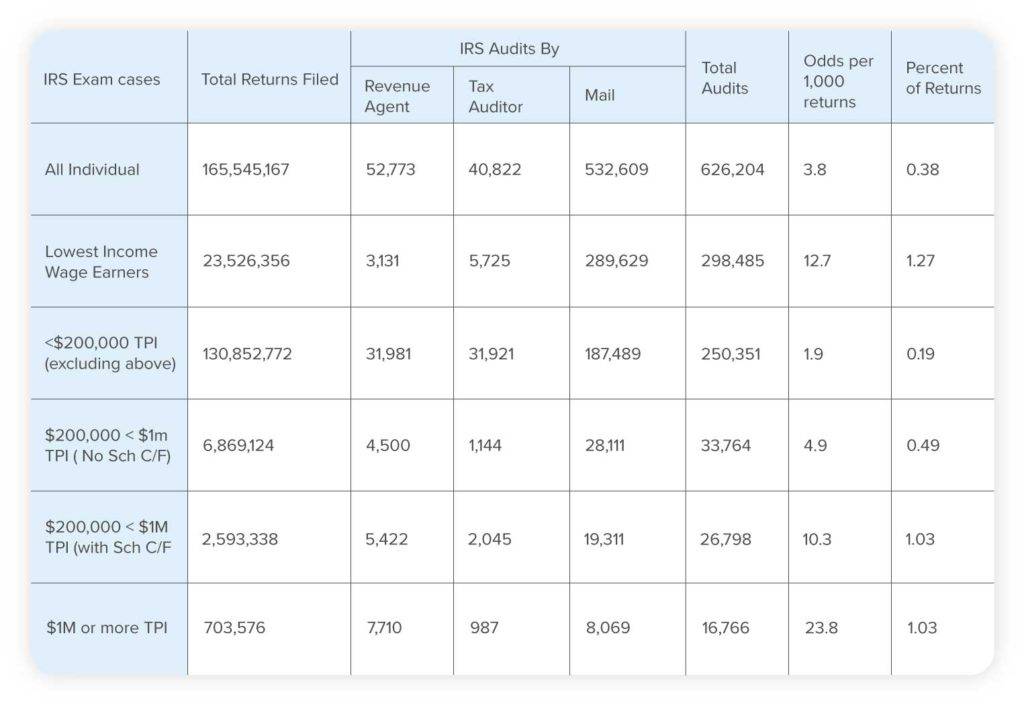

During fiscal year (FY) 2022, few millionaires were audited compared to lower-income examinations, which continued to occupy most of the IRS’s audit resources. That’s according to statistics compiled by the Transaction Records Access Clearinghouse (TRAC) at Syracuse University. Shocker.

- The likelihood of a millionaire being audited by the IRS fell to 1.1% (7,710 agent-examined returns of 703,576 returns filed with total positive income (TPI) of $1 million or more.) In other words, barely over 1 out of every 100 millionaires were audited.

- These results are based on internal IRS management reports released each month to the TRAC under a court order resulting from litigation under the Freedom of Information Act.

Note. The chart below shows a higher percentage of millionaire audits because it includes limited audits by tax auditors and by correspondence. The lowest income wage-earner’s return had a 12.7% audit rate, mostly because of the earned income tax credit.

The Problems Posed by Low-Income Taxpayer Audits

Low-income taxpayer audits, which occur primarily through the mail (known as correspondence audits), are one of the most serious problems plaguing the IRS and taxpayers, according to National Taxpayer Advocate Erin M. Collins. What makes this type of audit so troubling is that taxpayers are not assigned a single point of contact and struggle to reach anyone at the IRS to resolve the issue — a problem taxpayers and tax pros alike know all too well.

- Additional IRS audit information can be reviewed in Collins’ 2022 Annual Report to Congress released this month.

Trump’s Tax Returns Released:

Speaking of IRS audits of million-dollar income returns, Former President Trump’s tax returns were released by the Democrat-led House Ways and Means Committee last month. Determining whether that was a good idea or not is perhaps best for a another discussion over cocktails.

- The committee originally released Trump’s tax returns in a tweet with a link to a zip file, which has since been removed.

- At the request of the Ways and Means Committee, The Joint Committee on Taxation also released a report on its review of the 2015 to 2020 tax returns and the IRS audit file on the returns.

Expert Analysis on Trump’s Tax Returns:

Want to take a deeper dive into Trump’s tax returns? Our expert instructor Mark Seid has a one-hour webcast reviewing the returns from his perspective as an IRS Agent for 10 years and as a practicing CPA for 20 years. Check it out below.

Sharon Kreider, CPA, has helped more than 15,000 California tax preparers annually get ready for tax season. She also presents regularly for the AICPA, the California Society of Enrolled Agents, CCH Audio, and Western CPE. You’ll benefit from the detailed, hands-on tax knowledge Sharon will share with you—knowledge she gained through her extremely busy, high-income tax practice in Silicon Valley. With her dynamic presentation style, Sharon will demystify complex individual and business tax legislation. She’s a national lecturer for business and professional groups and consistently receives outstanding evaluations. In 2014, she was awarded the prestigious AICPA 2014 Sidney Kess Award for Excellence in Continuing Education.

DIG DEEPER:

How The $3.5 Trillion Budget Blueprint Could Impact Your Clients

The new reporting requirements on brokers are addressed in Section 80603 of the bill. “Broker,” by definition in Sec. 6045 (c)(1), is expanded to include “any other person who (for a consideration) regularly acts as a middleman with respect to property or services…A person shall not be treated as a broker with respect to activities consisting of managing a farm on behalf of another person.” In turn, the bill defines a “digital asset” as “any digital representation of value which is recorded on a cryptographically secured distributed ledger or any similar technology as specified by the Secretary.